Markets were on edge this week in anticipation of a potential shock interest rate hike from the Bank of England (BoE) or the US Federal Reserve to combat rising inflation, although their nervousness proved premature.

Both central banks maintained interest rates, remaining steadfast in their view that inflation is transitory. The BoE and Fed were cautious not to raise interest rates too quickly as this could risk choking off the economic recovery after the pandemic.

Yet with interest rates nailed to the floor at record lows while the pandemic is largely over, it seems that the only place left to go for rates is up.

Steven Bell, chief economist at BMO, said: “The case for a base rate rise is clear: inflation has risen significantly, there are signs that it is not simply a transitory move; moreover, the economy has recovered significantly, and, despite the squeeze from the chancellor’s Budget, should continue to expand.

“Monetary policy was put into emergency mode due to the pandemic. The emergency is now largely over and monetary policy should adjust accordingly.”

An increase in rates will mean the share prices of most equities will decrease as their future earnings get discounted more with a higher interest rate.

Similarly, most long-dated bonds will also be re-valued lower as their future coupon payments become reduced relative to a higher risk-free rate from central banks.

As such, investors in a traditional 60/40 equities bond portfolio might be left with nowhere to hide if interest rates hikes are either unexpected or perceived as too aggressive.

Below, Trustnet asked fund managers what other assets investors can look to that will perform well in a rising interest rate environment.

Philip Matthews, a co-portfolio manager of the TB Wise Multi-Asset Income fund, pointed to property as a good sector to consider amidst potential rising inflation and interest rates.

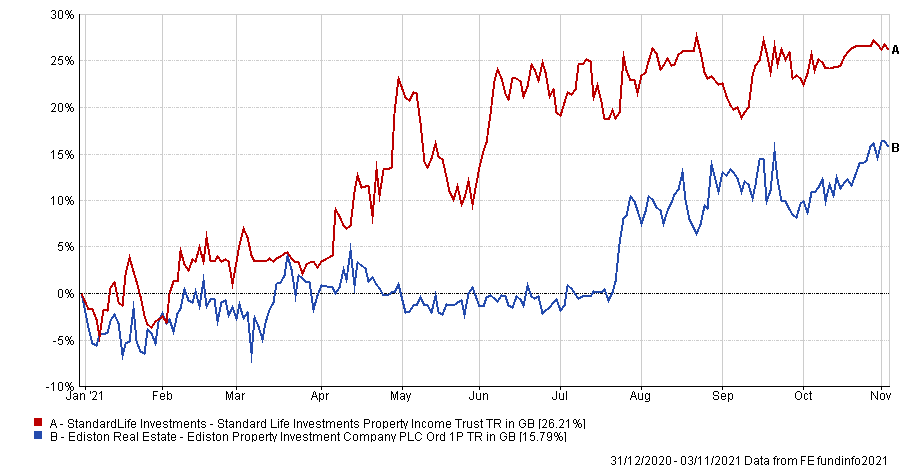

He highlighted Ediston Property Investment Company, an investment trust predominantly exposed to retail parks, as an example.

“It currently yields 6.5%, however, we believe the dividends have ample opportunity to grow from here as tenants return to paying rent that was foregone during the crisis,” he said.

“Similarly, the Standard Life Investment Property Income Trust, yielding 5.1% and on a discount of 17%, looks attractive.”

Performance of the property trusts year-to-date

Source: FE Analytics

Matthews also highlighted Impact Healthcare REIT, which he said offers “more direct” inflation protection.

“The portfolio, constituting 109 care homes let to 12 tenants and two healthcare facilities let to the NHS, has collected 100% of rent due over the course of the past twelve months,” he explained.

The Starwood European Real Estate Finance was another investment that he said looked attractively priced.

“The company represents a diversified portfolio of real estate debt investments in the UK & continental Europe,” he said. “Unlike other areas of corporate credit, the company has not regained its pre-crisis levels and sits at a 6% discount to net asset value, whereas pre-crisis it traded at a premium.

“If inflationary pressures do drive central banks to take action to increase base rates and Libor and Euribor rates follow, then the Starwood portfolio will benefit as 76.7% of the portfolio has floating interest rates.”

Vince Childers, head of real assets multi-strategy at Cohen & Steers, agreed that real assets – such as property – should perform well in such an environment.

However, he also broadened this out to other areas, such as commodities, infrastructure and natural resources.

Childers said: “The potential for a lasting economic recovery with above-trend global growth is expected to drive continued strong commodity consumption.”

He added that infrastructure has historically delivered strong relative returns during surprise inflation due to their inflation-linked pricing mechanisms in many infrastructure revenue models, although certain subsectors can be impacted by rising interest rates in the short run, he said.

FTSE Global Infrastructure vs FTSE All World index year-to-date

Source: FE Analytics

Richard Sem, fund manager at Pantheon Infrastructure, said he was buying assets with strong organic growth or those with strong downside protection through contracted revenues to protect his portfolio from any inflation or interest rate shocks.

These included things such as social infrastructure/public private partnerships (PPP), certain transportation assets, energy efficiency assets like smart meters and certain digital infrastructure assets.

“These assets often exhibit contractual structures that are directly tied to inflation, and in most cases higher inflation rates are passed through to underlying revenues,” he explained.

“However, it is also imperative inflation and interest rates are considered thoroughly alongside fundamental growth drivers when underwriting investments.”