Technology will be a leading theme over the next decade but bonds are a good short-term play, according to Simon Nichols, manager of the BNY Mellon Multi-Asset Balanced fund.

The £2.4bn portfolio has an 11.3% allocation to technology compared to 8.4% average in the IA Mixed Investment 40-85% Shares sector.

This allocation has been helpful over the long term, with the fund up 88.2% over the past decade, while it has also made strong returns placing it in the top quartile of the XX sector over the past three, five and 10 years.

Here, Nichols tells Trustnet how deratings could provide a good entry point to technology and why US bonds becoming a bigger part of his portfolio.

Total return of fund vs sector over the past decade

Source: FE Analytics

What is your investment approach?

We invest predominantly in equities, with around about 70% to 80% of the fund in stocks. We also have allocations to government bonds and cash and we can invest anywhere, so it’s a very flexible portfolio.

Because we can invest anywhere, we like to gain the broadest range of views possible and we get that from our expertise across the firm. We take all that on board and create a portfolio of equities and bonds that meet the objectives of the portfolio to deliver long-term capital and income.

How does that approach differ from your peers?

We're directly invested – we're not looking to be a fund-of-funds – and we’re relatively concentrated with equities in the mid-50s which is complemented by exposure to bonds and cash.

That concentration really does come through in terms of the performance because we’re largely driven by the alpha that we're getting from that equity selection and backing our best ideas, not investing in hundreds of stocks.

Has your bias towards equites been damaging to performance over the past year?

Bond markets produced lower returns than equity markets looking back over the past year. The gilt market was down more than 20% last year and, whilst equities did suffer into that derating, many others produced higher returns than bonds.

What equity sectors do you see outperforming in the future?

We’re really long term, so the themes that excite us would be those areas of the market that have the potential for disruptive change.

Most of those stocks you will find in the technology and healthcare sectors and those are the areas that we are most overweight in.

Those are areas we would highlight, maybe not on a six-month view but certainly over the long-term.

Have you taken advantage of deratings to allocate to those sectors?

I think technology is going to be the key driver of most economies over the long term. Once they’re past this cyclical hump, I think these are great companies to invest in.

I think it's definitely a case of getting through this tough period. There was a time where they had supernormal returns in the Covid period but I see no reason why the returns shouldn't be fantastic in the future.

We haven't yet majorly reinvested our high cash balances back into equities but there's obviously a lot of volatility in markets that we are looking to use to invest in names that have got great long-term prospects.

Why haven’t you increased exposure to that sector yet?

Technology is already our largest overweight so there hasn't been a major move back into that area yet. We reduced exposure there a little bit in 2022 but we’ve started to build it back up this year by adding some new names like Nvidia, which is a semiconductor designer.

We've actually been increasing our allocations to bond markets because the yields available have become much more attractive. They weren’t yielding anything but the change in real yield has moved significantly.

Share price of Nvidia over the past year

Source: Google Finance

What bonds have you been buying?

We've increased both to the US and UK bond markets because they’re well-developed markets with high ratings.

We use our bond allocations very much as stabilisers, so we don't have any money in corporate and high yield bonds – we're taking risk in equities, not within the bond element of the portfolio.

UK bonds make up most of your fixed income exposure – why do you prefer them?

The yields are relatively similar in the US and UK at the moment. You can now get a little bit of a higher yield in the in the US than the UK.

The US market had a real yield of minus 1% last year, but that’s gone up to 1.5% at the start of this month, so that's been a key change for returns from bonds.

From a currency point of view, we are a sterling dominated fund so we keep an eye on currency exposures. Cleary, having some overseas exposure with the weak sterling was beneficial last year.

Are US bonds now looking more attractive than in the UK?

You get a slightly higher yield in the US, but there’s not a lot in it at the moment. Developed market bonds tend to move together because central banks tend to act together.

Inflation expectations in the UK are a little bit higher than they are in the US, but then you have the issues with Brexit so there’s not a lot in it.

Which of your holdings performed best over the past year?

BAE Systems was a really strong performer for us over the last year given the geopolitical issues we saw in Ukraine. It contributed around 50-60 basis points to the overall relative performance of the fund.

What was your worst performer?

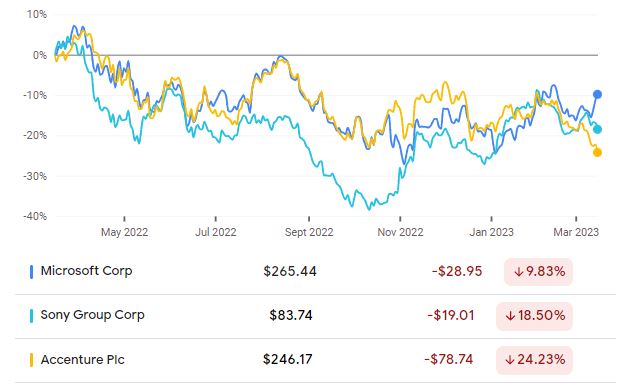

The most negative contributors to performance will be some of our bigger technology holdings such as Accenture and Sony. Microsoft didn't keep up with the broader market last year, so that would be up there as well.

Microsoft detracted about 30 basis points from performance, with Accenture and Sony at around 25 basis points each.

There was some weakness in earnings last year from some currency issues because of the strong dollar and particularly from the cyclical hump in the fourth quarter. Over the longer term, we anticipate that these stocks can perform well.

Total return of Microsoft, Sony and Accenture over the past year

Source: Google Finance

What are your interests outside of fund management?

I like to run, so I’ve entered into the Leeds half marathon in a couple of months’ time. Training for that is what I do on evenings and weekends.