UK funds run by Liontrust and BlackRock have been chosen to replace portfolios managed by Columbia Threadneedle and Martin Currie by AJ Bell analysts, who made two swaps in the firm’s Favourite Funds list in January.

Best-buy lists are a tool to help investors decide what to buy. While they are constructed with the long term in mind, sometimes factors change that require a fresh perspective.

That has been the case this year for AJ Bell’s recommendations. CT UK Equity Income was removed from the list after veteran fund manager Richard Colwell left the firm towards the end of last year, despite being replaced by longstanding deputy Jeremy Smith.

In its place is Adam Avigdori’s and David Goldman’s BlackRock UK Income fund, which the analysts “have a higher conviction in” and has “a similar investment approach”.

“This is a core UK equity income strategy, which offers a pragmatic, style-agnostic approach and is managed by an experienced and well-established management team at BlackRock,” they said.

“The managers use a pragmatic style neutral approach, targeting a balance of income returns ahead of the benchmark without sacrificing long-term capital growth. This has served managers well over the long term.”

Over the past decade, BlackRock UK Income has made 102.4%, beating the average IA UK Equity Income peer and FTSE All Share index by around 25 percentage points. However, it is 14 percentage points behind the Columbia Threadneedle fund that has been removed.

Total return of funds vs sector and benchmark over 10yrs

Source: FE Analytics

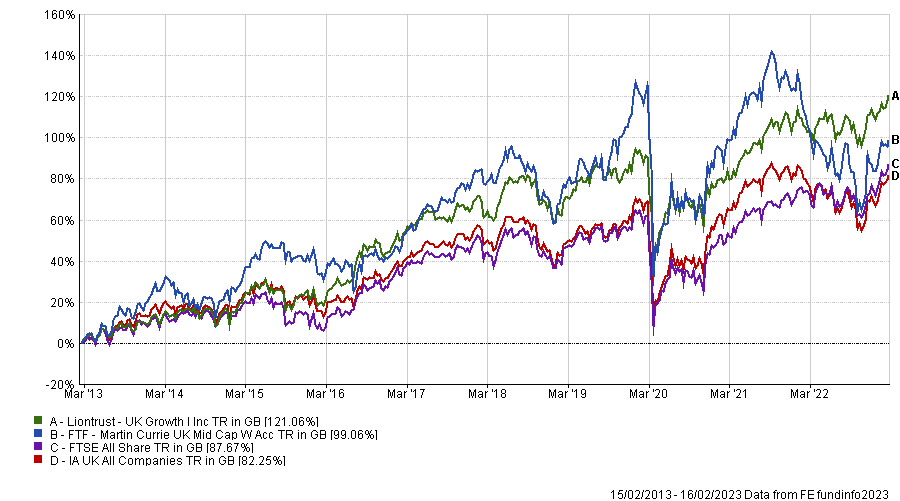

The other major change this year was the removal of FTF Martin Currie UK Mid Cap in favour of Liontrust UK Growth. AJ Bell’s analysts argued that the former faces “uncertainty with the team dynamic” following a series of retirements in recent years, including veteran Colin Morton, who left in 2022.

In comes Liontrust UK Growth, managed by the ‘economic advantage’ team headed by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh.

It is not a direct replacement, as the former fund invests solely in the mid-cap space while the new entrant can invest across all market capitalisations. Indeed, the Liontrust portfolio is 69% invested in FTSE 100 names, with just 21% in FTSE 250 stocks.

However, it has been more successful over the long term than the fund it replaces, with Liontrust UK Growth up 121.1% over 10 years, compared with a 99.1% gain for the FTF Martin Currie Mid Cap fund.

Total return of funds vs sector and benchmark over 10yrs

Source: FE Analytics

“We have conviction in this management team who hold a clear philosophy and investment process that have been tried and tested over time,” the AJ Bell analysts said.

“The structure ensures a disciplined and pragmatic investment approach, offering a competitive advantage. The longevity of the team and consistency of implementation provides credibility, with a strong focus on long-term sustainability of profits on companies held within the portfolio.”

AJ Bell is not the only investment platform to make changes, however. Last week the UK’s largest fund supermarket – Hargreaves Lansdown – announced two new additions to its Wealth List.

L&G Future World ESG UK Index was added, with passive investment analyst Alexander Watkins noting that the firm is “currently one of the best for integrating ESG solutions into tracker funds”.

“It is a good option for broad exposure to the UK stock market, while being mindful of environmental, social and governance (ESG) issues. An index tracker fund is one of the simplest ways to invest, and we think this fund could be a great low-cost starting point for a portfolio aiming to deliver long-term growth in a responsible way. It could also be a good addition to a portfolio of other tracker funds.”

The platform also added the Polar Capital European ex-UK Income fund, which had an exceptional year in 2022, up 7.3% when much of the IA Europe Excluding UK sector made a loss.

Josef Licsauer, investment analyst at the Hargreaves Lansdown, said: “We like the defensive nature of the approach and the disciplined investment process. Our conviction lies with manager Nick Davis, who has built a strong track record in European income investing.

“The fund could be a good addition to an investment portfolio focused on income, or provide some diversification to other European or global funds focused on growth.”