Manager changes are never good for funds, as they open up questions around how the vehicle will continue under a new leadership.

That’s what is happening to Jupiter UK Special Situations following this morning’s news of veteran stockpicker Ben Whitmore stepping away, with Alex Savvides joining in his place from JO Hambro.

But not all change is bad, with Charles Stanley chief investment analyst Rob Morgan describing the manager swap as “something of a coup” for Jupiter.

Below, we asked experts what to make of the development. While some were convinced by the move, others noted quite a few points that need clarifying.

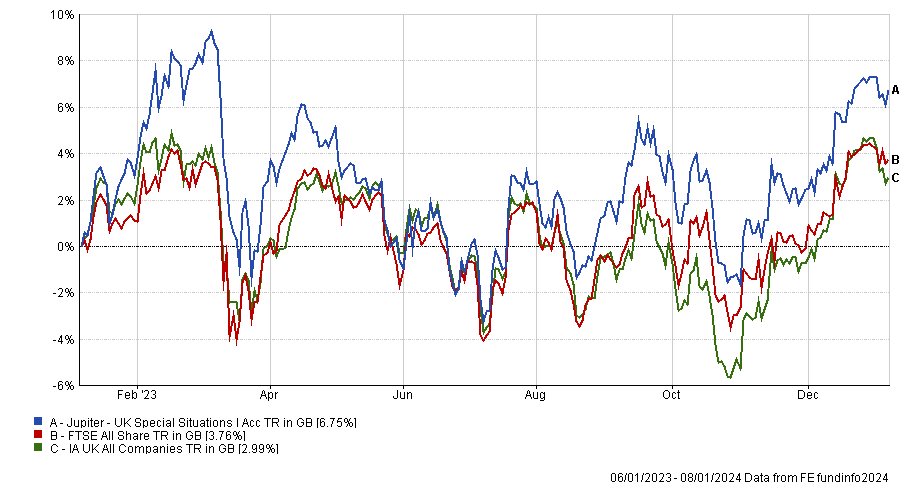

Performance of fund vs sector and index over 1yr

Source: FE Analytics

While the two managers’ investment styles aren’t too dissimilar, there are a number of key differences, as 7IM senior portfolio manager Peter Sleep pointed out.

“Front and centre of Whitmore’s process are value metrics such as [Benjamin] Graham and [David] Dodd and [Joel] Greenblatt, while Savvides emphasises strategic and operating momentum, but with a value mindset,” he said.

“Both managers have similar risk characteristics, although Whitmore buys a number of offshore stocks into his UK fund, whereas Savvides tends to invest more in the UK and at the margin, he has a more of a mid-cap bias.”

For Savvides’ JOHCM UK Dynamic fund, the exposure to this part of the market contributed to outperformance in recovering markets such as in late 2016 and since November 2020, but FE Investments analysts said the fund “is not immune at times when these companies go strongly out of favour as experienced in 2020”.

The differences continue at a portfolio level, where Savvides has a few restructuring plays which aren’t part of Whitmore’s playbook, who instead has approximately 20% of the UK-based fund in offshore equities – ideas from the JGF Jupiter Global Value fund he co-manages. It remains to be seen how these differences will be dealt with going forward.

The most optimistic analyst was Darius McDermott, managing director at Chelsea Financial Services, who said that Jupiter is replacing “one of the best UK equity managers with one of the best UK equity managers”.

“We believe Jupiter has done a good job of replacing Whitmore’s expertise on the UK Special Situations strategy,” he said.

“We are also happy that Adrian Gosden and Chris Morrison are joining the fold on the income strategy – which brings together a stellar team of active UK equity managers. The fund is a buy.”

Also on the positive side, Morgan opted to hold the fund.

“Although the imminent departure of Whitmore will come as a disappointment to investors, the appointment of Savvides is something of a coup and softens the blow considerably. He comes with plenty of experience in the UK market, a similar value style and a decent stock-picking record,” he said.

“A change of manager is not usually a positive development, but on this occasion the prospects are good and investors should consider retaining the fund as it will be in good hands. In addition, there isn’t the option to follow the outgoing manager to a similar mandate.”

That is true at least until he manages to open his boutique firm, one of the reasons why he’s leaving Jupiter.

Bestinvest managing director Jason Hollands highlighted that Jupiter UK Special Situations was in the Bestinvest Best Funds List in the past, but it currently isn’t.

“We prefer other UK value strategies with more consistent track records, such as Artemis UK Select, Fidelity Special Situations and Redwheel UK Equity Income, as well as the Fidelity Special Values, Murray Income and Temple Bar investment trusts,” he said.

However, he liked the “well-established and clearly articulated” investment process of the Jupiter fund and its quality filters to avoid value traps, as well as Savvides’ “good track record” and was also bullish on UK value strategies.

“This is an interesting place to be at the moment given the very cheap multiples currently available in UK equities both relative to global equities and where they have historically traded at. For value managers, this creates a significant opportunity set. Should the current clouds of negativity towards UK equities lift at some point, there is a lot of upside potential from stocks re-rating,” he concluded.

At AJ Bell, which includes the fund among its Favourite Funds list, head of investment research Paul Angell said that it is "clearly unwelcome news" when managers set up their own shop having established a reputation for themselves in a fund management company.

"It's a headache when this happens and holders of the funds will inevitably want to review their investment in the coming weeks and months, although there is no need for a knee-jerk response given the long handover and experienced incoming manager," he said.

"Only time will tell if the share price drop is an overreaction, and Jupiter will be doing everything it can to illustrate that the strategy can be run just as effectively going forward."

There is no news on who will take charge of the JOHCM UK Dynamic fund once Savvides has left. A spokesperson for JO Hambro Capital Management said: “Savvides and his team will continue to manage the strategy and all underlying funds in the interim whilst we confirm plans to ensure a smooth transition of responsibilities. We will be in contact shortly to share these arrangements.”