Private equity trusts, technology investment companies and American funds are among the 10% of portfolios that would have made savers an ISA millionaire, according to data from AJ Bell.

The study assumed investors had put away the maximum allowance on the first day of each tax year since 1999. Of the 472 funds and trusts with a performance record stretching back to 1999, when ISAs were launched, just 50 would have made you a millionaire from investing your full ISA allowance each year.

Investors would have had a higher chance of becoming a millionaire with investment trusts, which account 35 of the 50 names.

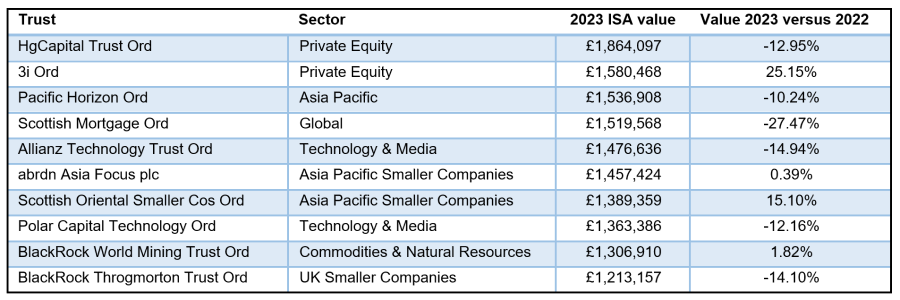

The top 10 trusts that would have made investors an ISA millionaire

Source: AJ Bell

HgCapital* would have earned investors the most money, making a total of £1.8m despite a down year, while fellow private equity trust 3i was second.

Other popular names including Scottish Mortgage and Polar Capital Technology made the list after a strong decade in the 2010s, although they have come off the boil in recent years.

Conversely, despite a volatile decade post the 2008 financial crisis, strong returns from the mining sector post-Covid means BlackRock World Mining Trust also made the list.

Asia has been a particularly strong area for investors, with three trusts on the list: Pacific Horizon, abrdn Asia Focus and Scottish Oriental Smaller Companies.

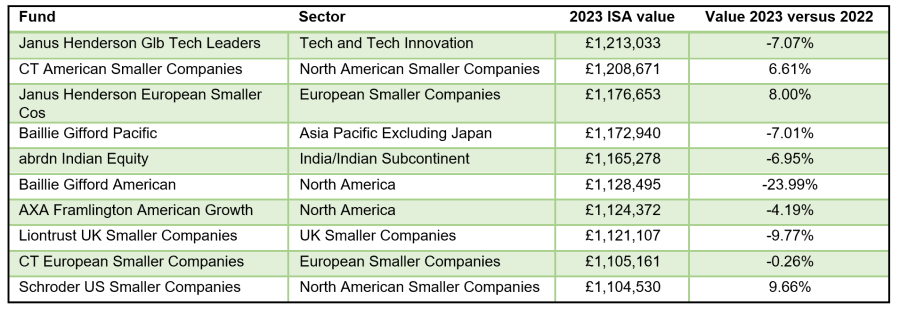

Turning to funds, the only Investment Association sector that would have made savers a millionaire is IA India/Indian Subcontinent, where the average fund would have made investors £1.1m. Aberdeen Standard SICAV I Indian Equity was the only fund among the 10-highest returners, as the below table shows.

The top 10 funds that would have made investors an ISA millionaire

Source: AJ Bell

Laith Khalaf, head of investment analysis at AJ Bell, said: “The best performing funds and trusts over this period are invested in riskier, sometimes specialist areas of the market, like technology and private equity.

“Smaller companies funds also feature heavily, reflecting the robust returns enjoyed by this segment of the market. It’s notable that many of these funds and trusts have fallen in value in the last year, some of them quite considerably.

“The fact they have still banked enough good performance to produce ISA millionaires shows your final investment ranking is a reflection of returns from start to finish, not just in the final furlong.”

All of the funds and trusts to make investors a millionaire are actively managed, although some of this may be because passive funds were less prevalent in 1999 than they are today.

Trackers also tend to invest less in smaller companies, private equity and other higher risk assets, which have dominated the past 20-plus years. The closest was HSBC American, which would have netted investors £991,986 since 1999.

Khalaf said there are three “magic ingredients” to becoming an ISA millionaire – investing the full allowance, doing so on the first day of the tax year and taking risk by backing the stock market.

However, there is also a good dose of luck required. Indeed, saving a full ISA allowance every year since 1999 would have netted £684,891 if invested in the average global stock market fund.

The ISA allowance is at an all-time high of £20,000, which means there is scope for more people to become millionaires even if they take a bit less risk with their portfolio.

“The higher allowance may also mean we gradually see the age profile of ISA millionaires falling, because at the moment it’s largely the preserve of the more seasoned members of the investing community. The average age of ISA millionaires on the AJ Bell investing platform is 74, though the youngest is flying the flag for millennials at the tender age of 35,” he said.

Based on putting the full £20,000 into an ISA each year and achieving a 6% annual return after charges (the long-run average of stock markets), an investor would make £1m after 24 years, so they still do need to be long term in their planning. Even if the amount invested is halved to £10,000 it can be achieved after 33 years.

However, he noted that while being an ISA millionaire is a good target, it is not necessary. A pot of £200,000, for example, could still provide £8,000 in income per year (assuming a 4% yield), which is a good boost to state and private pensions.

*HgCapital Trust is an investor in FE fundinfo.