Many trusts have been struck by soaring inflation and tightening monetary policies this year, but those investing in European equities have been particularly battered.

The war in Ukraine and lost gas imports from Russia have compounded to create a challenging market environment for European investors.

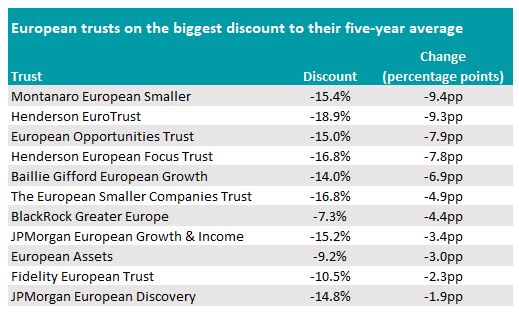

As a result, trusts in the IT Europe and IT European Smaller Companies have dropped to an average discount of 14%.

Here, Trustnet looks at the European trusts on the biggest discount to their five-year average and asks fund pickers where the best bargains lie.

Source: QuotedData

James Carthew, head of investment companies at QuotedData, said that he was surprised by the poor performance of quality trusts such as Montanaro European Smaller.

These types of trusts are usually resilient to market drawdowns because they avoid investing in overly indebted companies, but Montanaro European Smaller had the biggest discount to its five-year average on the list.

It is trading 9.4 percentage points cheaper than it has over the past five years after it fell 46.9% since the start of the year.

Total return of trust vs sector in 2022

Source: FE Analytics

However, Carthew pointed out that Baillie Gifford European Growth was the worst performer of both sectors over the past year – growth stocks typically outperform smaller companies, but its growth bias has been a damaging trait. It dropped 47.7% in the past 12 months as markets rotate away from growth and into value.

The trust is trading 6.9 percentage points below its five-year average and is unlikely to improve until monetary policy loosens, according to Carthew.

He said: “We may need to see clear evidence that inflation is rolling over so that expectations of falling interest rates start to come through before it recovers. For now though the trend is still toward higher rates.”

Total return of trust vs sector over the past year

Source: FE Analytics

Although all of the trusts on the list are down this year, Andy Merricks, fund manager at 8AM Global, said that each of them are decent portfolios that will reward investors over the long-term.

Of all the trusts, he said that Montanaro European Smaller and Henderson Euro Trust are the most appealing options on their current discounts.

“Short term they’ve been horrendous but looking at their longer-term performance they look attractive,” he added.

Henderson Euro Trust’s discount of 18.9% is 9.3 percentage points lower than its five-year average, and although returns are down 21.8% this year, it is still performing better than its peers in the IT Europe sector.

Merricks said that he would hold off buying either of the trusts for the time being however as returns show no sign of improving and their discounts are likely to fall further.

He said: “If you look back from two or three years from now, some investors will rue having taken the opportunity too early as they got caught in another leg down. They could have taken a later opportunity.”

Alternatively, Emma Bird, head of investment trusts at Winterflood, said that Euro Trust’s sister fund, the Henderson European Focus Trust, was the most attractive buy.

Its discount was slightly lower than Euro Trust at 15%, widening the gap between its five-year average by 7.9 percentage points.

Likewise, the trust beat its sister fund this year, declining 17.2%, while also outperforming by 13.4 percentage points over the long-term, up 175.6% over the past decade.

Total return of trusts vs sector over the past decade

Source: FE Analytics

Bird said that manager, John Bennett’s track record for delivering high returns was an appealing case for investing in the fund.

Similarly, the proactive allocation changes he made to the portfolio this year have hedged the trust against some of the market’s worst drawdowns, according to Bird.

For example, Bennett “significantly increased” the trust’s exposure to energy once power and gas shortages in Europe made shares in the sector more lucrative.

Bird said: “We believe that their pragmatic approach to investing is well-suited to the current environment. The managers remain active stock pickers and we would expect the fund’s long-term performance to continue to be driven by stock selection.”

On the other hand Philippa Maffioli, senior advisor at Blyth-Richmond, said that the Blackrock Greater Europe trust was on the most attractive discount.

Its discount of 7.3% is 4.4 percentage points lower than its five-year average, with return sinking 36% in 2022.

However, the trust is a top quartile performer in the IT Europe sector over the past three to 10 years, with returns up 184.2% in the past decade.

Maffioli said that its 1.42% yield is quite low compared to its peers but is worth investing in for those looking for growth opportunities on Europe.

“For those who are not too concerned about wide discounts and are looking for a company with a sound performance record, this would be my choice,” she added.