Keeping an eye on alpha (the return generated independently from passive index growth) is key for investors who don’t want to overpay for their funds.

This becomes even more central as too many managers are charging “alpha” fees for “beta” performance, Argonaut’s Barry Norris recently told Trustnet.

In this series, we are highlighting the strategies that most successfully and most consistently outdid the index and delivered high levels of alpha on a one-year rolling basis since 2018.

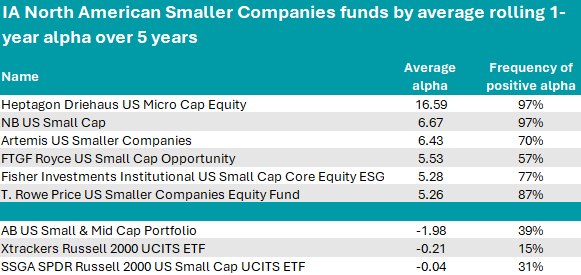

Here we look at the Investment Association’s smaller companies sectors, beginning with North America.

Of the 23 funds with a track record of at least five years, 20 achieved an average alpha above 1. The only exceptions were the active AB US Small & Mid Cap Portfolio, with a negative alpha of -1.98, and the passive strategies SSGA SPDR Russell 2000 US Small Cap UCITS ETF and Xtrackers Russell 2000 UCITS ETF.

With a whopping 16.59 average alpha, Heptagon Driehaus US Micro Cap Equity was the leader of the list and it also maintained a positive alpha in 97% of the 61 periods over the past five years.

Run by managers at Driehaus, a US privately held boutique asset management company, the strategy focuses on micro-caps and is benchmarked against the Russell Micro Cap Growth index, which it more than comfortably outperformed over the past five years, as shown in the chart below.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

In second position, NB US Small Cap also kept a positive alpha 97% of the time, but with a much lower average alpha of 6.67, closely followed by Artemis US Smaller Companies (6.43).

The Artemis fund stood out to Square Mile analysts for manager Cormac Weldon’s “highly credible” track record and the soundness of his investments style, which “combines detailed company analysis with an appreciation of the wider economic environment” and “has proven successful across a range of market conditions”.

“We believe the team's diverse skill set and fairly flat structure complements the overall investment approach,” they said.

“We acknowledge that, compared to a number of its competitors, the team is by no means large, but in this case we think its size is advantageous as it leads to swift decision making in a market that can be prone by short, sharp changes in investor sentiment.”

Source: FinXL

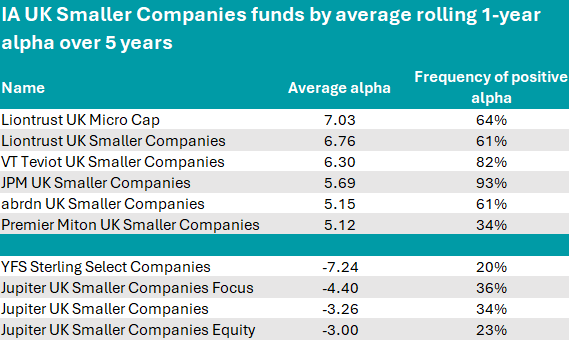

On this side of the Atlantic, Liontrust scooped the top spot with Liontrust UK Micro Cap, which took the lead with an average alpha of 7.03, and Liontrust UK Smaller Companies (6.76), both run by the same team including FE fundinfo Alpha Managers Anthony Cross and Julian Fosh.

The investment process for both funds emphasises the intangible strengths of companies, which by their very nature are difficult to assess using more traditional analytical techniques and therefore are often overlooked by many market participants, Square Mile analysts highlighted.

“Given Liontrust UK Smaller Companies’ emphasis on smaller companies, steps have been taken to limit the fund's capacity, which is reflected in the higher than average management fee, [of 1.32%],” they said.

“Nevertheless, we do not necessarily see this as a negative for it both protects existing investors and ensures the integrity of the approach and also note that inclusive of all fees, the fund's long-term track record is exemplary.”

The same process and a similar fee (1.25%) apply to the smaller micro-cap fund, which has a market capitalisation of £275m.

On the other side of the table, the highest negative alpha was that of YFS Sterling Select Companies, but the rest of the list of companies with a negative alpha greater than 1 was dominated by Jupiter strategies – Jupiter UK Smaller Companies Focus, Jupiter UK Smaller Companies and Jupiter UK Smaller Companies Equity.

Source: FinXL

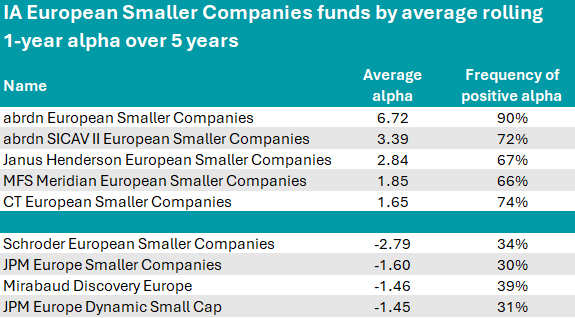

In Europe, the asset manager that stood out was abrdn, which took the top two spots of the table with the £82m abrdn European Smaller Companies (average alpha: 6.72%) and its €878.4m SICAV version (3.39), both managed by Andrew Paisley.

Not far below, the Janus Henderson European Smaller Companies caught the attention of FE Investments analysts for managing to achieve “a consistent balance of value and growth stocks” through its business cycle approach and its strict valuation discipline, which differentiate it with the rest of its competitors who mainly invest in quality-growth business and therefore exhibit a clear factor tilt.

“Owing to its balanced approach the fund managed to hold up well in every market environment, thus delivering consistent performance across time,” they said.

Source: FinXL

Schroder European Smaller Companies sat at the bottom of the table, with an average alpha score of -2.79.

IA sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds.