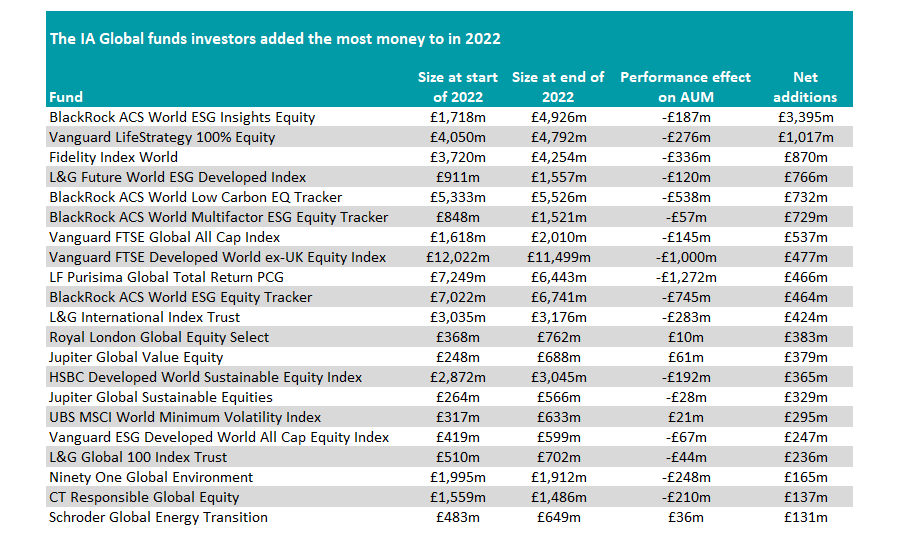

Investors hoping to ride out the worst of last year’s volatility flocked to passive funds and those with environmental, social and governance (ESG) mandates, according to data from FE Analytics.

Indeed, of the 21 funds in the IA Global sector to take in more than £100m of new money from investors in 2022, two-thirds (14 out of 21) were passive vehicles, while more than half (11) focused on ethical investing.

BlackRock ACS World ESG Insights Equity was the fund to take in the most new money last year, combining the two themes together. The fund took in £3.4bn of new money from investors last year, despite making a loss.

It is one of four BlackRock ACS funds to make the list, as the below chart shows. All focus on ESG characteristics in some way and cost less than 0.1% in ongoing charges.

Source: FE Analytics

Investors moved towards ESG funds in 2022 despite the poor year overall for this strategy. Broader ESG funds tend to invest in technology stocks that struggled in 2022 but some specialist portfolios such as Ninety One Global Environment, CT Responsible Global Equity and Schroder Global Energy Transition all attracted new money from investors.

There was also a clear switch towards traditional passives, with Vanguard LifeStrategy 100% Equity among the most popular funds of the year.

While the popular fund range’s lower-risk portfolios struggled, its equity-heavy end proved enticing for investors, who moved up the risk scale last year to avoid the sell-off in bonds.

Fidelity Index World, the cheapest broad global equity tracker in the sector costing just 0.12% per year, was the third most allocated to fund in 2022 as investors focused on limiting their losses by investing in the cheapest options available.

When markets fall, investors tend to focus more on fees, as more expensive funds tend to erode cash much quicker than those with smaller costs.

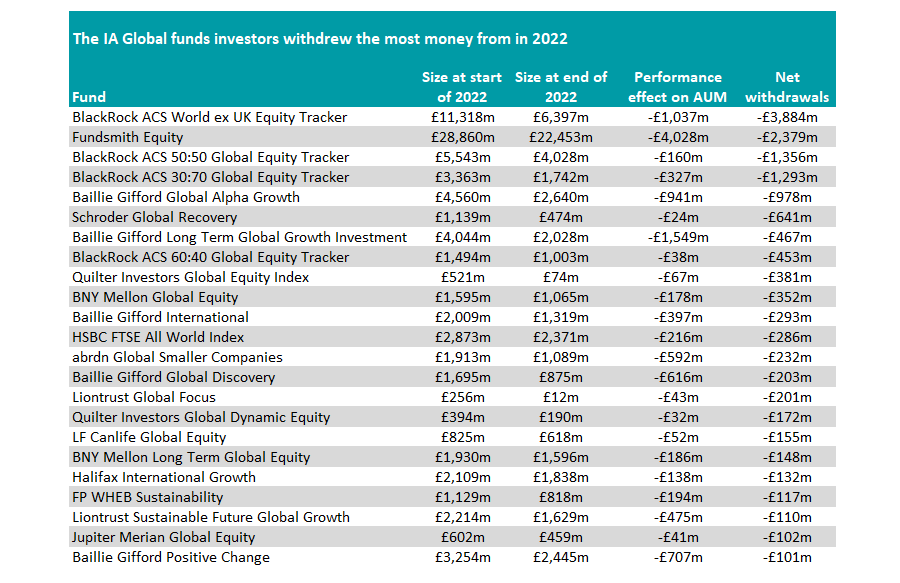

Turning to those portfolios that investors moved away from in 2022, the BlackRock ACS range also found itself atop this pile, with the BlackRock ACS World ex UK Equity Tracker fund almost halving in size of the course of the year.

Around £1bn was taken out from performance, while £3.8bn was removed by investors, meaning the fund went from £11.3bn in assets under management (AUM) at the start of the year to £6.4bn by the end.

However, there were far more active equity funds on this list, with Fundsmith Equity the largest manager-led portfolio to experience outflows.

In total, the fund lost £4bn in AUM from performance, while a further £2.4bn was withdrawn (on a net basis). It takes the formerly £28.9bn fund down to £22.5bn, although it remains huge compared with most of its peers.

Source: FE Analytics

Investors soured more broadly on global equities, with 23 funds suffering more than £100m in outflows. Consistent with others in the series, Baillie Gifford funds struggled, with its Global Alpha Growth, Long Term Global Growth Investment, International, Global Discovery and Positive Change portfolios all on the list. Collectively, investors removed around £2bn on a net basis from these funds in 2022.

There were a host of ethical funds on this side of the line as well, with FP WHEB Sustainability and Liontrust Sustainable Future Global Growth joining Baillie Gifford Positive Change at the bottom of the list.

This is third in the latest series. Previously we looked at the multi-asset funds, as well as regional equity portfolios in the US, Europe, emerging markets, Asia and Japan.