The Fidelity International multi-asset team has taken some of its chips off the table and has moved to a ‘neutral’ stance on equities.

With elections and recession worries, concerns around “a more negative seasonality” are rising, said Salman Ahmed, global head of macro, so he wants to maintain liquidity.

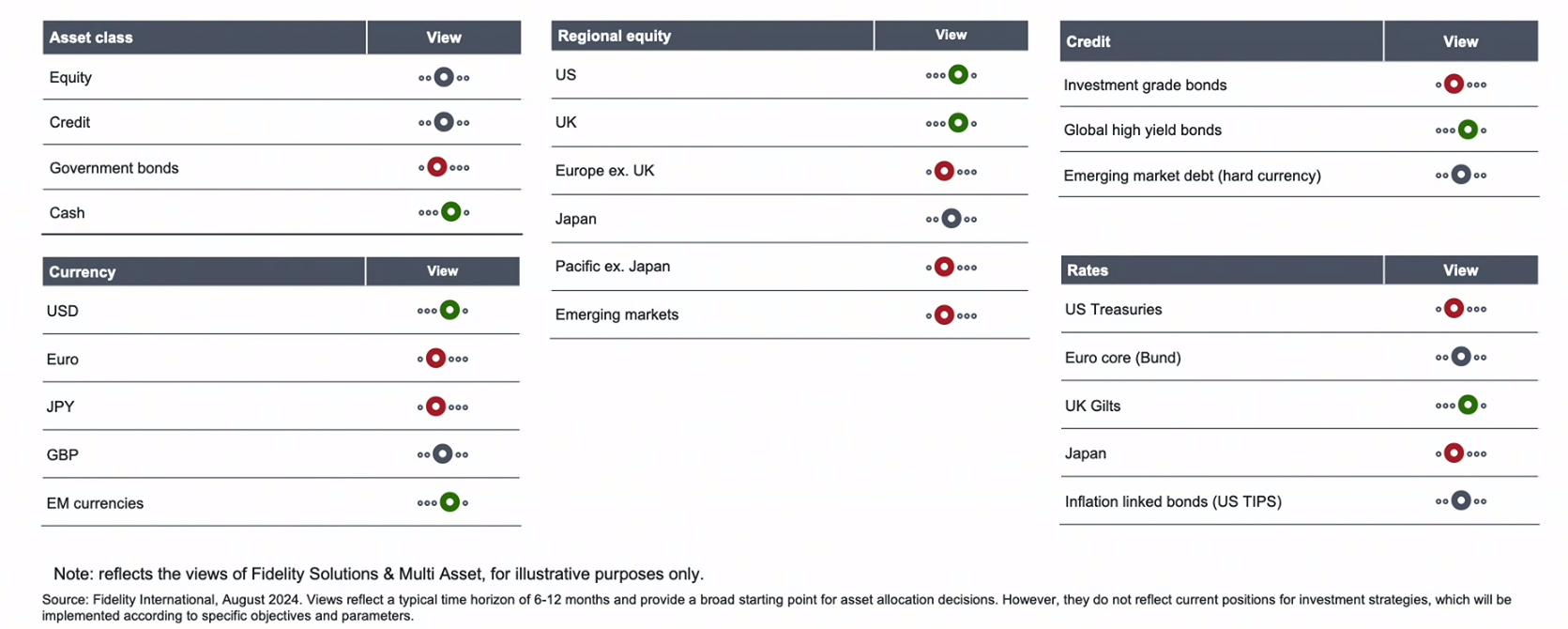

Cash is now the only asset class where the multi-asset team has a positive outlook, as the chart below illustrates.

Fidelity’s latest core allocations

Source: Fidelity International

“There are many factors at play here, but we neutralised our equity long exposures after the markets normalised following 5 August,” Ahmed said. “We were maintaining them to play the soft-landing scenario, but if there is a drawdown in equities, we wouldn’t buy into it.”

Within fixed income, the team is retaining a long position in high-yield versus investment grade, but this is “under constant discussion” and “most likely to be neutralised as well” if the data continues to deteriorate.

These moves were made on the back of worsening economic data as the cycle approaches “mid-to-late” stage, in what Ahmed called a “tug-of-war” between a soft landing and a cyclical recession.

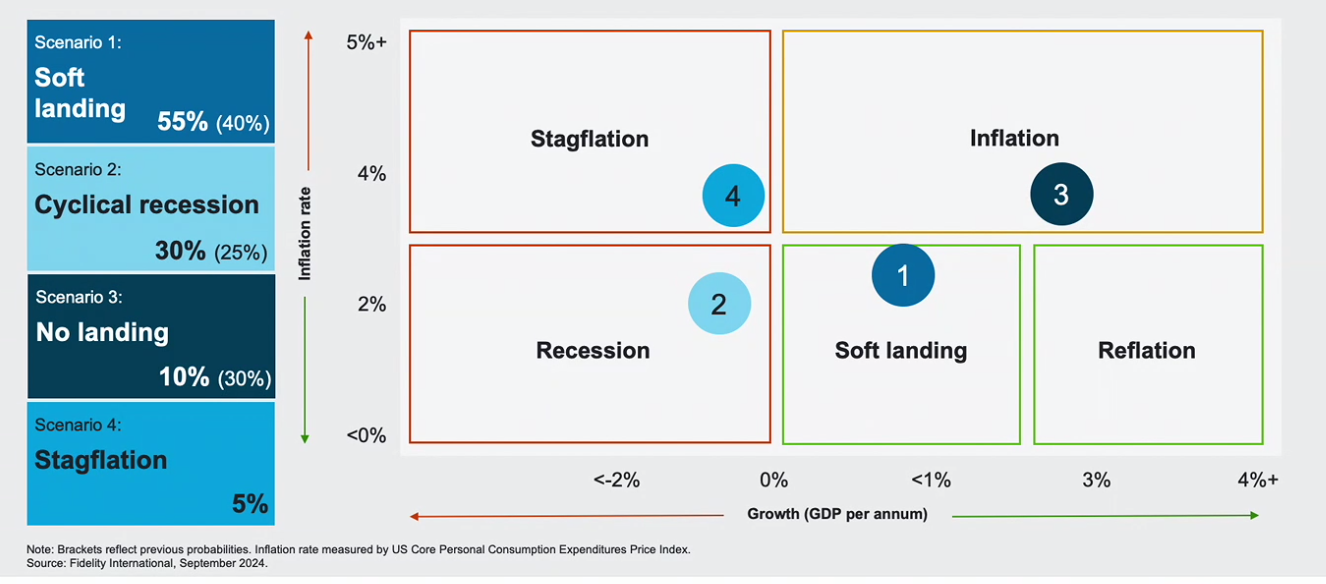

A soft landing is the most likely outcome, with a probability of 55%, according to Fidelity’s fixed income global chief investment officer, Steve Ellis.

However, Fidelity has increased its forecast of a recession occurring this year to a “very hefty” 30% from 25% on the back of “clearer signs” of a slowdown in the labour market, especially in the US, many of which aren’t priced in by the markets.

“In terms of recession risks, there’s not a hell of a lot priced into fixed income and credit markets, but there are more sinister things going on under the bonnet than people think and a good chance of a stronger downturn than many are expecting,” he said.

On a surface level, labour-market data looks "relatively benign", but when it starts cracking, it feeds on itself, trickling down from one industry to another, he said. This is why the debate about whether the Fed will cut by 50 or 25 basis point is so heated – to understand whether the Fed sees more risks than the rest of us.

However, Ellis thinks the most important question is the level at which US interest rates will eventually settle because that will determine the direction of markets. The goal rate is currently priced in at about 2.85% by the end of next year, but "it could be even lower than that if we do see a recession," he warned.

Four scenarios for economic markets in 2024

Source: Fidelity International

This doesn’t mean there are no selective opportunities within equity markets, said equities co-chief investment officer Niamh Brodie-Machura.

Firstly, the mega-cap leaders need “a little bit of caution”. These stocks have been driven less by the economic cycle and more by their own structural cycle, which will now be impacted by a “lower conviction in their ability to meet earnings expectations”.

Expectations for 2024 are still for double-digit growth in the S&P 500 and slightly higher earnings growth are also expected for 2025, but “the positive creep higher through the first half of the year has now rolled off”, the co-CIO explained.

“It is still mega-cap tech stocks that are expected to deliver growth and earnings, but the greatest delta is starting to be in those other sectors where you're seeing potential for broadening in the market.”

This is why Brodie-Machura is looking at the small- and mid-cap end of the market as “an interesting place to be”, especially in the UK.

“When you get positive stimulus, whether it's fiscal or monetary, reaction from those stocks gives you a much clearer pass through,” she said.

FTSE 250 companies are positively exposed to economic stimulus, have good cash generation, a 4% dividend yield and are trading on 12x earnings.

“You can see real value there,” she said. “This is what we are doing within the equity team, we're looking selectively for where you can still see outsized opportunity.”

Brodie-Machura suggested to steer clear from equity sectors and strategies where there is “a real stretch in terms of price-to-cash earnings and a lot of hope baked into share prices rather than actual delivery of earnings”, while in fixed income, Ellis would urge investors to “play safe” by locking in yields on fixed maturity funds before interest rates fall further and reducing high-yield exposure to prepare for a more recessionary environment.