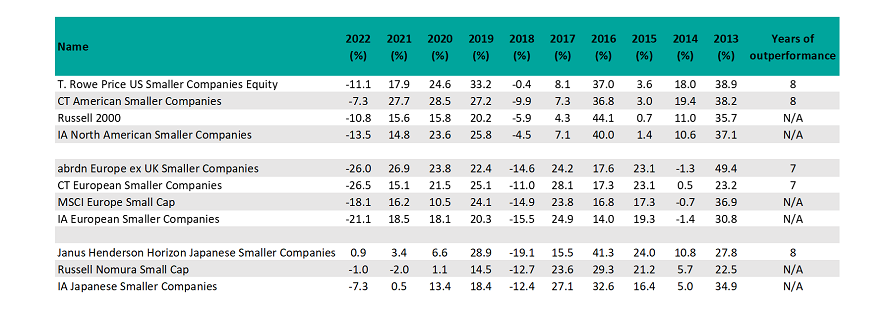

Some of the IA’s regional small-cap sectors are tiny: for example, IA Japanese Smaller Companies contains just seven funds that were launched before the start of 2013.

However, the size of the markets that funds in these sectors aim to beat can still be enormous – close to $6trn in the case of the Russell 2000 – and doing so on a consistent basis remains an impressive feat.

IA North American Smaller Companies

T. Rowe Price US Smaller Companies Equity is the most consistent IA North American Smaller Companies fund of the past decade, beating the Russell 2000 – the most common benchmark in the sector – in eight of the past 10 calendar years and its peer group composite in nine.

Performance of funds vs sectors and indices

Source: FE Analytics

In second place is CT American Smaller Companies, which beat the Russell 2000 in eight of the past 10 calendar years and the sector average in the same number.

Curt Organt, who has managed the $2.3bn T. Rowe Price US Smaller Companies Equity fund since March 2019, has no explicit style bias.

“Our strategy utilises the full opportunity set, from deep value to aggressive growth, across industries and sectors,” he said.

“Generally, we are looking for high-quality companies that we expect to compound value over time. Analysts may uncover out-of-favour companies with strong potential for improvement, or companies that may appear fully valued, but whose long-term growth potential is underappreciated.”

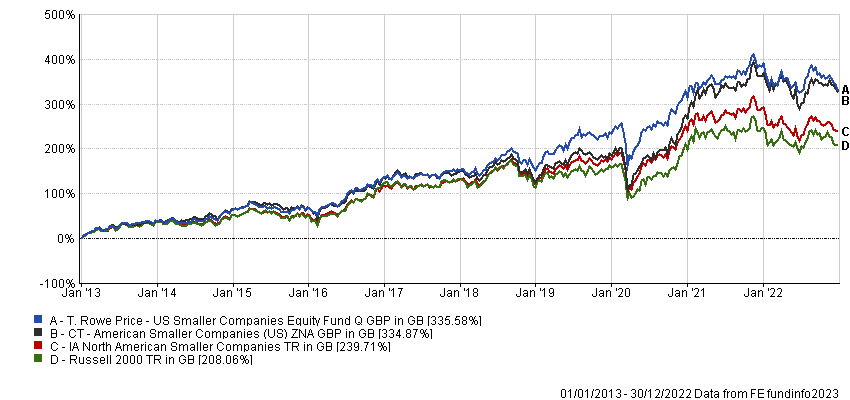

T. Rowe Price US Smaller Companies Equity made 335.6% over the 10-year period in question, compared with gains of 239.7% from its sector and 208.1% from the Russell 2000 index. It has ongoing charges of 1.06%.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

CT American Smaller Companies manager Nicolas Janvier has a more defined strategy, explicitly looking for companies that are improving.

“A lot of fund managers tend to say they invest in the best of the best, meaning higher quality companies,” he said.

“You generally don't find us using that kind of language. We believe alpha is captured by finding companies that are getting better from a fundamental perspective, meaning they are gaining market share, which is translating into higher profitability and a higher return on invested capital.”

The £793m CT American Smaller Companies fund made 334.9% over the 10-year period in question. It has ongoing charges of 0.88%.

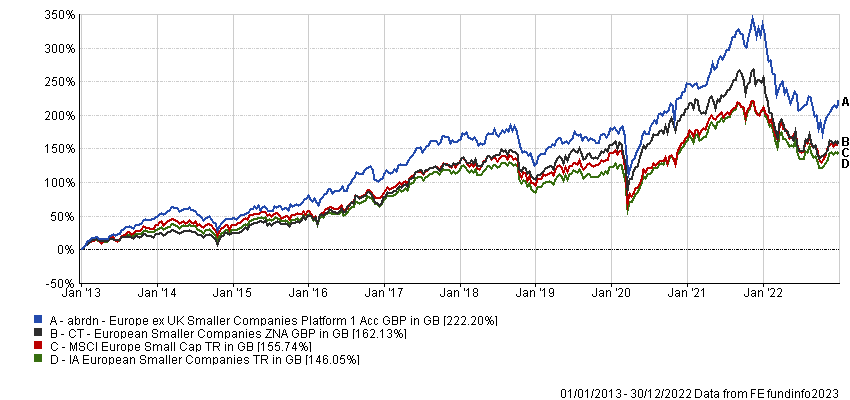

IA European Smaller Companies

In the IA European Smaller Companies sector, abrdn Europe ex UK Smaller Companies came out on top. It beat the MSCI Europe Small Cap index – the most common benchmark in the sector – in seven of the past 10 calendar years and its peer group composite in eight.

Again, a Columbia Threadneedle fund, CT European Smaller Companies, finished in second place. It beat the MSCI Europe Small Cap index and the sector average in seven of the past 10 calendar years.

Andrew Paisley, the manager of abrdn Europe ex UK Smaller Companies, uses abrdn’s proprietary Matrix tool to help him identify high-quality companies with long term-growth potential and strong momentum working in their favour. Paisley said this process, having originally been introduced for a UK small-cap strategy in 1997, has proved its worth through four economic cycles.

abrdn Europe ex UK Smaller Companies made 222.2% over the 10-year period in question, compared with 155.7% from the MSCI Europe Small Cap index and 146.1% from the IA European Smaller Companies sector. The £54m fund has ongoing charges of 0.91%.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

Mine Tezgul, the manager of CT European Smaller Companies since December 2019, also invests in high-quality businesses.

She said a hallmark of these is competitive advantages such as: cost advantages, meaning they can produce goods or services for less than their competitors; scale benefits; network effects; intangible assets; and high switching costs, where a product or service is so embedded in a customer’s business it would prove too expensive or complicated to consider a competitor.

CT European Smaller Companies made 162.1% over the 10-year period in question. The £360m fund has ongoing charges of 0.88%.

IA Japanese Smaller Companies

Janus Henderson Horizon Japanese Smaller Companies is the clear winner in the IA Japanese Smaller Companies sector, beating the most common benchmark, the Russell Nomura Small Cap, in eight of the past 10 calendar years. Its nearest competitor, Invesco Japanese Smaller Companies, beat the index in six of these.

The Janus Henderson fund beat its sector average in six of the past 10 calendar years.

Manager Yunyoung Lee bases his investment approach on valuations, catalysts and long-term structural growth drivers. He claimed that intensive interviews of company management teams are what gives him his edge.

“We aim to carry out interviews with all our holding companies every quarter and rebalance the portfolio on what we learn from these discussions,” he said.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

Janus Henderson Horizon Japanese Smaller Companies made 231.7% over the 10-year period in question, compared with gains of 204% from its sector and 145.8% from the Russell Nomura Small Cap index. The £280m fund has ongoing charges of 1.07%.