The new UK individual savings account (ISA) will enable investors to plough an additional £5,000 tax-free into domestic shares or UK equity funds.

But savers need not wait until its introduction to back UK-listed businesses and indeed, many British investors already do so, said Laith Khalaf, head of investment analysis at AJ Bell.

Therefore, the big question for Khalaf is how much of their portfolios should investors allocate to the UK?

He highlighted three approaches to the domestic market: “passive”, “active” or “patriotic”.

A passive approach means that investors simply follow global equity benchmarks. As such, UK stocks would account for around 4% of the portfolio.

“That’s not a huge amount and many income seekers in particular will want more” he observed

With an active approach, investors manage how much money they want to have in each region.

“A good starting point might be to hold 20% in each of the UK, US, Europe, Japan and emerging markets. You can then dial these proportions up and down depending on your confidence in each market,” Khalaf said.

Finally, investors taking a patriotic approach might go the whole hog and invest 100% of their portfolio in the UK. As a result, their fortunes will be entirely tied to those of the UK stock market.

Over the past decade, this approach would have caused investors to miss out on the greater returns offered by foreign markets.

For instance, £10,000 invested in the UK stock market 10 years ago would have grown into £16,469, while the same amount invested in global shares would now be worth twice as much (£31,207).

Khalaf said: “That doesn’t tell us what future returns will look like of course, but it does highlight the danger of allocating all your money to just one region. Sentiment can lead you astray when investing, including a desire to favour the domestic stock market out of loyalty.”

He also warned ‘patriotic investors’ that many large domestic companies “aren’t terribly British”. For instance, mining company Antofagasta operatesd predominantly in Chile, while HSBC is a global bank deriving 80% of its profits from overseas.

Performance of indices over 10yrs

Source: FE Analytics

Why should you bother with UK equities?

Although the performance of the UK stock market over the past decade is not enticing, Khalaf highlighted features that savers might find attractive.

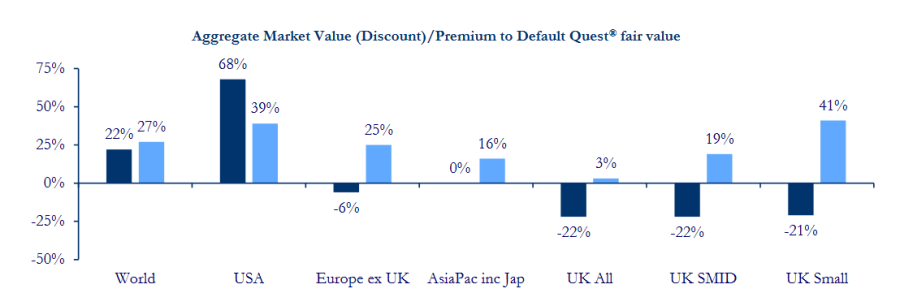

To begin with, UK equities come with a cheap price tag compared to international peers but also relative to their own history.

Khalaf said: “Stock valuations are low by historical standards, and this provides both a cushion against further falls, and potential upside if sentiment turns more positive.”

Source: Odyssean Capital LLP

The UK stock market also pays a high level of dividends, which should put it on income seekers’ radar.

“The FTSE 100 is currently yielding 3.9% on a historic basis, with the potential for both capital and dividends to rise over time,” added Khalaf.

Income-seeking investors might want to consider investment trusts as they have the ability to hold back dividends in good years and pay in the bad ones, which leads to a smoother income trajectory, he suggested.

Finally, Khalaf mentioned UK smaller companies, due to their low valuations.

He said: “This is a more volatile area best suited to more adventurous investors who can take a long-term view, but over the past 20 years the average UK Smaller Companies fund has returned 360% compared to 239% from the typical UK equity fund.”

Five funds to build an exposure to UK equities

For income seekers, Khalaf highlighted City of London, which is one of the Association of Investment Companies’ dividend heroes, having raised its payout every year since 1966 (the last time England won the football World Cup).

Khalaf said: “This trust benefits from having had Job Curtis at the helm since 1991, with a focus on dividend growth and quality, largely from the large-cap segment of the UK stock market.”

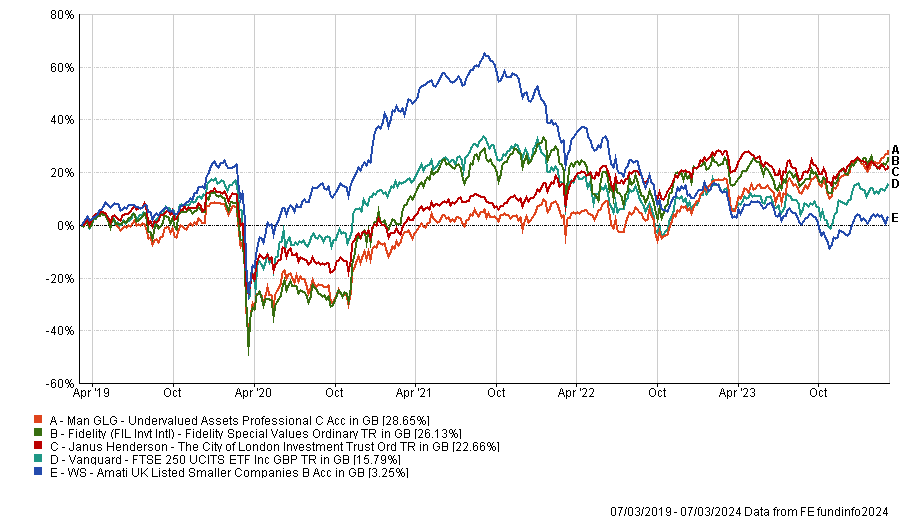

He also pointed to Man GLG Undervalued Assets, which invests in UK companies of all sizes that FE fundinfo Alpha Managers Henry Dixon and Jack Barrat believe to be undervalued. “This leads it to be heavily skewed towards more cyclical areas of the market,” Khalaf said.

For investors comfortable with a higher risk approach, Khalaf suggested Fidelity Special Values, managed by Alpha Manager Alex Wright, a contrarian investor looking for unloved or overlooked companies that are set to stage a recovery. The fund has more than 100 holdings and invests across the market cap spectrum.

Performance of funds over 5yrs

Source: FE Analytics

Khalaf also picked a small-cap fund, WS Amati UK Smaller Companies, that Dr. Paul Jourdan has run for more than 20 years.

He said: “The whole team is steeped in experience when it comes to small-cap investing. They look for high quality companies with competitive advantages. They have an emphasis on the AIM market, but they can invest in stocks all the way up to the FTSE 250.”

Investors seeking cheap exposure to UK mid-caps may want to consider Vanguard FTSE 250 ETF. Khalaf said that this segment of the UK stock market has historically performed well and has a more domestic economic focus than the big blue chips of the FTSE 100.