Global emerging markets and Asian funds have been among the worst performers in the past three years, with average fund in the IA Asia Pacific Excluding Japan, IA Global Emerging Markets, IA Asia Pacific Including Japan and IA China/Greater China sectors making negative returns over the period.

But there are always exceptions. Indeed, a few funds in those sectors have not only delivered positive returns but have beaten UK inflation, meaning domestic investors have made a real return. Below Trustnet has researched the funds that have achieved this feat.

An option to get exposure to emerging markets (or Asia) and beat inflation over the past three years has been to avoid Chinese equities. This asset class has been a laggard following government crackdowns in different parts of the economy, weakness in the real estate sector and a prolonged Covid lockdown.

For instance, Invesco Emerging Markets ex China (UK) has delivered the strongest real growth for investors, as it has outperformed the UK CPI by 24 percentage points, with no exposure to Chinese equities.

Instead, the fund favours countries such as South Korea, Taiwan and India. It predominantly invests in the technology and financial sectors with holdings such as Taiwan Semiconductor Manufacturing, Samsung Electronics and HDFC Bank.

Performance of fund over 3yrs vs sector, MSCI China and CPI

Source: FE Analytics

Jupiter Asian Income has also produced real growth for its investors while having no exposure to China, preferring instead Australia, India, Taiwan and Singapore.

Manager Jason Pidcock looks for quality companies that have the ability to increase their dividends over time. As a result, the portfolio is made of 30 to 40 large and liquid stocks.

Analysts at Square Mile said: “He is a great believer of keeping things simple, as overcomplicated structures or opaque business models often mean that their behaviour and development are likely to be difficult to predict.

“The manager's focus on high quality businesses means that we would expect the fund to protect better in times of market stress (though this will depend on the factors that are driving markets) and this has been a feature of most of the fund's albeit short performance profile.”

Performance of fund over 3yrs vs sector, MSCI China and CPI

Source: FE Analytics

Investors aiming to beat inflation through buying into the emerging markets and Asia would have had the best chance to outpace the UK CPI with a small-cap fund.

In fact, seven out of the 10 funds that have beaten the UK inflation in those sectors over three years are smaller companies funds.

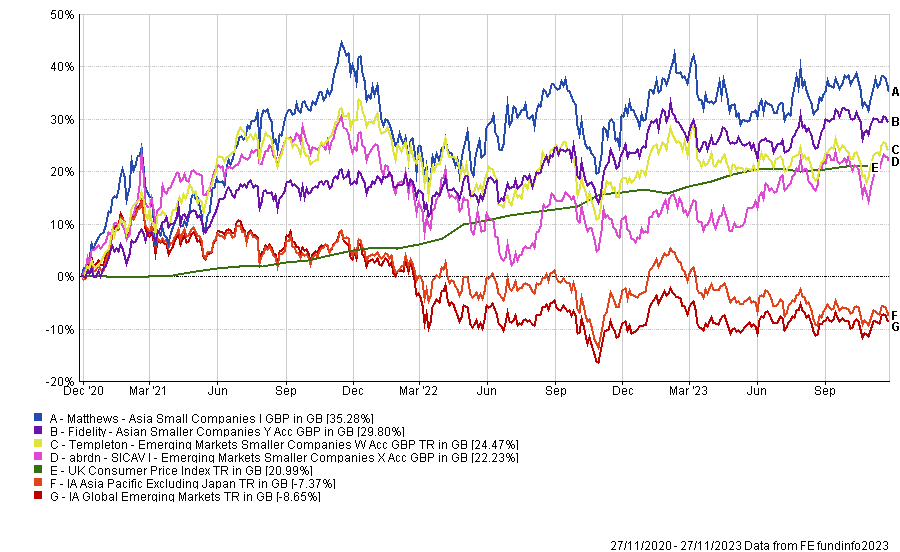

Among those seven funds, four are actively managed: Matthews Asia Small Companies, Fidelity Asian Smaller Companies, Templeton Emerging Markets Smaller Companies and abrdn SICAV I Emerging Markets Smaller Companies.

Performance of funds over 3yrs vs sectors and CPI

Source: FE Analytics

Yet, investors not so keen on paying higher fees for a manager could also have protected their money from inflation while getting exposure to emerging markets small-caps via passive funds such as SPDR MSCI Emerging Markets Small Cap UCITS ETF, iShares MSCI Emerging Markets SmallCap UCITS ETF and WisdomTree Emerging Markets Small Cap Dividend UCITS ETF.

Finally, Artemis SmartGARP Global Emerging Markets Equity is another emerging markets fund that has beaten inflation over the past three years.

Unlike the previous funds, Artemis SmartGarp Global Emerging Markets Equity does not shun Chinese equities and does not focus on small-caps either.

Managers Peter Saacke and Raheel Altaf use Artemis’s proprietary tool SmartGARP, which rates every stock on eight criteria: growth, value, earnings estimate revisions, momentum, accruals, environmental, social and governance (ESG), investor sentiment and macroeconomic forecasts.

Analysts at FE Investments said: “As the SmartGARP model is used to initially identify stocks, performance will always be tied to how good the model is – so failure to improve the model consistently, or failure to remove factors that underperform or have little predictive power, in a timely manner could work against the fund.

“The fact that the fund does not only look at deep value or distressed stocks and that the model incorporates a variety of factors beyond value implies that it could be used as a core emerging-market allocation.”

Performance of fund over 3yrs vs sector, indices and CPI

Source: FE Analytics

It should be noted that all the funds that have beaten the UK CPI are from either the IA Global Emerging Markets or the IA Asia Pacific Excluding Japan sector. There were no funds from the IA Asia Pacific Including Japan and IA China/Greater China sectors able to deliver real growth in the past three years.