Small-caps globally have underperformed larger companies for over a decade due to macro conditions favouring their bigger counterparts, higher volatility and investor risk aversion pushing capital away from the lower end of the market.

Nonetheless, there are winners to be found – wherever you look.

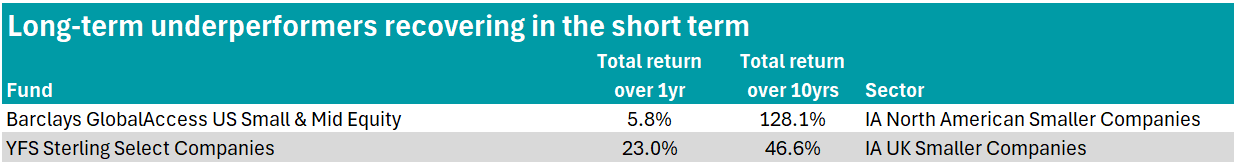

As such, Trustnet has identified funds that languished in the fourth quartile for returns in their sector over 10 years but stormed into the first quartile over one year (to year-end 2025). Later in the article, we also look at the reverse.

Here, we looked at IA European Smaller Companies, IA UK Smaller Companies and IA North American Smaller Companies.

Across all three sectors, there were only two that shot to the top of the charts in 2025 having struggled for much of the past decade.

Source: FE Analytics

Starting with domestic small-caps, the £29.3m YFS Sterling Select Companies fund, which gained 23% in 2025 – a top-quartile return in the IA UK Smaller Companies sector. Its 10-year return of 46.6% placed it in the fourth quartile in the long term, however.

Managed by Melwin Mehta, Miles Nolan and Rik Tipton, it invests at least 75% in UK smaller- and mid-cap companies – typically those with a market capitalisation up to £5bn. The remaining portion may be allocated to larger companies, overseas stocks, cash or other areas.

Beyond size, the managers focus on high-quality and differentiated businesses with demonstrable profitability, asset strength and reasonable valuations.

YFS Sterling Select Companies gained 37.7% over three years but made a 4.9% loss over five, with a particularly difficult stretch between 2019 and 2022, when it was in the bottom-quartile of the peer group in each calendar year.

It was the worst performing small-cap fund in 2021 and 2022, but was the best performer in 2025, which marked the second consecutive year in which the fund made a top-five return.

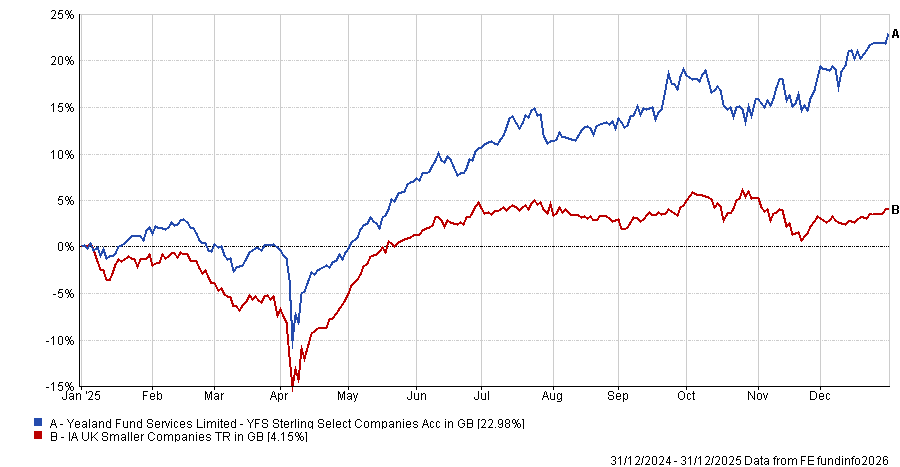

Performance of the fund vs sector in 2025

Source: FE Analytics

Away from the UK, Barclays GlobalAccess US Small & Mid Equity is also in the fourth quartile for returns in the IA North American Smaller Companies sector over 10 years, gaining 128.1%, but it catapulted to the first quartile in 2025, gaining 5.8%.

The $103.1m fund has an FE fundinfo Crown Rating of five and is managed by Ian Aylward and deputy manager Ziad Abou Gergi. It targets long-term capital growth by investing in US small- and mid-cap companies, with the portfolio holding over 350 stocks.

While informed by the Russell 2500 index, stock ideas are drawn from a panel of sub-managers, with scope to diverge significantly from the benchmark.

Kennedy Capital Management joined the line-up in 2011 with a 35% target allocation, followed by Wellington Management in May 2015 with a 45% target allocation and The London Company later that year with a 20% target allocation.

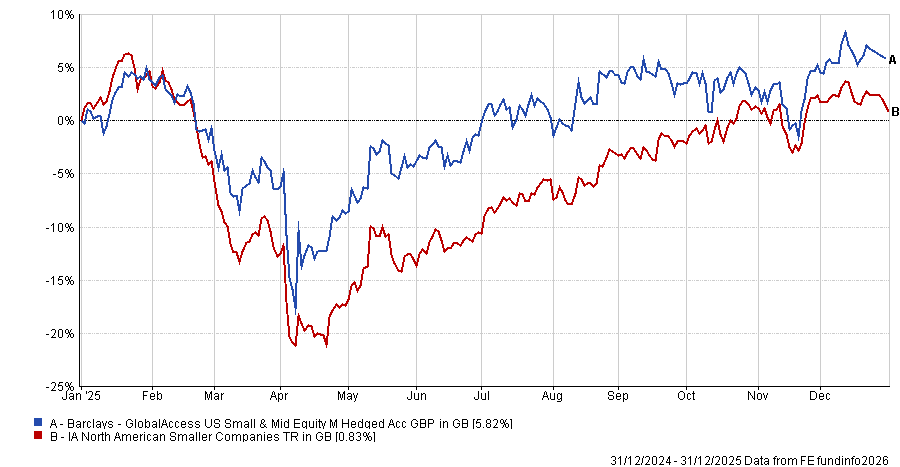

Performance of the fund vs sector in 2025

Source: FE Analytics

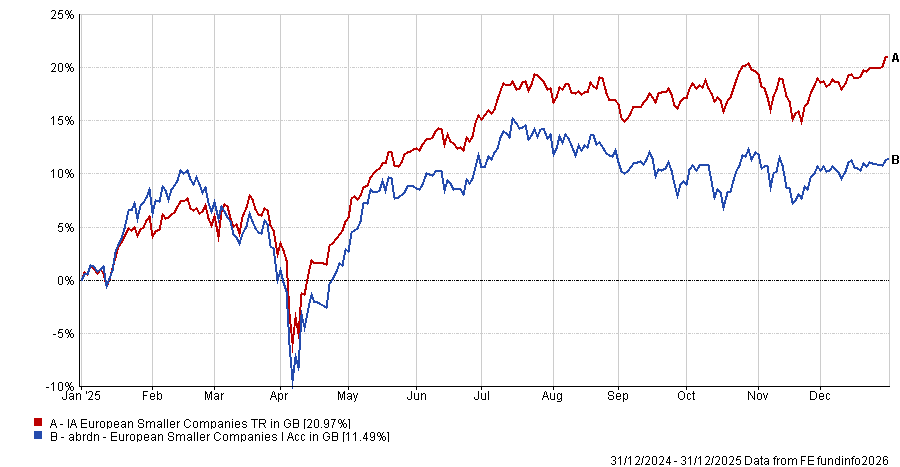

No previously struggling funds in the IA European Smaller Companies sector were able to turn things around in 2025 with a top-quartile return.

However, one dominant long-term performer did slip down the rankings in the short term. Abrdn European Smaller Companies has delivered strong longer-term returns, sitting in the first quartile over 10 years for returns in the IA European Smaller Companies sector with 172.8%.

However, 2025 proved tougher, with the fund sliding to the fourth quartile and gaining 11.5%.

Source: FE Analytics

In contrast, the top-performing fund in the sector over one year is Mirabaud Discovery ex-UK, which delivered returns more than three times higher at 36.7%. It also beat the Aberdeen fund over 10 years, posting a 191.6% return.

Abrdn European Smaller Companies is managed by Andrew Paisley and aims to outperform the FTSE Developed Europe Small Cap index over rolling five-year periods.

The near 50-stock portfolio has its largest sector exposures in industrials and financials, with top 10 holdings including Swedish technical solutions group Addtech and tabletop fantasy and futuristic battle games company Games Workshop Group.

The strategy was highlighted by Trustnet in 2024 for achieving top-quartile long-term returns through meaningful benchmark divergence. However, in 2025, its deviation from the benchmark meant it had less exposure to large defensive names which outperformed in an environment unsettled by sustained geopolitical tension.

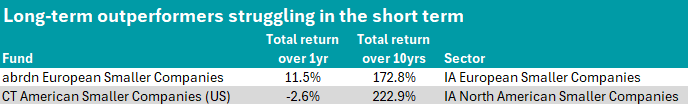

Performance of the fund vs sector in 2025

Source: FE Analytics

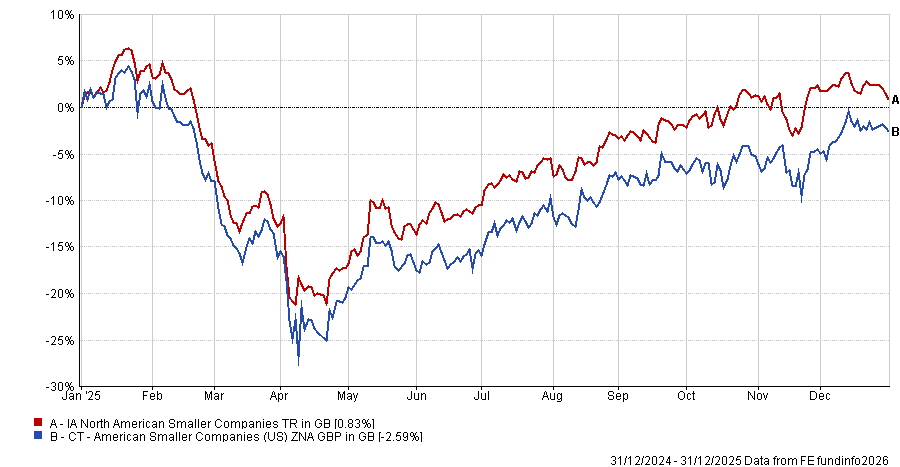

The other fund in the table is CT American Smaller Companies (US), which lost 2.6% in 2025 – putting it in the fourth quartile in the IA North American Smaller Companies sector.

Managed by Nicolas Janvier and Louis Ubaka, the fund defines smaller companies as those with market capitalisations between $500m and $10bn, typically holding fewer than 80 stocks.

It is tilted to more cyclical, rate-sensitive sectors, such as industrial, financials and REITs, which struggled in an environment of sustained elevated interest rates and weak risk appetite.

The managers also incorporate the Columbia Threadneedle ESG Materiality Rating Model to ensure at least 50% of the portfolio is invested in companies with strong environmental, social and governance (ESG) principles – although it can invest in stocks that derive limited revenue from tobacco production, thermal coal and indirect nuclear weapons exposure.

The £745.4m fund has a much stronger long-term record, sitting in the first quartile over 10 years with a 222.9% return.

Performance of the fund vs sector in 2025

Source: FE Analytics