Investors pulled almost £700m from equity funds in January, with UK and European portfolios bearing the brunt, data from Calastone’s Fund Flows Index has shown.

In total, a net £697m was removed, marking an unprecedented eighth consecutive month in which investors withdrew their cash.

The firm credited investor concern with US president Donald Trump’s threats to hike tariffs on Europe and other NATO countries as part of his bid to take over Greenland.

Indeed, the first half of the month was relatively muted, with net sales and buys cancelling each other out. But outflows accelerated on 19 January and continued for the rest of the month, as the prospect of US tariffs and the president sending military planners to the island sent markets tumbling.

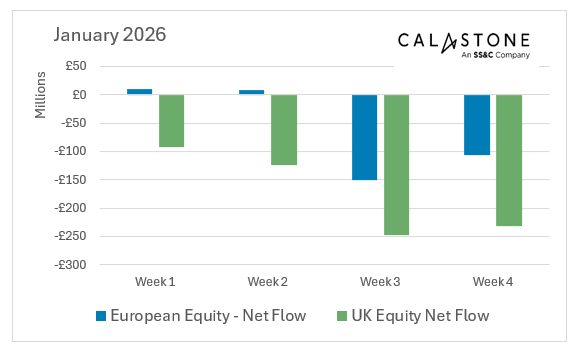

Fund flows of European and UK equity funds in January

Source: Calastone

Additionally, most of the net sales came from the two places Trump targeted: the UK and Europe. European equity funds suffered their worst month since January 2025, as investors pulled £237m from the sector, while investors withdrew £694m from UK funds over the month, mostly in the final two weeks.

Edward Glyn, head of global markets at Calastone said: “The pace of outflows in January was far slower than in the run-up to the Budget, where a record flood of selling was prompted by concerns of possible higher pension and investor taxes.

“This indicates that the risk of conflict over Greenland was more of a tail risk in investors’ minds rather than a clear and present danger. It shows, however, that it doesn’t take much to fracture fragile sentiment, especially when stock prices are riding this high.”

Elsewhere, outflows from Asia funds continued, although they remained in line with the monthly average, while investors withdrew less from Japanese equity funds in January than they had done in previous months.

Emerging markets, global and North American funds all enjoyed net inflows during the month.

“Investors now have to be more alive to geopolitical factors than in the past and they are titrating their geographical allocations accordingly,” Glyn noted.

Passives remained popular, with net inflows of £1.4bn, while active funds suffered, with £2.1bn removed last month.

Turning to other asset classes, investors flocked to bond funds, which took in £459m in new money last month. Here, corporate bond funds were more popular, while government bond portfolios were sold down. Multi-asset funds also proved popular to start 2026, with more than £1bn added in the month, right around the 10-year monthly average.

Lastly, money market funds suffered outflows for the first time since April 2024, while investors took a net £51m out of property funds.