UK dividends will rise more slowly in 2023 than in 2022 as we enter into a recession and economies around the world shrink. This is the conclusion of Link Group’s latest report on UK dividends, which suggested last year’s numbers will be hard to replicate in the coming 12 months.

The dividends market ended 2022 at £94.3bn, which corresponds to an 8% increase on a headline basis. This result was supported by growth figures in almost every sector of the economy and by the weakness of the pound, which provided an additional £3.8bn boost to payments declared in dollars, the report read.

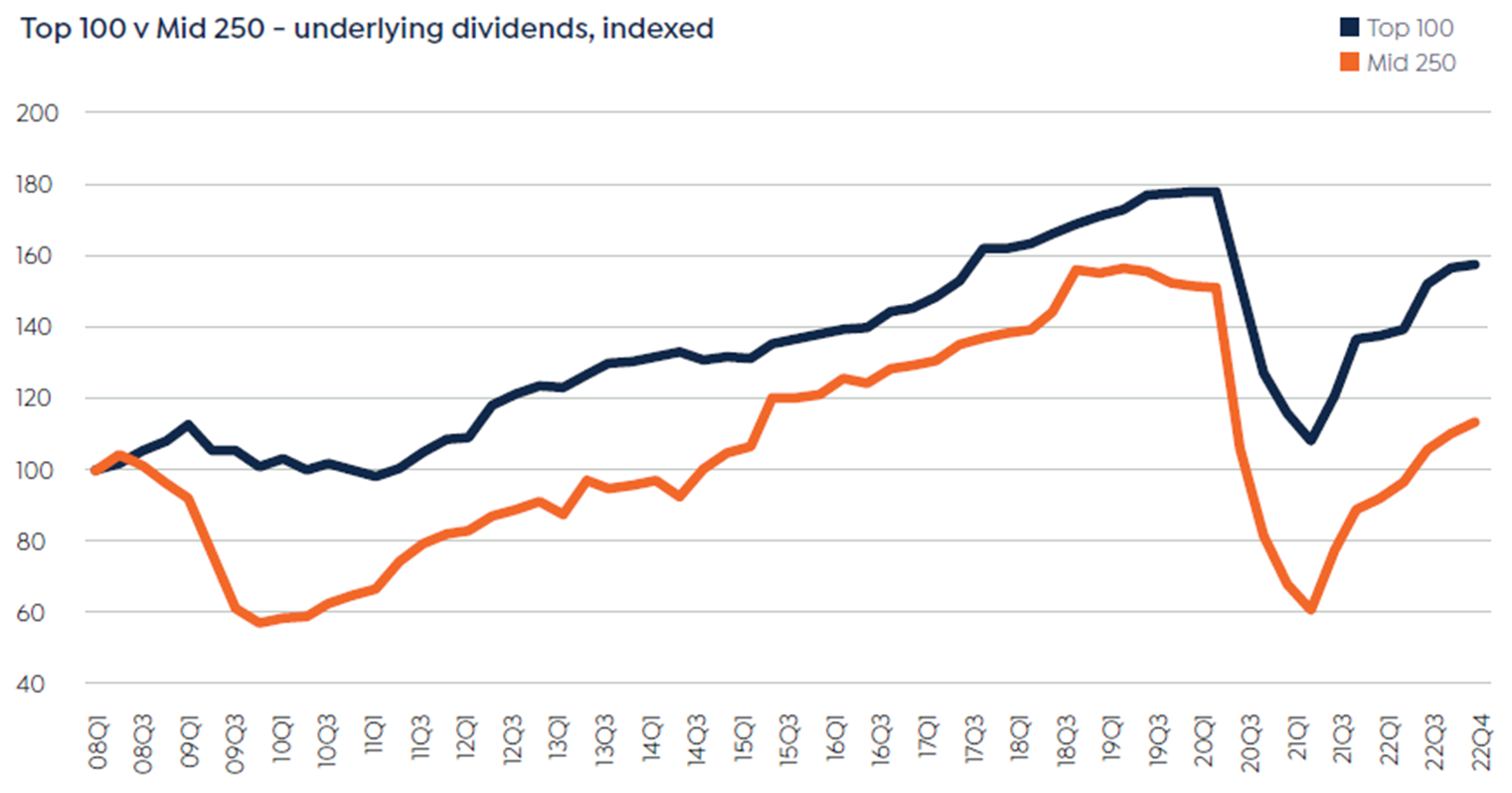

Among the main contributors to growth were mid-cap companies, which recovered sharply from the cuts made during the Covid pandemic and grew dividends faster than their larger counterparts in the FTSE 100, as illustrated below.

Underlying dividends of the top 100 and 250 companies

Source: Link Group

On a sector basis, banks were the most significant driver of growth in 2022, accounting for one quarter of the underlying increase during the year.

In the first half of the year, miners seemed on track to be the largest dividend-paying sector for the second year running, but commodity prices impacted dividends in the second half.

In the oil industry, booming energy prices pushed pay-outs a fifth higher, but share buybacks were the focus, as Link Group estimated that Shell repurchased £16bn of its own shares, adding up to almost one third of the UK buyback total.

In fact, companies bought back record numbers of their own shares, equivalent to 2% of the UK’s market capitalisation and more than half the value of dividends paid during the year.

According to Ian Stokes, UK and Europe corporate markets managing director at Link Group, the outlook for the rest of the year both in the UK and around the world is “decidedly gloomier” than this time in 2022.

“Company margins in most sectors are already under pressure from higher inflation and squeezed household budgets,” he said.

“Soaring interest rates are now crimping profits by raising debt-service costs too. This will leave less money for dividends and share buybacks in many sectors.”

According to Link Group’s report, mining pay-outs in particular will be the first to disappoint, though the extent of their decline is still uncertain.

Another performance drag will come from 2022’s record share buybacks, which will hold back growth by at least one percentage point, the report anticipated. With these headwinds, headline pay-outs are expected to fall 2.8% to £91.7bn.

However, Stokes said that underlying dividends are likely to grow in 2023, as the report predicted an increase of 1.7% year-on-year to £86.2bn in 2023.

“Even with lower mining pay-outs, there is good growth coming through from the banks and oil producers and across the wider market, cuts made during the pandemic mean that pay-out ratios are conservative on the whole,” he continued.

“Companies would also rather reduce share buybacks than cut dividends, as cutting dividends is a very negative signal to give to the market. With the former so high, there is plenty of wiggle room.”

The UK will enter the recession with profits “at a comfortable level” compared to dividends, which will also provide support.