The FTSE will be gone in eight years if UK stocks continue to be bought out at the current rate, according to Henry Dixon, manager of the £1.5bn Man GLG Income fund and £1.4bn Man GLG Undervalued Assets fund.

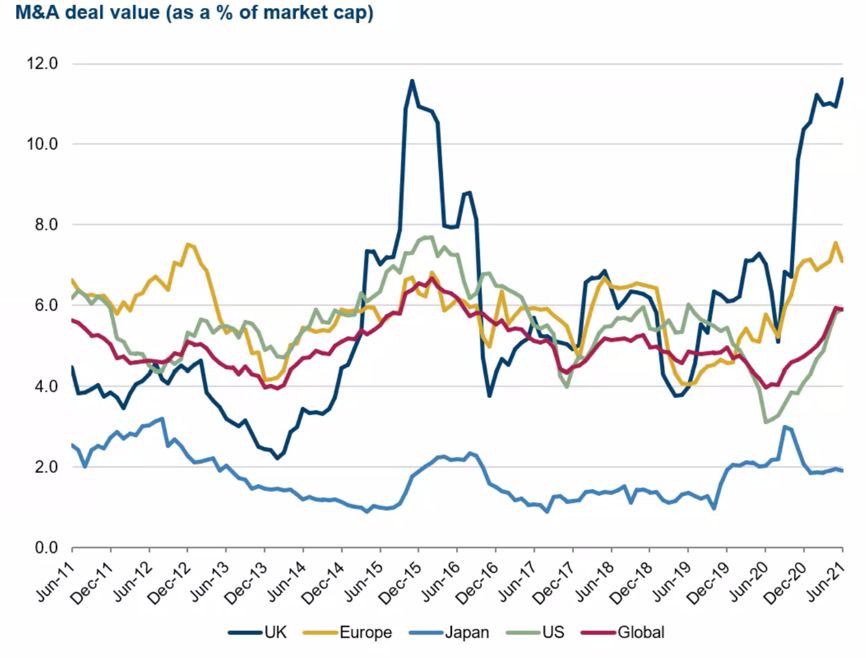

The UK equity market has seen a significant spike in merger & acquisition activity this year, historically and geographically. It has seen 28 deals so far, the most of any major region.

Dixon said the only thing that will stop this trend is a revaluation of UK equities.

“If we keep losing 12% of the UK market cap every year, then UK equities on the listed shelf have about eight years to live,” he claimed.

“Now clearly, there will be IPOs on the other side – but this is a very, very pronounced period of de-equitisation in the UK market with regard to M&A [mergers & acquisitions].”

Source: Man GLG Group

Although the chart above shows M&A deal value also spiked in 2015, Dixon attributed most of this to two large deals that occurred in the latter part of that year.

One was Anheuser-Busch InBev’s acquisition of British multinational beverage company SABMiller, for £68bn. The other was Royal Dutch Shell’s £47bn buyout of oil & gas exploration firm BG Group.

But Dixon said it was not just the value of the completed deals this year that was notable.

“I think the difference is just the sheer number of bids we're seeing for smaller companies,” he added.

“If I look back at spikes in corporate activity, it has usually been a very good precursor of UK equity performance.

“So at least there is someone who agrees with the value argument in the UK, and that's corporates who are – one would hope – some of the more informed buyers of UK equities.”

Dixon also said there has been a major disconnect between how much UK earnings have rebounded and the equity market’s valuation.

Although the aggregate forecast for earnings growth in the UK for 2021 was 46% at the start of the year, the manager initially doubted that figure.

However, he also noted that in 2009, the year after the most recent major stock market crash, earnings growth was roughly 30%.

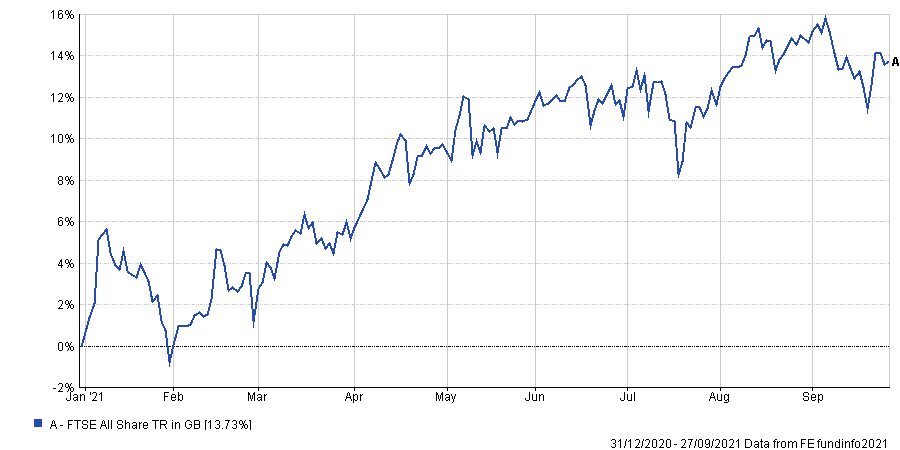

“Although 46% is clearly a very big number, but to the end of June, markets saw that 46% earnings growth repeatedly revised up during the year by 15% – but the market hadn't fully kept pace,” he said.

“As I sit here at the end of the third quarter, the earnings revisions have gone up again. We're now seeing those revised up by about 27%, and the market has really only captured about half of that.”

Performance of FTSE All Share year-to-date

Source: FE Analytics

“It has been well documented that there's been economic momentum, but this isn't just an economic exercise,” Dixon continued.

“Bottom-up in the stock market, the earnings delivery has been fantastic. There's an element of frustration the markets haven't fully kept pace with that.”

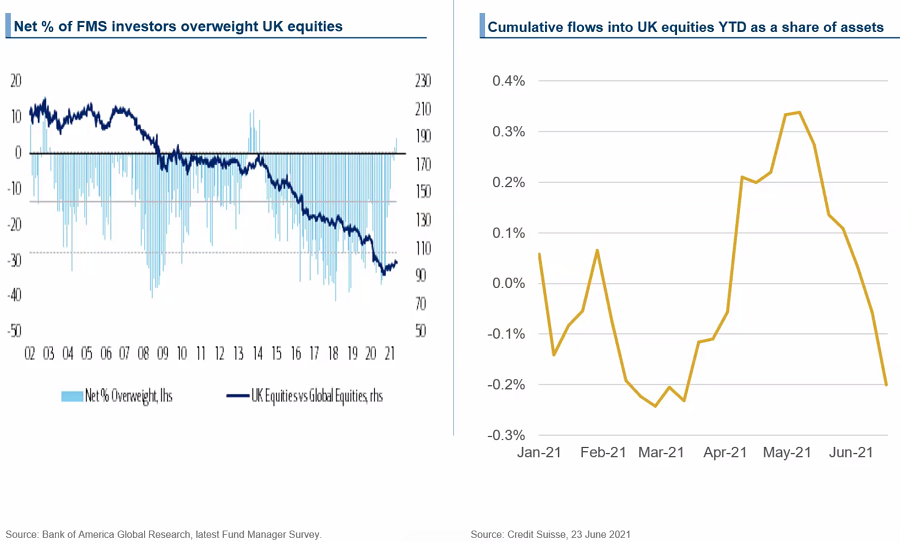

According to data from the Bank of America Merrill Lynch Global Fund Manager Survey, there was a tipping point earlier this year where professional investors said they were overweight UK equities.

However, Dixon said there was a contradiction between what fund managers were saying and what they were doing in terms of fund flows, which are still trending negative despite an initial positive period earlier in the year.

The chart below shows the results of the survey and the year-to-date fund flows into UK equities.

“I think it's more of an indication of where people want to be than necessarily where they are,” he added.

“The UK really was the only major equity asset class anywhere in the world to sit out the fund-flow bonanza.

“I'm a little bit perplexed that UK equities cannot find greater favour among institutional investors,” he finished.

The Man GLG Income fund has delivered a total return of 45.8% over the past five years, compared with 31.7% from the FTSE All Share and 26.1% from the average fund in the IA UK Equity Income sector. It is ranked first quartile over five years and has an OCF of 0.9%.

Source: FE Analytics