In 2022, Emerging Market (EM) equities sold off on heightened risk aversion associated with geopolitical risk, reactive Fed monetary tightening and the strict zero-Covid enforcement policy enacted by its largest economy and the stock market, China.

While 2023 is set to see the global economic backdrop remain challenging, the EM stock market performance is likely to behave much more positively and offers an exciting investment opportunity.

We expect three related positive inflections to drive EM performance, namely: a reopening of China, lower global inflation and for EM economic growth to accelerate compared to the developed world.

These global drivers should improve sentiment and allow EM equity multiples to re-rate from current depressed levels. Meanwhile, EM earnings expectations have already been revised to prudent levels, which should see greater price stability and the prospect of positive surprises.

Overall, this leaves EM equities well-placed to deliver strong absolute returns and to outperform developed markets.

China to pull a rabbit out of the hat

One of the key drivers for EM performance in 2023 is likely to be China where we see most of the recent headwinds recede. Chinese policy is turning more accommodative as the Politburo targets improvements in economic growth, youth unemployment and business confidence.

There have been policy initiatives announced to stabilise the real estate sector, the regulatory reset looks to be behind us, while recently geopolitical tension with Australia and the Philippines appear to be defusing.

Significantly, the speed and efficacy of moves to remobilise the population, following tight zero-Covid enforcement, are surprising positively which can lead to the rapid normalization of consumption patterns.

Households have accumulated significant savings that have not been impeded by higher inflationary pressure seen elsewhere in the world. This should trigger significant pent-up demand as the economy reopens to the benefit of China and her trading partners.

Risks in China remain though. In the short-term, the rise in infections will weigh on economic activity and they will take time to fully dissipate. We are also wary of slower developed world demand weighing on Chinese export growth and certain industries. However, sentiment is already depressed and valuations are attractive which should incentivise investors back to the country.

China is the world’s second-largest economy and accounts for more than one-third of global growth. It represents a significant source of consumption, including 40% of global vehicle sales, 25% of smartphone sales, 50% of global steel demand and 15% of oil demand.

China is also a leader in technological advancement in manufacturing and at the epicentre of the global climate transition, given its dominance in renewables and electric vehicle supply chains.

Consequently, China’s reopening during its Year of the Rabbit is a key catalyst for EM economies and stock markets in general.

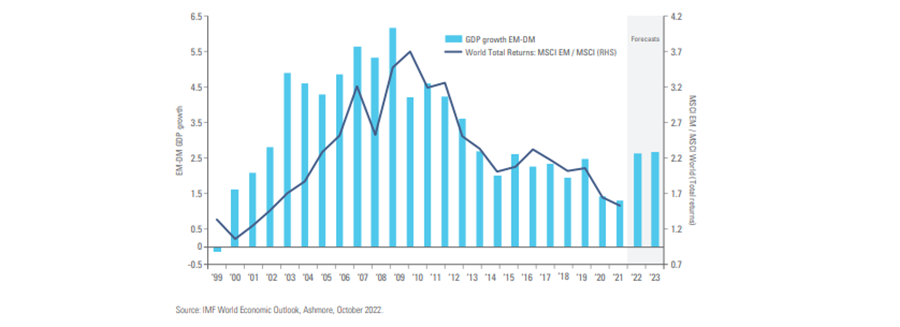

Looking beyond China, other EM countries will also benefit from an improving economic profile compared to their developed market peers. For instance, market consensus expectations is for EM real GDP growth to outpace developed markets by 3 percentage points or more in 2023 and 2024.

Historically, there has been a close relationship between an expanding growth premium and relative stock market returns, and there is little reason to believe this time should be any different.

A view from Latin America

In Mexico, fiscal prudence and pre-emptive monetary tightening resulted in the Mexican Peso becoming one of the best performing currencies globally in 2022. Alongside macro stability, Mexico is set to benefit from accelerated nearshoring on the North American supply chain.

The outlook in Brazil has become less clear. Brazil was one of the first economies to meaningfully tighten monetary policy and with inflationary pressure already peaking this paved the way for real wages to increase buoying consumption and economic indicators in general.

However, the populist fiscal policies of president Lula may see this trajectory delayed, weighing on the outlook. Brazil is home to world leading commodity exporters, which in certain cases should be prime beneficiaries of a Chinese economic recovery so investment selectivity will be key.

Opportunities across Asia and the wider universe

In Asia, Indonesia continues to benefit from higher renewable energy demand supporting nickel prices and increased downstream processing of metals. Meanwhile, Indonesia’s current account moved into surplus, which should support the currency and capital inflows.

In Thailand, the domestic economy is recovering due to improving tourism flows, a trend that will accelerate now that China has opened its borders. Pre-Covid, tourism accounted for around $45bn (around 10% of GDP), while currently, it is only around $3bn (less than 1% of GDP). This should also lead to strong support for the Thai baht.

Domestic growth drivers will likely dictate asset prices in several small EM and frontier market countries. Economic reforms and institutional progress are expected to continue in Vietnam and Morocco, and the prospect of structural monetary reforms in countries like Egypt and Argentina may bring investment opportunities from distressed levels.

The market risk-reward has moved in EM’s favour

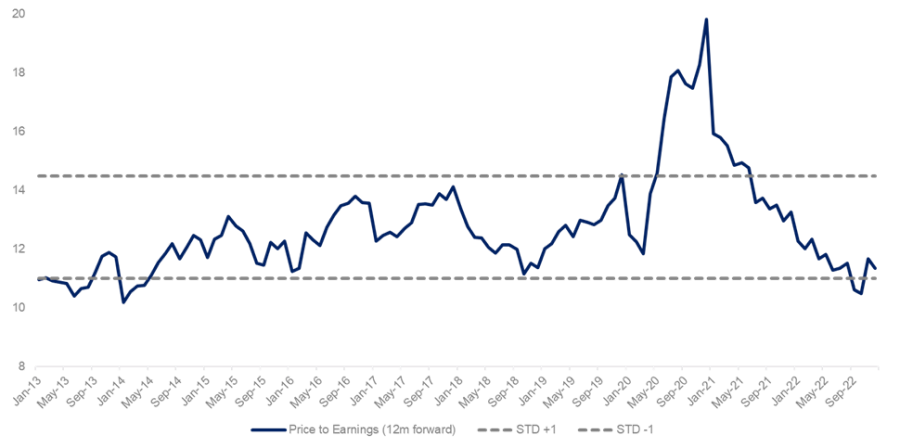

After the longest market drawdown in history, investor positioning in EM equities is currently light. The MSCI EM Index trades around 11x forward earnings, below its long-run average of 12.5x. Meanwhile, 2023 earnings growth expectations are prudently in the single digits after declining by around 15% from their highest levels in 2022.

MSCI Emerging Markets price to earnings ratio

Source: MSCI. Ashmore. Data as at December 2022

Encouragingly, there is increasing evidence of EM corporates cutting costs and maintaining capital expenditure discipline. Thus, margins can expand in 2023 as higher revenue growth is led by increased demand and lower costs.

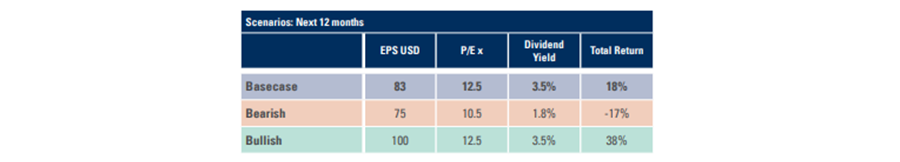

A conservative base-case scenario assumes the current dividend yield of 3.5% and EM multiples rising to 12.5x earnings, leading to ‘high-teen’ returns in 2023. As always, the heterogeneity of EM means that active management remains key and opportunities plentiful.

Source: MSCI. Ashmore. Data as at December 2022

Edward Evans is portfolio manager of emerging market equities at Ashmore Group. The views expressed above should not be taken as investment advice.