GQG Partners manages $140bn in global and regional equities and its flagship emerging markets fund is the best performer in its sector, yet the Florida-based firm is still relatively under the radar in the UK and Europe.

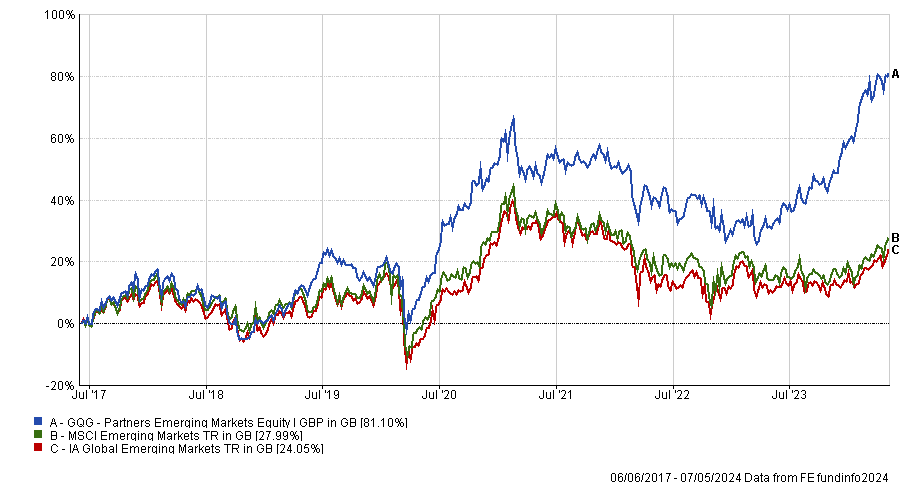

The $3bn GQG Partners Emerging Markets Equity fund is the top performing strategy in the IA Global Emerging Markets sector over one and five years and the sixth best performer over three years. It has left both its benchmark and sector in the dust since inception, as the chart below shows.

As such, its managers Rajiv Jain, Brian Kersmanc and Sudarshan Murthy have just won the FE fundinfo Alpha Manager of the Year award for Asia and emerging market equities. GQG’s global and US equity strategies were also nominated for awards.

Fund versus benchmark and sector since inception

Source: FE Analytics

One of the reasons for its stellar track record is GQG’s ability to spot risks, avoid the downside and, essentially, win by losing less. Here, GQG has a secret weapon: journalists, accountants and former private equity professionals.

The global equity manager has built a team of people with experience atypical of buyside analysts and charged them with identifying risks and patterns, and helping the firm to avoid groupthink. Their research dovetails with another team of more traditional stock-picking analysts.

Financial journalists were writing articles about issues in the US subprime mortgage market as early as 2006, which triggered GQG founder Jain’s interest in working with reporters and non-Wall Street professionals.

Chulantha De Silva, a client portfolio manager at GQG and former investment banker, said: “Wall Street does have a lot of smarts but it does have a herd mentality.”

Jain had a team of former journalists at his previous employer Vontobel, but expanded this function at GQG, which he established in June 2016, to include accountants, private equity specialists, technologists and healthcare experts.

“We have multiple different eyes from different vantage points on the same franchise,” De Silva said. He thinks following conventional wisdom is a huge problem in fund management and to outperform, managers need an “outside advantage”.

Accountants are adept at tracking patterns and can provide insights into the quality of companies’ management teams by studying corporate accounts. “Accounting is the language of business,” he observed.

Professionals with a background in private equity, meanwhile, can analyse the capital structures of companies.

“Tech folks double up as disruption specialists. The catalyst for that tool was to make sure none of our companies got ‘Amazoned’ out,” De Silva continued. With the advent of generative artificial intelligence (AI), “every stock in every sector is at risk of disruption”.

All of these “non-traditional folks” assist GQG with wealth preservation by identifying major risks to companies in the portfolio, so GQG can sell them before their share price tanks. “Every manager does a great job of buying stocks. Where most people falter is knowing when to get out,” he explained.

Another element of the firm’s sell discipline is that analysts and portfolio managers are afforded the flexibility to change their minds and challenge their own investment thesis. “At most firms you are frowned upon for changing your mind. At GQG you are incentivised to change your view on a stock,” he said. “We’d rather be found out wrong in a conference room at GQG than by the market.”

Another unconventional hiring strategy was to deliberately introduce a younger cohort three years ago – not junior analysts per se but young people specifically.

The Florida-based firm had always prided itself on its diversity (half of its staff were born outside the US and 40% are women) but one key area in which it was not diverse was age. As a result, no-one in the firm was using certain apps that have a younger audience. “How do you manage risk when you are not in the disruptive ecosystem?” he asked.

The new wave of recruits proved themselves invaluable when GQG re-entered the energy sector in 2021, De Silva recalled. He and his contemporaries had a jaded perspective on energy having burned their fingers previously but their new junior colleagues were able to look at energy with a fresh mindset.

The same teams of analysts, which GQG calls its ‘research mosaic’, cover emerging and developed markets simultaneously. “I think we’re better investors in Apple because we know China. We’re better investors in Meta because we know India,” De Silva said, adding that in India, 750 million people use WhatsApp. “Put another way, how can you invest in Apple if you don’t know China?”