Investors who don’t have the time or the drive to manage their own asset allocation, sometimes rely on mixed-asset managers to do that for them.

This doesn’t mean however that they can completely forget about their investments, and investors should always make the time to review their choice of fund and ensure they’re getting their money’s worth.

One way of doing that is through alpha, or the measure of outperformance against the fund’s own benchmark – the higher the alpha score, the more bang for your buck.

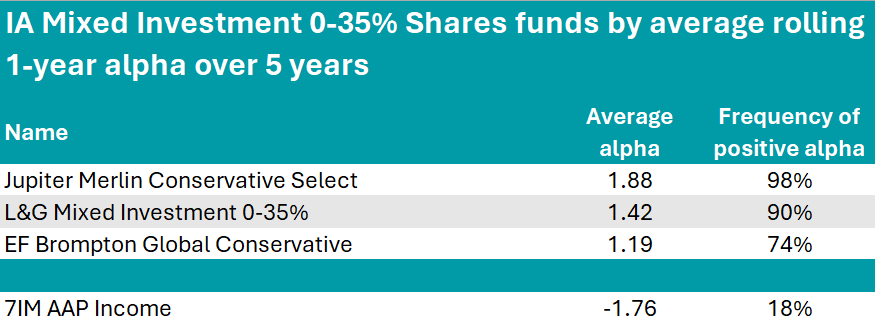

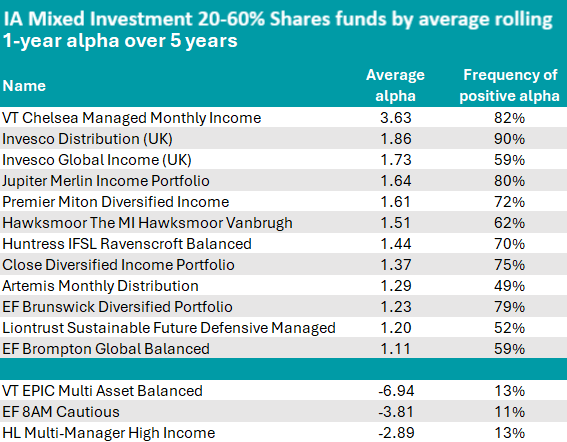

Below, we highlight the average alpha scores of the two Investment Association cautious mixed-assets sectors measured monthly since 2018 over 61 year-long periods. Outperformance is relative to the funds' own benchmarks – which for every fund below was the peer group.

For those who invest in the IA Mixed Investment 0-35% Shares funds, the best choice, with the highest average score of 1.88, was the Jupiter Merlin Conservative Select fund, which maintained a positive alpha in 60 of the 61 periods measured.

Jupiter’s fund-of-funds range took up many top positions in the other sectors as well, and according to Square Mile’s analysts, much of its longer-term success can be attributed to managers John ChatfeildRoberts and Algy SmithMaxwell, who have “adeptly blended an ability to navigate the broader economic environment with astute fund selection”.

Based around capital preservation, one of the key features of this fund is its conviction-led portfolio that is built without reference to the peer group benchmark.

“Overall, we hold this team in high regard and consider this a strong offering for investors seeking a product run by experienced and proven investors, with a strong long-term record of managing multiasset fund-of-funds portfolios who have successfully delivered on the fund's expected outcome since launch,” Square Mile’s analysts said.

Source: FinXL

In second position, the L&G Mixed Investment 0-35% achieved an average alpha of 1.42 by investing in other L&G strategies with a 20-80% split between equities and bonds, of which 26% is developed government bonds, 29% developed corporate bonds and 14% high yield and emerging market debt. It is managed by Bruce White and Christopher Teschmacher.

At -1.76%, 7IM AAP Income had the lowest alpha – however, this passive range of strategies is highlighted by RSMR analysts for offering “consistency of process, return and volatility over the medium to longer term”.

The 7IM investment process focuses on finding value in both asset allocation and fund selection and places significant resource into the areas that they feel will produce the greatest levels of return.

The first fund to stand out in the IA Mixed Investment 20-60% Shares was VT Chelsea Managed Monthly Income, with its 3.36 of average alpha.

With £57.8m of assets under management, it is a small fund but stands out for its performance, achieving an FE fundinfo Crown rating of five.

It has a target weighting of between 40% and 60% in UK and overseas equities, although it under this at present (30%). Within its equities bucket, the fund has 42% invested in the UK, 23% in Europe and 18% in the US.

Alongside equities and fixed interest (31%), the fund also invests in alternatives (20%), including aircraft leasing, property (12%) and target absolute return strategies (3%).

Source: FinXL

Taking up the second and third position are two Invesco strategies: Invesco Distribution and Invesco Global Income.

The former is an absolute return strategy that outperformed the peer group in 90% of the periods measured and is rated by RMSR analysts for its “high-quality team in both fixed interest and equites, lower volatility and proven track record”.

“The process brings together two of Invesco’s strongest teams [equity and fixed interest] in what is a relatively conservative fund, its balance dictated by the fixed interest element,” they said.

“We would consider this as a good first step into the equity market for income seekers without increasing the risk of a portfolio by a significant amount.”

Also of note were the Premier Miton Diversified Income and Hawksmoor The MI Hawksmoor Vanbrugh portfolios.

The lowest scores were those of VT EPIC Multi Asset Balanced (-6.94), EF 8AM Cautious (-3.81) and HL Multi-Manager High Income (-2.89).

IA sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies, global bonds.