Investors tempted to chase riskier assets after another year of strong markets should resist the urge, according to Hugh Gimber, global market strategist at JP Morgan Asset Management, who argued that 2026 is “not a time to get greedy”.

“I do not believe this is the time to give up on quality,” he said, adding that, while the global economy is holding together, the backdrop does not justify pushing too far down the risk spectrum.

JP Morgan’s view starts from a macro environment in which growth looks broadly healthy, economic activity is “in reasonable shape all around the world” and inflation risks are tilted more to the upside than the downside. However, Gimber drew a clear distinction between what policymakers should ideally do and what they are likely to do in practice.

“If we were to prescribe what economic policy should be this year, you’d probably be thinking this is a good time for governments to repair and manage, perhaps central banks to be leaning against some of those upside inflation risks,” he said. “That is beyond what we are expecting in 2026.”

Instead, the firm expects further fiscal support and a broadly downward path for interest rates, with only a few exceptions. That combination should keep growth supported across regions and sectors, even if the outcome is uneven.

Markets, however, are already pricing in a favourable scenario. Valuations reflect a fairly optimistic outlook and are stretched in many areas. “Valuations are high. That’s undeniable,” Gimber said, noting that developed and global equity markets are trading at elevated levels by historical standards, with some close to the 90th percentile of the past 25 years.

He cautioned against using valuations as a short-term market-timing tool but said they matter far more over longer horizons. Over 10 years, there is a strong relationship between starting valuations and subsequent returns.

In the near term, the key question is whether earnings growth can live up to expectations. Small misses would likely be manageable, but larger disappointments could be more problematic.

“The bigger concern is sharp downgrades because at these valuation levels markets would struggle to absorb a more material fall in earnings expectations,” Gimber said.

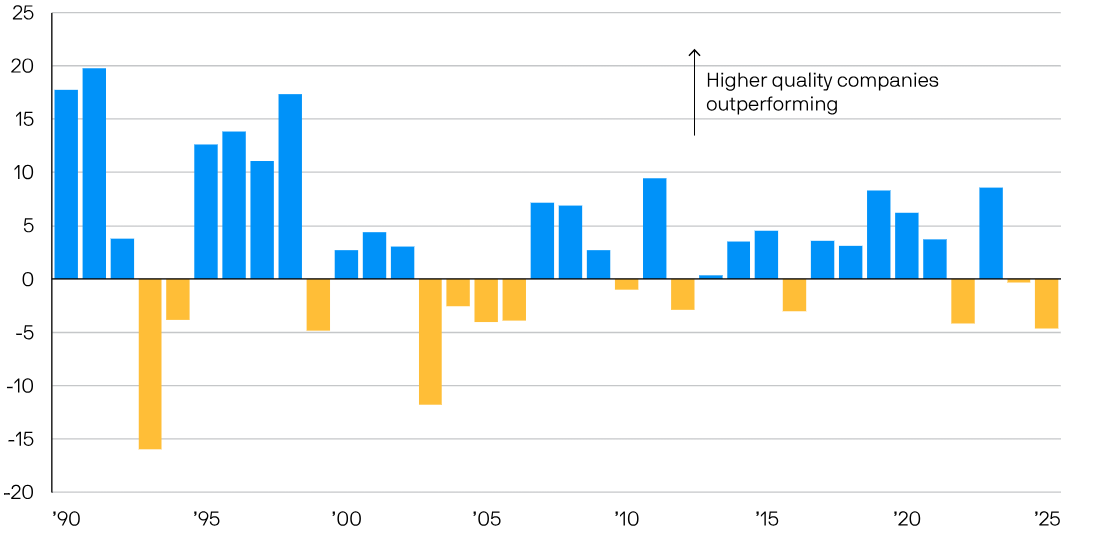

In JP Morgan’s view, that environment reinforces the case for quality, even after a difficult period for higher-quality stocks (last year, these companies suffered one of their weakest relative performances since 2003).

Calendar year performance of MSCI World Quality against MSCI World

Source: LSEG Datastream, MSCI, J.P. Morgan Asset Management. Relative returns are shown in USD total return terms. Data as of 31 December 2025.

“This doesn’t feel like a time to be pushing down the quality spectrum,” Gimber said. If recession risks were to re-emerge, higher-quality businesses would again prove more resilient, he added. Today, such companies trade at a premium of around 13%, close to their long-term average and well below the levels seen 18 months ago.

Regional diversification is another area where JP Morgan believes investors need to act. Long-term outperformance by US equities has steadily increased portfolio concentration. “Investors haven’t taken action; geographic diversification has actually been falling,” Gimber said, with reduced exposure to Europe and emerging Asia and a heavier weighting towards the US.

He said this imbalance needs to be addressed, as broader economic growth and valuation differences should allow regional returns to diverge more meaningfully, with Europe being key. “Do not write off Europe in 2026”, Gimber said.

A central factor is Germany’s shift towards fiscal expansion. Planned spending of around 12% of GDP over the next decade, largely through infrastructure investment, has already driven an increase in government investment. Southern Europe, particularly Spain and Italy, has been performing relatively well, while Germany and France have weighed on growth.

“If you add a stronger Germany to already robust southern Europe, that for me paints a pretty decent picture, particularly at a time when expectations are so low about the European outlook.”

The UK, by contrast, looks set for a less eventful year. The strategist said he would prefer to hear “as little about UK politics as possible”, arguing that stability would allow the corporate sector to take the lead. With the Budget out of the way, there are tentative signs of improving business confidence. “I think this is another muddle-through year in the UK,” Gimber said.

Finally, he urged caution around artificial intelligence (AI), one of the market’s most popular themes. While not disputing AI’s long-term potential, Gimber believes expectations have moved well ahead of reality. Forecasts for AI-related capital expenditure have risen sharply, but adoption outside the largest technology firms remains limited.

“What we’re most focused on is not what the tech giants are telling us, but what other sectors are saying about AI adoption,” he said. Survey data show usage remains relatively low, suggesting a gap between current reality and market expectations.