With a global recession looming as business and consumer spending plummets due to the Covid-19 crisis, Comgest portfolio manager Alistair Wittet believes businesses with strong brands and pricing power will still continue to grow.

Wittet – who co-manages the €3.4bn Comgest Growth Europe fund along with fellow FE fundinfo Alpha Managers Laurent Dobler, Arnaud Cosserat, and Franz Weis – said the team favours high-quality growth businesses with high returns on capital, unique business models, high barriers to entry and strong brands, even in a recessionary or inflationary environment, an investment philosophy echoes that of Terry Smith’s Fundsmith Equity and the Lindsell Train strategies.

“Brand power not only generates high returns, but it also provides you with quite a few safety mechanisms in difficult times,” he explained. “If you have a genuinely unique product with pricing power, you can protect yourself.

“If you are selling a commodity, if your costs are increasing [due to inflation] but you are not able to pass it on because the competitor environment isn’t allowing you to, or because you are in a recession and the demand isn’t there, that’s where you really get a squeeze on your profit margins.”

He said a company like Ferrari has an extremely defensive revenue stream, as well as a defensive cost structure, because they sell their products with an extremely high gross margin; more akin to that of a luxury goods company than an auto company.

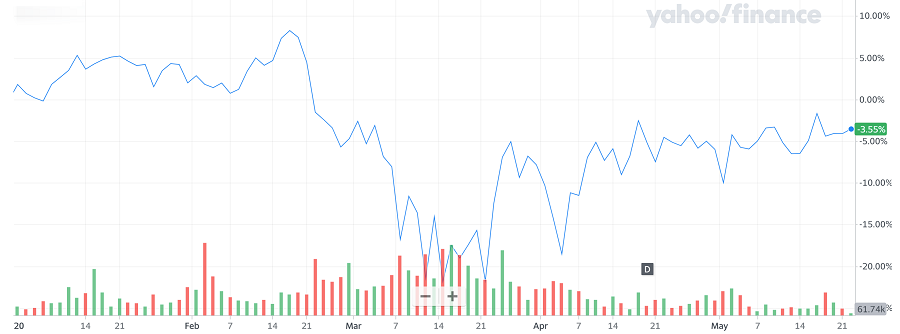

Performance of Ferrari YTD

Source: Yahoo! Finance

“High gross margins are already a form of protection, if there is an increase in your raw material cost, it doesn’t have such a big impact on your bottom line,” said Wittet.

“From a demand perspective they limit the supply to such extent that there are huge waiting lists for their products. They are selling to a very small niche of extremely wealthy customers who even in difficult economic times are willing to buy those products.”

Wittet said other companies like Ferrari that he favoured included LVMH, Hermes, and L’Oreal due to their deep understanding of luxury, their know-how of building a brand, and ability to continue growing over years and decades.

Healthcare was another area that performs well even in a recession, said the Comgest manager, pointing to consistent growth in US healthcare spending since 1970, as far as the data goes back.

“Healthcare is a spend that does not fall, even in economic recessions, and even in a year like this, healthcare spending will grow again,” he said.

“This growing global spend will benefit companies like Roche and their oncology products, it benefits Ambu which sells life-supporting equipment to hospitals, it benefits ICON which carries out drug trials.

“Anything really in that healthcare space, even in a year like this, should prove extremely defensive. Healthcare is a mega-trend related to ageing populations, but it's an area which would be very unlikely to see structural declines in spend, especially after a health-related crisis.”-

By focusing on quality-growth companies with recession-proof qualities, Comgest manager noted how the team have been even during the global financial crisis, the fund’s portfolio earnings had continued to grow.

“In a normal recession, if we take the example of 2009, the earnings for the index fell by roughly 50 per cent, while the earnings for the portfolio grew,” he explained.

“Even in an extremely difficult economic environment, these businesses, and the portfolio, have historically proven its defensive profile by still being able to generate earnings growth.”

Despite the favourable environment that quality-growth stocks have experienced for the past decade, Wittet said he had been trimming some of the higher quality holdings leading up to the Covid-19 correction in March.

“We had seen growing valuation premiums being paid for high-quality growth businesses,” he explained. “That led us over the past couple of years to reduce our exposure to some of those names and to build our exposure to some other companies which are slightly less dynamic in growth profile or for whatever reason were not perceived as high quality.”

Some of those companies included ICON, retailer B&M European Value Retail and computer training company Solutions30: quality companies with good growth prospects where valuations hadn’t hit extreme levels.

But when markets started to sell off, he began to reduce exposure to some of those names and started to add to higher quality-growth companies that previously had been too expensive.

Wittet said: “The reality is that the sell-off was very quick and the rebound was very quick. I think there’s still more moves we’d like to do in that direction.

“I think valuations in some cases have come back up to levels that strike us as being a little bit stretched, so we’re ready as and when those opportunities present themselves to re-orientate the portfolio towards some of those faster-growing names.”

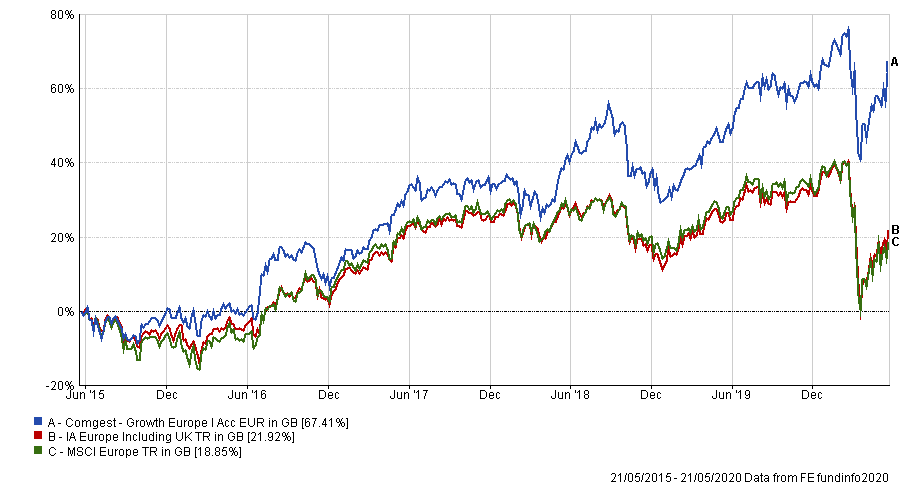

Performance of fund vs sector over 5yrs

Source: FE Analytics

Comgest Growth Europe has made a total return of 67.41 per cent over the past five years compared with a gain of 21.92 per cent for the average IA Europe Including UK peer and a 18.85 per cent return for the MSCI Europe benchmark. The five FE fundinfo Crown-rated fund has an ongoing charges figure (OCF) of 1.04 per cent.