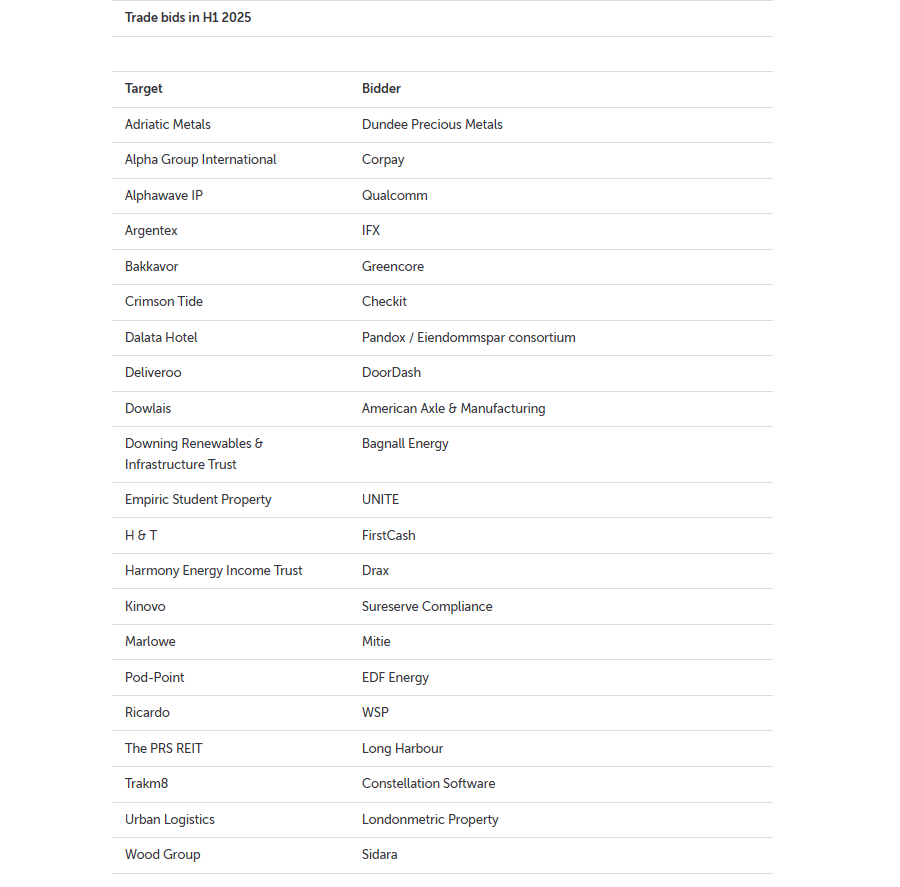

Out of nearly 50 takeover attempts involving UK-listed companies so far this year, trade buyers – typically firms operating in the same or a related sector as their targets – have accounted for almost half (21), according to data from AJ Bell.

This runs counter to the prevailing narrative that private equity is the dominant force in UK takeovers. In reality, private equity has been far less active than expected in 2025.

“Private equity companies haven’t been as prolific or successful with UK takeovers this year as their reputation implies,” said Dan Coatsworth, investment analyst at AJ Bell.

Bids this year have included high-profile names, such as food delivery group DoorDash’s successful £2.9bn bid for rival Deliveroo in May. In March, Tesco food supplier Bakkavor agreed to a £1.2bn bid from rival Greencore.

Trade bids in H1 2025

Source: AJ Bell. Company announcements

Some businesses also chose to put themselves on the market. For example, hotel business Datala put itself up for sale in March, “effectively saying it didn’t suit being a listed company because it was much smaller than quoted peers, it was undervalued, and the shareholder base was concentrated”.

The rise of trade buyers this year was attributed to their time horizon and willingness to take a long-term approach. “Trade buyers will take a long-term view of a company’s potential worth, and they are often happy to pay a fair price”.

As a result, they will try and buy a business that may remove a major competitor from the market or open the door to a new geography, as demonstrated in the deals above.

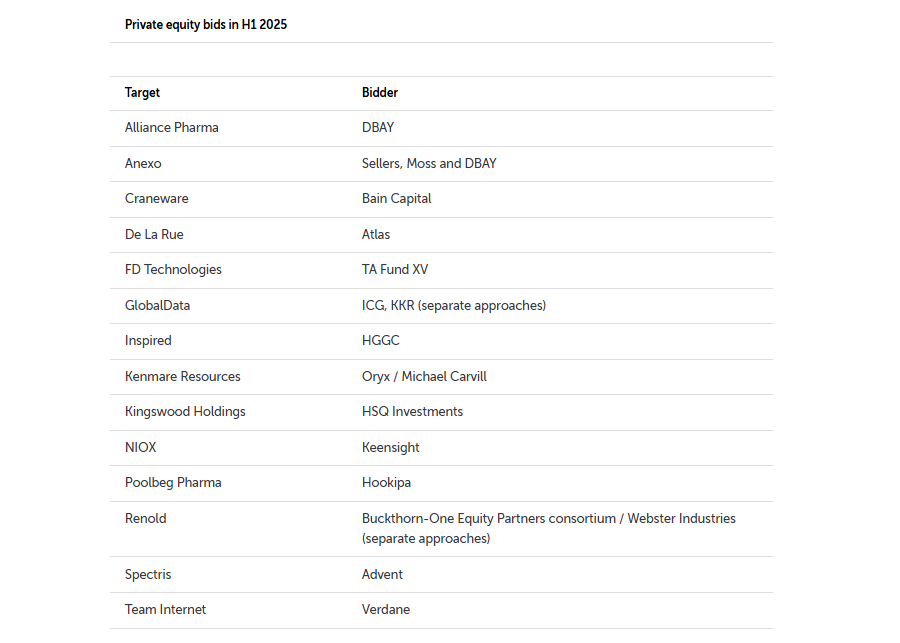

By contrast, private equity firms – while still actively bidding for high-profile companies, such as Advent’s failed £3.7bn bid for industrials group Spectris in June – had a far more limited presence int the market.

Private Equity bids in H1 2025

Source: AJ Bell. Company announcements

There are 14 private equity bids in the chart above, compared to the 21 trade bids over the same period. Of these, five ended up failing, including KKR’s earlier attempt to target analytics company GlobalData.

“It’s easy to suggest private companies are behind most bids, yet data tells a different story,” said Coatsworth.

This is a sharp departure from this time last year, when experts suggested ‘clever money’ from private equity bidders was behind a wave of mid-cap takeovers.

The lack of activity from private equity this year is not an issue of funding because the industry is “awash” with cash, Coatsworth noted.

Trade and tariff uncertainty could be playing a role, with private equity companies perhaps pausing investment due to the misty outlook in the same way as public companies. “If they are going to spend big bucks, they will want confidence in the geography, industry and corporate profit potential.”

Secondly, he argued private equity firms' risk appetites have dwindled. They want companies that make good money currently rather than ones that might be profitable in the future, in contrast to trade buyers. Private equity wants to be able to “flip an acquisition within three to five years at a profit” and they may be struggling opportunities that fit that bill.

Finally, “private equity firms often look for missing pieces of the puzzle”. They generally aim to acquire businesses that can be combined with other companies in their portfolio to create a larger entity they can sell on. He added: “The UK market might not have the sort of characteristics they are looking for.”

However, private equity firms and trade buyers are hardly the only people behind this year’s merger and acquisition activity.

Investment trusts were responsible for seven bids this year as part of the recent “takeover frenzy” in investment trusts. Several vehicles below £200m have been realising they need to merge or wind up, and with high-profile campaigns by activist investors such as Saba, many trusts have started making offers to “gobble up” some of their competitors.

This has included high-profile mergers such as the recent £2.1bn deal between Fidelity European and Henderson European Trust.