The UK economy faces a uniquely difficult outlook, combining low growth with stubborn inflation, according to Michael Matthews, FE fundinfo Alpha Manager of the Invesco Sterling Bond fund. “The UK has the worst of both worlds,” he said. “It’s got stagnant, low growth, but a high-inflation dynamic.”

Matthews, who has long held a bearish view on the UK, acknowledged that he had underestimated the market’s resilience so far. UK fixed income has performed better than expected, as yields rose to attractive levels and spreads remained tight despite persistent macro uncertainty. But while hard data has remained supportive, soft indicators are starting to wobble.

“The outlook is so uncertain. The UK was looking like it would be better this year when growth started to pick up, but those bets are off the cart,” he said.

His stance remains more cautious than that of many investors. “Generally, people are more optimistic on the UK than I am,” he said. This is especially true for equity managers, as UK equity markets are “now looking a bit more attractive than the US”.

In bond markets, however, the story is more nuanced, with the manager particularly concerned about US tariffs, the limited impact from recent tax changes and broader political risk.

“Supply chain issues are the big known unknowns,” he said. “Every day you’re waking up to see what the new headline is, to see whether they’re going to be brought back, extended, reversed. It’s really hard to model their impact.”

He warned that geopolitical shocks could undo the UK’s recent advantages, such as lower energy prices and a stronger pound. “If there’s a big geopolitical event, that could offset these benefits,” he said. “[A potential conflict between] China and Taiwan is something we often talk about in internal meetings”.

However, domestic risks are even greater because of the UK’s “challenged” fiscal situation. “The government might try to reverse some of the cuts introduced with the Budget to improve its popularity but given the challenged fiscal situation that could be tricky”.

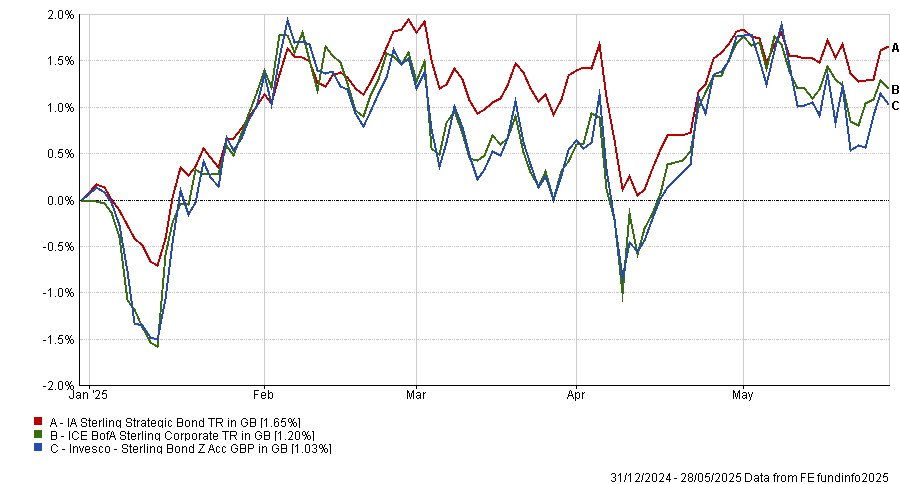

That said, the UK still represents more than half (54%) of his £909.8m portfolio. After a positive 2023, when the fund was the eighth-best strategy in the IA Sterling Strategic Bond sector, relative performance has slumped to the bottom quartile of its peers over the 2024 and 2025 so far.

Performance of fund against index and sector over the year to date

Source: FE Analytics

To turn things around, Matthews is remaining defensive on credit, arguing that overall yields are attractive but spreads have become uncomfortably tight.

Instead he is looking where others are not. In particular, he is finding opportunities at the long end of the curve and has started to buy long-duration gilts. “Gilts do look attractive, but everyone hates the long end of all markets at the moment”.

On credit, yields remain “attractive”, but with sterling spreads at 90 basis points the prices are still unjustified.

“Given the amount of uncertainty out there, we didn’t think the spreads were getting to a point where they were screamingly cheap. Fundamentals are supportive. Technicals are super strong. The valuations are a bit rich,” he noted.

Sterling investment grade does continue to offer value, however. “The shape of the UK yield curve is giving us 5.5% to 6% yields without really taking too much credit risk, so we don’t need to extend that much.”

His focus on yields has led him to cut exposure to the AT1 market (Additional Tier 1, or bonds issued by banks that pay high interest but can be written off or turned into shares if the bank’s finances weaken) and he has brought down his corporate hybrids “pretty much to zero”, because he can get the same yields in a senior credit without too much credit risk.

In terms of sector positioning, Matthews isn’t taking strong views. “There’s no sector that’s really challenged,” he said. “The auto sector is topical, given the tariffs, but it didn’t really create any more cheapness there than it did in any other sector.”

The main issuers in the Invesco Sterling Bond portfolio are BP (2.2%), Lloyds (2%), Santander (1.9%). The overall duration is 6.4 years.