Witan’s James Hart is backing the FTSE All Share to outperform for a second successive year – but is far from convinced about the prospects for the index over the longer term.

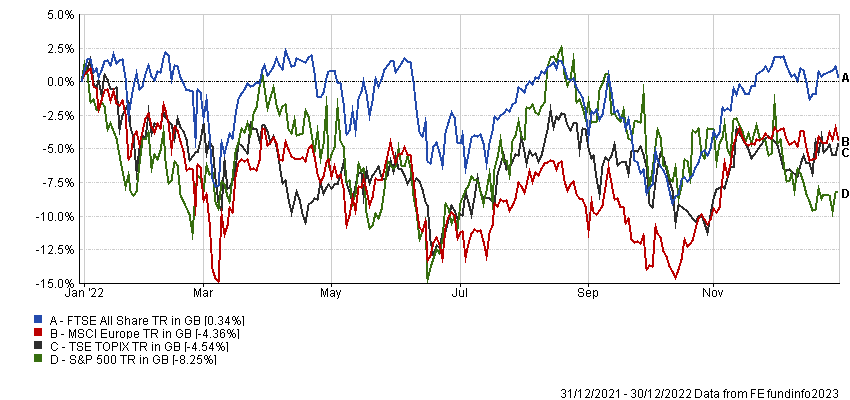

The UK was the best-performing major developed market last year, eking out a positive return while all others fell. This was only the second time it beat the MSCI World index in the past 10 calendar years.

Performance of indices in 2022

Source: FE Analytics

However Hart, Witan’s investment director, said there was no reason why it couldn’t repeat the trick in 2023.

“Headlines and statistics mask a lot of luck,” he said. “The UK was the only major market to be up last year in sterling terms, so you might think it's shot its bolt, that it’s about time that Europe caught up or the US re-took the lead again.

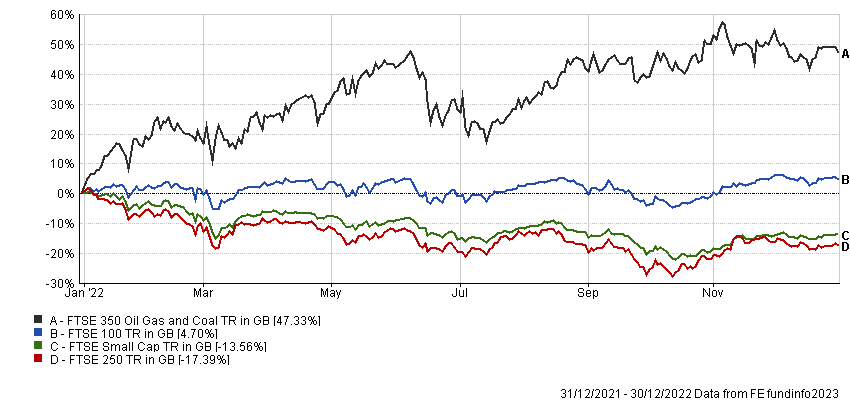

“But it was only up because energy was up so strongly. And energy is a massive component of the UK market. Below that headline number, mid and small caps were down about 15%, which put them bottom of the pack in terms of developed markets. UK stocks are very, very cheap.”

Performance of indices in 2022

Source: FE Analytics

Hart said that with energy prices coming down, there is the opportunity for a re-rating in UK stocks outside of the oil & gas sector. Another tailwind is the stabilising political backdrop, after “the situation with the comedy twins”, as he referred to Liz Truss and Kwasi Kwarteng, which he said was “another nail in the coffin for the UK's reputation on the back of Brexit”.

He added that investors shouldn’t fear the prospect of a Labour government, as Keir Starmer represents the more moderate wing of the party.

However, Witan has been steadily reducing its exposure to the UK over the long term, with Hart saying it has become home “to just about every dodgy emerging market miner”, while there are fewer opportunities to own great businesses.

Expanding on the latter point, he cited a quote from Dyson founder Sir James Dyson who said: “UK culture doesn’t celebrate the entrepreneur.” Hart claimed this has led many of “the UK’s greatest minds” to move abroad, especially to the US which is more business-friendly.

“There have been many examples of great British companies being founded in a garden shed or on an iPad – in fact the iPad (and iPhone) was conceived by Jonathan Ive, a Brit working for a US company,” he said.

“The greatest of all is perhaps Tim Berners-Lee, who invented the World Wide Web while working at CERN in Switzerland.”

To illustrate his view, he named ARM, DeepMind, WaveOptics, MessageLabs, Autonomy, Micro Focus and Aveva as examples of British tech companies that have either been bought by foreign firms or listed abroad.

As a result, less than 2% of the UK market is classified as tech companies, compared with about 25% for the US, a figure that doesn’t include tech-related firms such as Amazon.

“This doesn’t mean that the UK is a bad investment – far from it,” Hart added. “We see great value – and therefore the potential for some good years of equity performance – but I fear for the long-term relevance of the UK stock market if we cannot nurture our ground-breaking companies and keep them here for the long term.”

Hart is far from the only manager to have expressed concern about the ability of UK companies to scale up.

James Anderson, the former manager of the Scottish Mortgage Investment Trust, once claimed the UK was one of the worst-placed countries in the world for grasping the opportunities in disruptive tech and related areas, and that it relied too heavily on ‘old world’ industries.

“Unless we see an era where the many [UK] start-ups actually translate into being something at scale, which I don’t really see much evidence of, I think the wholesale destruction that will happen in the next 10 to 20 years is enormous,” he said.

“I think there is far too much belief that somehow these big companies are safe. I don’t think they are any safer, really, than the big banks were in the last crisis.”

In 2021, Henry Dixon, manager of the £1.5bn Man GLG Income fund, pointed out that 12% of the FTSE All Share by market cap was taken over that year and claimed the index would be gone by 2030 if the trend continued at the same rate.