Markets are predicting a soft landing based on the current valuations of stocks and high yield bonds, but JPMorgan Multi-Asset Growth & Income’s Gareth Witcomb remains cautious for the remainder of the year.

According to the investment company manager, 2022 was “one of the hardest market environments I have ever been in” and even after a strong rally to start the year, there are a number of “underlying cross currents” that could affect markets in the coming months.

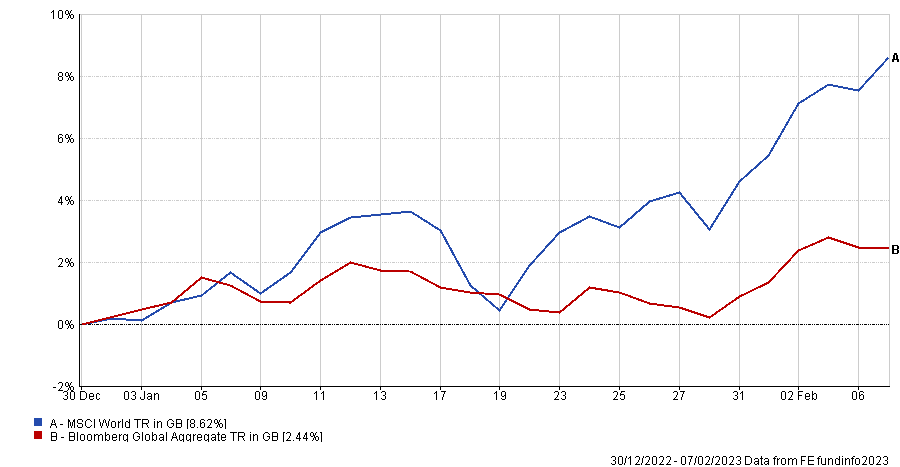

So far in 2023, global stocks are up 8.6% while the Bloomberg Global Aggregate bond index has made a 2.4% gain. This has been welcome respite for investors, but the manager of the £75m investment trust said those in the market should look at growth, which is likely to be in scarce supply this year.

Performance of indices in 2023

Source: FE Analytics

“I don’t think there is anything controversial in saying that. Even the most optimistic of forecasters expect global growth to be below trend in 2023,” he said.

With growth likely to be low, it depends on where the market is pricing assets, rather than whether they can improve earnings, that will determine returns from here.

Witcomb said better inflation figures in the US have cheered investors, but he noted that the market could be overly confident that the Federal Reserve will end its interest rate hiking cycle.

“In the US, the markets has been buoyed by inflation moving lower, but how much of a hard or soft landing is priced in? If I look at high yield spreads, they are relatively tight. It feels as though a softer landing is in the price there. You can make that case to an extent in equities as well,” he said.

It is for this reason that Witcomb is unwilling to “load up on risk” and has been telling clients that this is not necessarily the time to be buying equities. “We are still fairly cautious,” he said.

“The Fed may be able to engineer a soft landing, but its also possible that it doesn’t and there is recession. We are somewhere between a mild recession and a soft landing, depending on what the data says, but these things are hard to forecast and there are risks on both sides.”

He added that it was “hard to see us on a major two-year bull run” given the starting valuations of most stock markets and the questions over whether companies can sustain their earnings, but argued that, for the next few months, “the market can be buoyed by better inflation data from the US and the reopening of China which is happening at a rapid rate”.

Indeed, where Witcomb has added risk to his portfolio, he has centred it around the Chinese reopening trade, deploying capital to the emerging markets and China in particular.

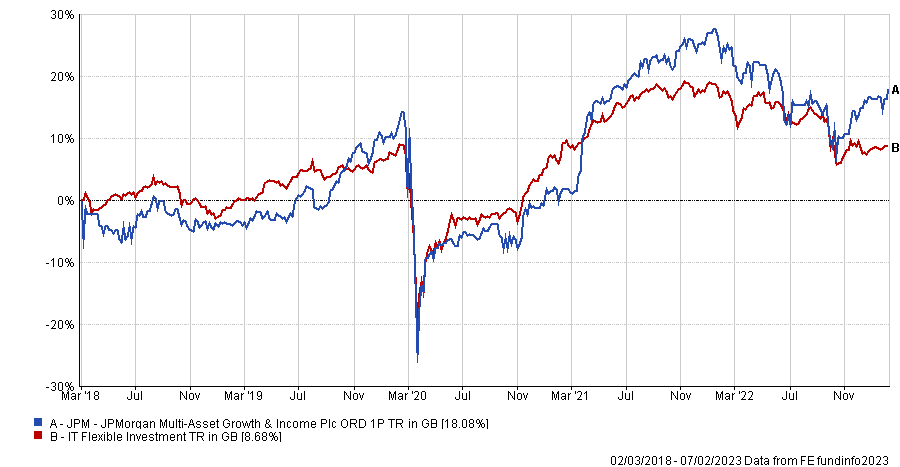

Performance of trust vs sector since launch

Source: FE Analytics

“We have been surprised by the speed of the China reopening and we have got bespoke exposure there. With the dollar peaking, we think there is cause for mild optimism in the emerging markets, where central banks have also done a better job at keeping inflation down and acting pre-emptively,” he said.

He has also been “cautiously adding” to Europe through call options and was “surprised” that the market had performed so well in 2023 so far (the MSCI Europe Excluding UK index is up 9.2% year-to-date).

“China reopening is clearly beneficial for European equities,” he noted, as companies on the continent tend to be exporters, selling their goods into Asia.

Conversely, the manager is “relatively cautious” in places such as the US, where the Federal Reserve may have to stay on its interest rate path “for a bit longer”.

He also suggested investors “keep allocations low” to high yield credit markets, where the risk is not yet priced in and there could be more volatility to come.

Here, Witcomb has been allocating to high-quality fixed income assets such as government bonds and high investment grade credit, where he “has a hard time seeing negative returns this year”.

“Whether you get more than cash is a good question, but I think there is optimism there. If you can get a meaningful return from government bonds, are people willing to take on more risk in their portfolios? That may be part of the reason we have seen the [bond] rally that we have,” the JP Morgan manager said.