Vanguard has proposed a set of retail investment reforms to improve financial outcomes for individuals and unlock an estimated $2.1trn (£1.7trn) in excess savings across major OECD countries.

The asset manager outlined its recommendations in its new Core Components of a Successful Retail Investment System report, which argues that global capital markets could benefit from a 10% reallocation of idle household cash into long-term investments.

Vanguard estimates household savings across OECD countries total approximately $51.7trn, with a significant portion held in low-yielding cash accounts.

The report argues that many individuals are not making effective use of their savings, citing persistent barriers such as low financial literacy, lack of confidence and fear of market loss. It calls for system-level changes to help convert more savers into investors and support them with the tools to make informed financial decisions.

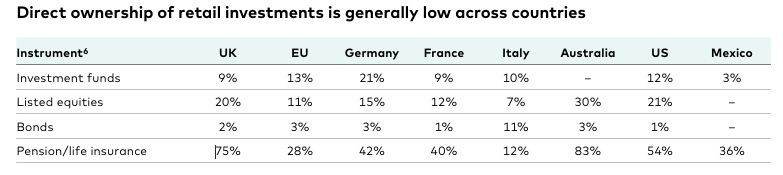

Source: Vanguard, Financial Conduct Authority (FCA), 2024 data; European Central Bank (ECB), 2021 data; Australian Stock Exchange (ASX), 2023 data; Australian Tax Office (ATO), 2024 data; Federal Reserve, 2022 data, National Institute of Statistics and Geography (INEGI), 2024 data.

Chris McIsaac, head of international at Vanguard, said: “Helping individuals invest for their long-term financial future has never been more important. Our research shows that even modest changes in investor behaviour – supported by pragmatic policy measures – could help improve financial outcomes for millions.”

The report comes amid rising global concerns over retirement adequacy. As populations age and public finances come under pressure, individuals increasingly bear the responsibility for their financial futures. Vanguard argues that a modern, consumer-focused investment system is essential in this environment.

The firm has proposed an eight-point policy framework, divided into three focus areas: encouraging participation, expanding access to help and ensuring fairness in retail investing.

Vanguard recommends the implementation of automatic enrolment in retirement investment plans. Citing successful models in several countries, the firm says auto-enrolment can significantly increase participation by eliminating the inertia that prevents individuals from actively investing.

The report also urges governments to expand tax-incentivised savings vehicles. By offering tax benefits for contributions to investment accounts, policymakers can encourage individuals to move beyond cash holdings and into diversified portfolios.

In addition, Vanguard supports the use of default investment products. These solutions guide individuals who may lack the time, knowledge or motivation to select suitable investments. Defaults can provide immediate access to professionally managed, risk-appropriate portfolios.

On expanding access to help, Vanguard called for a broader spectrum of advice and support services, encouraging regulators to enable scalable digital services to meet the needs of different segments of the population.

To build long-term trust in investing, the firm also stressed the importance of national financial literacy programmes. Vanguard suggested evidence-based education initiatives, supported by regular research to track public understanding and identify effective interventions.

The report highlighted the need to eliminate conflicts of interest in the distribution of investment products. Vanguard supports regulatory models that restrict commission-based compensation structures, which it says may compromise the impartiality of financial advice.

It also called for simplified and comparable disclosures, enabling investors to evaluate products clearly and make informed decisions. Providers should be required to present information in accessible formats to encourage competition and transparency.

Finally, the firm advocates for comprehensive cost transparency. Investors must be able to assess the total cost of investing, including all-in fees, to evaluate whether they are receiving value for money.