Luxury has long been seen as a safe bet for investors, with high-end brands having greater pricing power and relying on resilient consumers who can afford their products at almost any price and in any economic cycle.

But cracks have emerged recently, as middle-income ‘aspirational’ consumers, especially those based in China, have been pulling back and company valuations have fallen below historic levels. This raised the question: Can the premium sector still deliver premium returns?

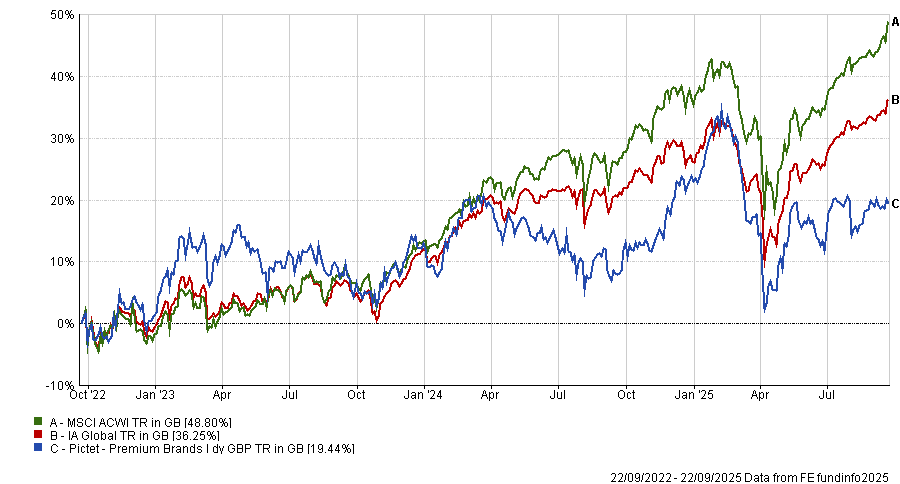

Caroline Reyl, manager of the Pictet Premium Brands fund, acknowledged that the current cycle is “quite difficult”. Her portfolio reflects that, having slipped from the first quartile of the IA Global sector, which it maintained between 2019 and 2021, to the third quartile from 2022 onwards. This year, the fund is entering the autumn in the fourth quartile for returns.

Performance of fund against index and sector over 3yrs

Source: FE Analytics

However, the manager remained optimistic and said the long-term case for luxury is still intact: “We have seen a few cycles in the past 20 years, with the financial crisis, pandemics, wars. At the end of the day, premium brands have been able to surf the waves of cycles over time to create value.”

That said, she admitted companies must innovate to remain relevant.

What luxury brands need to do

Reyl pointed to four factors that will determine which companies will succeed.

First is management execution. “It has never been so important as today to have experienced management who can deal with the complexity of the supply chain, keep pricing policy stable and make sure margins are not hit too much,” she explained.

Second is innovation across products and experiences. She cited science-based advances in beauty, creativity in luxury houses and experience-led offerings in hotels as areas that excite consumers.

Third is the need to re-engage the ‘aspirational’ consumer: “In the past three to four years, the mid-income consumer, who has been super important for the growth of premium brands, has suffered much more than others. The idea today for luxury companies is to re-engage with that consumer and make them come back into the stores.”

The Pictet Premium Brands manager pointed to Louis Vuitton’s new lipstick and make-up lines as an example of entry-level products targeting younger buyers.

Finally, Reyl said China remains the joker card: “It has been the main growth driver in the past 20 years, but in the past two years has really disappointed. We believe the authorities’ measures will bear fruit at some point, and we want to be there to capture the upside.”

Case study

The manager gave Richemont as an example from Pictet Premium Brands’ 36-holdings of how companies remain relevant.

She has owned the Swiss luxury goods group since the fund was launched 20 years ago and is now part of her top 10 holdings. It stands out for the Cartier and Van Cleef jewellery brands, displaying strong growth, pricing power and recent management changes that have come in making “courageous decisions”.

Performance of Richemont over 1yr

Source: Google Finance

Reyl praised for example the “shareholder-friendly” decision to sell Italian online fashion retailer YNAP, which was “diluting returns”.

She said: “We like the jewellery segment in particular. It is a segment that is very fragmented and unbranded, so Richemont has a real opportunity to gain market share.

“They changed their management in the past two years and now have highly capable CEOs heading the various brands. Margins are quite high. Free cash flow generation is very good.”

The outlook

Reyl argued that the cycle may be turning. “It may be time to consider premium brands, because in the long term, these companies are solid and the growth drivers are still intact,” she said.

Another reason for optimism is valuation. Despite their reputation, luxury stocks no longer trade at extreme premiums, although they remain more expensive than the MSCI World, which Reyl said is normal for high-quality businesses.

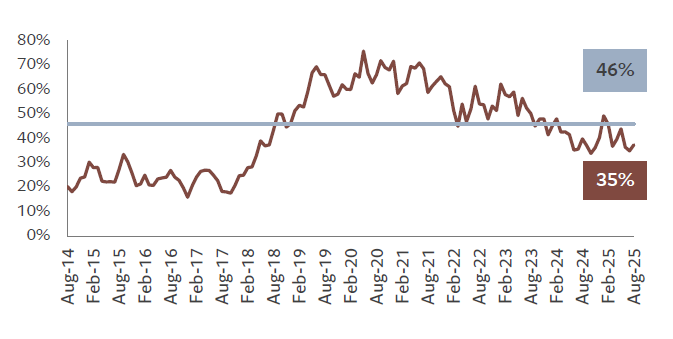

Premium brands’ P/E premium vs MSCI ACWI

Source: Pictet

“In the past two to three years, the premium has faded and we are now below the 10-year average and clearly below pre-Covid levels,” she said.

Reyl also stressed the wide dispersion in multiples. Ferrari and Hermès (both at 4.7%, they are the fourth and fifth largest positions in the Pictet Premium Brands portfolio) still command valuations above 40x earnings, while US retail names trade closer to 12–13x.