Liontrust Asset Management beat its multi-asset competitors by having the most balanced and adventurous strategies that consistently outperformed during the past five years, data from FinXL reveals.

Trustnet compared multi-asset funds by measuring their alpha – an indicator of a fund’s performance in excess of its benchmark that is often used by investors as a way to tell whether their funds have been worth their fees.

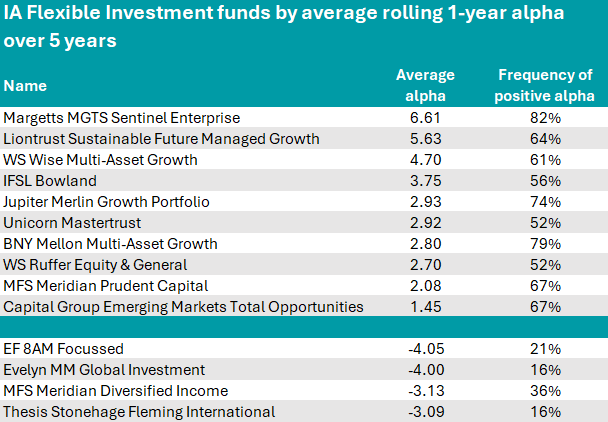

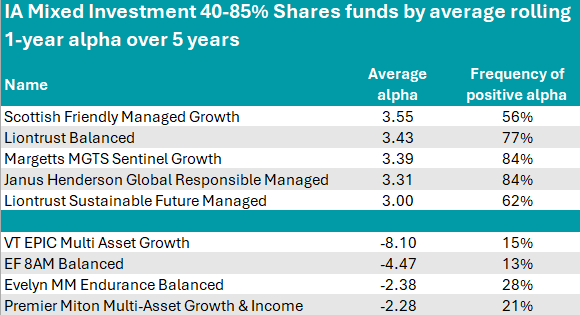

In the study below, we look at the IA Flexible Investment and the IA Mixed Investment 40-85% Shares sectors and highlight the constituents that have the highest 12-month average rolling alpha of the past five years, meaning that they outperformed their benchmarks in most of the 61 year-long periods that begin each month from January 2018 to December 2023.

In the IA Flexible Investment sector, where most funds measure their performance against the peer group average, the top vehicle was Margetts MGTS Sentinel Enterprise. This £105.2m portfolio had an average alpha of 6.61 and is led by FE fundinfo Alpha Manager Gerrit Smit, who is also in charge of the much bigger Stonehage Fleming Global Best Ideas Equity fund.

The Sentinel Enterprise strategy has been a top-decile performer over the past 10 and five years and remained in the second decile over the past three years and 12 months too.

Source: FinXL

A whole point below it, in second position, was the first Liontrust vehicle we encounter, the Sustainable Future Managed Growth fund, whose average alpha was 5.63.

The strategy, alongside the whole Sustainable Future range, is considered by Square Mile analysts “a strong choice” for investors who are looking to grow their capital by investing in companies that are making a positive contribution to the planet and society.

“The managers have demonstrated they are able to deliver robust returns following this tried and tested process but the approach can lead to a return profile that is more volatile than many peers. However, we think over the long term it can deliver superior returns,” they said.

The list also included the Jupiter Merlin Growth Portfolio (2.93) and WS Ruffer Equity & General (2.7).

Jupiter Asset Management featured predominantly amongst the cautious funds that keep delivering the most bang for your buck and its Growth Portfolio’s alpha confirms the group’s strength in managing multi-asset strategies.

The Ruffer fund, managed by FE fundinfo Alpha Manager Alex Grispos, beat its benchmark – the FTSE All Share – by an average of 2.7% in the past five years.

In pole position in the IA Mixed Investment 40-85% Shares sector sits the £163m Scottish Friendly Managed Growth fund, a five FE fundinfo Crown-rated strategy managed by Colin McLean, benchmarked against the FTSE All Share.

With an average alpha of 3.55, it was a top-decile performer in the 196-strong peer group over the past three years and a second-decile performer over five, while dropping to the second-quartile over 10 years and 12 months.

Source: FinXL

Moving on to funds that use the sector average as their benchmark, in second position was Liontrust Balanced, with an average alpha of 3.43.

The fund and its managers Tom Hosking and Hong Yi Chen joined the Liontrust stable in April 2022 with the acquisition of Majedie Asset Management.

The fund has bested its benchmark in more rolling one-year periods than not, but it hasn’t all been plain sailing. Between the transition to Liontrust and the end of 2023, the fund trailed the sector average but it returned to form this year, as the chart below shows.

Performance of fund against sector since moving to Liontrust

Source: FE Analytics

Another Liontrust fund, Sustainable Future Managed, also had a high average alpha score of 3.

Meanwhile, Janus Henderson Global Responsible Managed had a positive alpha in 51 out of the 61 periods measured and achieved an average alpha of 3.31. This is another strategy that avoids harmful industries and has a focus on sustainability.

It stood out to Square Mile analysts for its style diversification provided by its three sub-portfolios: a UK sleeve with an income focus, which balances out the global, growth-biased sleeve; and a fixed-income sleeve that is usually the smallest component but acts as a volatility dampener through a portfolio of G7 government bonds and global credit.

Finally, at the foot of the table was VT EPIC Multi Asset Growth, which had the worst average alpha of the sector at -8.1.

Sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies, global bonds, cautious funds.