Defensive positions in the first half of the year followed by a more aggressive approach in the back half of 2023 appears to be the consensus way investors should look to invest next year, according to experts.

The past 12 months have been challenging for investors, with most major markets down over the course of the year. However, there have been bright pockets, such as Latin America and the UK, which have held up favourably.

Turning to 2023, Monica Defend, head of the Amundi Institute, said that global growth will slow significantly next year as major economies enter recession.

“Global growth should land at around 2.2% in 2023 down from 3.4% in 2022 with developed markets expected to slow to 0.3% from 2.6% while emerging market growth should slow to 3.5% from 4%,” she said in the firm’s 2023 investment outlook.

The current economic landscape should continue into the new year, a profit recession and high inflation the likely harbingers of doom. While the US may avoid a full recession, growth will slow, while it is likely that the UK and Europe will fare worse.

“The exceptional spike in global inflation experienced over the past 18 months should persist into 2023 albeit at a slowing pace should take a toll on consumer spending and sentiment,” she said.

“At the same time, it should keep central banks in tightening mode in their effort to ease price pressures via cooler demand and prevent any unwanted loosening of financial conditions.”

However, after this wears off in the second half of the year as inflation begins to subside, investors will want to shift into risky assets with a tilt towards developed market equities.

With this dichotomy in performance between the first and second half of the year, Defend said tactical calls would need to be made.

“On regions the shift to profit downgrades makes the case for the United States over eurozone for now but non-US equity is expected to outperform later in the recovery stage,” she said.

Alex Tedder, head and chief investment officer of global and US equities at Schroders, has brought forward his expectations of a recovery and is already looking at non-US equity options.

The reason for this is is that the recession will not be as deep as feared. With unemployment so low, consumers are better able to weather higher costs, while government action to provide support with energy bills should also cushion the impact.

“An ongoing economic slowdown seems inevitable, but fears of a deep recession may prove unfounded, at least in some countries,” he said.

As such, he suggested that – although earnings estimates still have to come down from here – the current bear market has nearly run its course and that a recovery could take place earlier than expected.

Tedder said earnings could recover by the third quarter of the year, but that markets tend to price this in six-to-nine months ahead of schedule.

Assuming no other ‘Black Swan’ geopolitical events, such as the Russia-Ukraine war, for now he said companies that can prosper in a challenging environment should be investors’ main focus.

“Equally though, as the bear market matures, our research is taking us to several areas that have been out of favour for some time, such as Japan,” he added.

“We will leave you with the startling revelation that, thanks to low wage inflation and a highly competitive currency, it is now cheaper to hire a software engineer in Tokyo than it is Bangalore. There are always opportunities somewhere in the world.”

Staying in the same geographic region, Pieter Fourie, manager of Sanlam Global High Quality, said he has been adding to his emerging market exposure and is constructive on Asian equities as he expects the dollar to finally weaken in 2023 having stayed strong in 2022.

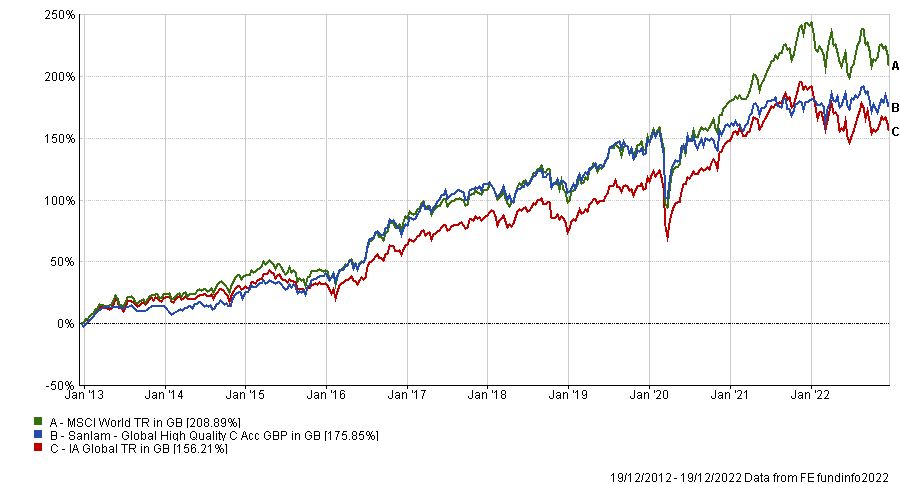

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“The general direction of a weakening US dollar should alleviate pressure on emerging markets and so we retain our overweight position and have been adding to our exposure over the past 18 months in anticipation of a better environment for this region in 2023,” he said.

“Our optimism for Asian equities is based on our belief that equities are forward looking and typically turn six-to-nine months before the economy. As the Chinese economy gradually starts to accelerate this should ease concerns that the economy will remain in a state of paralysis. Policy reflation in China could be more effective as zero-Covid restrictions are gradually phased out.”

Turning to investment styles, Defend said quality is a core position, but should eventually be replaced by deep value in the second half of the year, while dividend payers will work early before being replaced by smaller companies later on in 2023.

James Thomson, manager of the Rathbone Global Opportunities fund, agreed that a shift to quality was needed, noting that many high-growth names that have won over the past decade but suffered in 2022 will struggle to regain their pre-inflation multiples even if the market does recover. This means some stocks he has backed for years have now left his portfolio.

Total return of fund vs sector over 10yrs

Source: FE Analytics

“We have changed about 20% of the portfolio in 2022, replacing stocks such as Uber, Shopify, Align, Match, Signature Bank and Silicon Valley Bank, with higher quality growth,” he said.

“These are more predictable, resilient and cycle-tested companies, where we believe the strong will get stronger over the coming years. Examples include Apple, LVMH, Home Depot, Boston Scientific, Mondelez, Coke and McDonalds.”