Equity markets have posted stellar returns over the past decade but extreme valuations and historical precedent indicate that this could be about to reverse, according to managers.

Alec Cutler, FE fundinfo Alpha Manager of the Orbis Global Balanced and Orbis Global Cautious Standard funds, said this is a concern that many investors have ignored.

“People seem to think that equities are guaranteed a positive return. They aren’t. They could absolutely make zero in the next 10 years,” he said.

It seems “realistic” that equity markets deliver nothing or even lose money, thanks to the dominance of US stocks, which make up roughly 70% of the MSCI World index.

Since 2011, the S&P 500 has delivered a “spectacular” average yearly return of 14%, but this is based on unsustainable expectations, according to Cutler.

“To produce 14% again, you need valuations to go from already extreme 24x [price-to-] earnings to almost 40x earnings. You need corporate earnings, profit margins and valuations, which are near record highs, to increase further,” Cutler concluded.

The far more likely outcome is that the US equity market corrects and drags the rest of the global market down with it, he said. The average annual return of the S&P 500 is around 7%, so to return to that level, equity markets would post an average return of zero for “at least the next 10 years”.

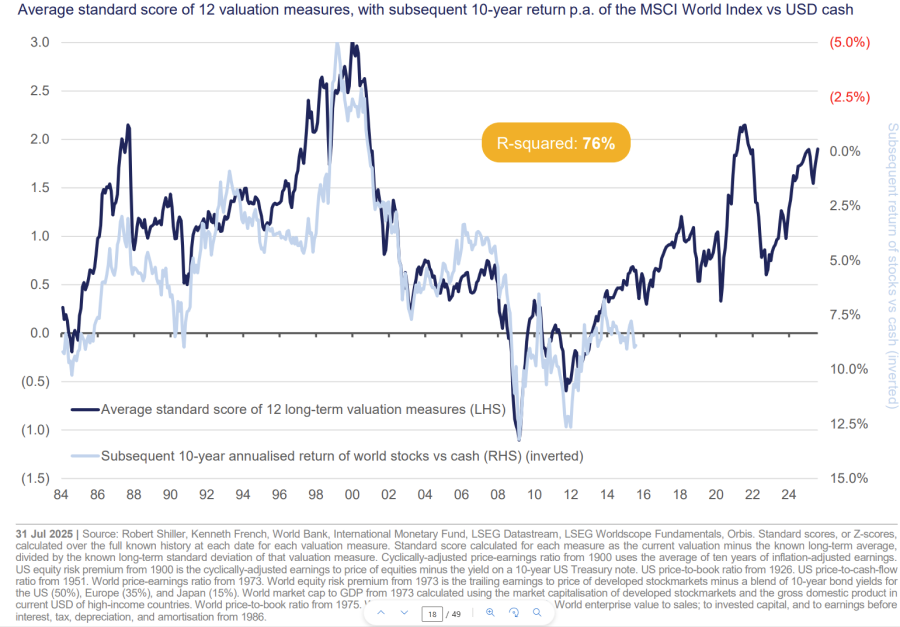

This may sound absurd, he noted, but it has happened before. The chart below shows the average expected return on equities over 10 years, from different market valuations.

Source: Orbis Investments

“If you look back in history as far as you can get, whenever we’ve been at this level of valuation, markets returned zero over the next 10 years,” the Orbis manager explained.

On top of this, the US government’s “financial mismanagement” in relation to escalating debt levels and investors pulling out of American markets (both bonds and equities) could lead to a weaker dollar. This in turn could fuel further capital exodus from the country, sparking a US downturn.

“I would not be shocked if you get a 0% return from the global equity market from here,” he concluded.

Simon Evan-Cook, fund of funds manager at VT Downing Fox, agreed that this is a realistic concern. “There’s no God-given right that equity markets will go up every year, let alone to go up for another 15 years in a row,” he said.

While the past decade has been “mostly sunshine and rainbows” for global equities, strong performance is causing investors to develop “worrying” assumptions.

For example, many investors have concluded that active funds are no longer needed due to their underperformance compared to a surging global equity tracker.

“I completely understand why some people are asking themselves if they need an active fund, given that any attempt to do anything different has underperformed,” the Downing Fox manager said.

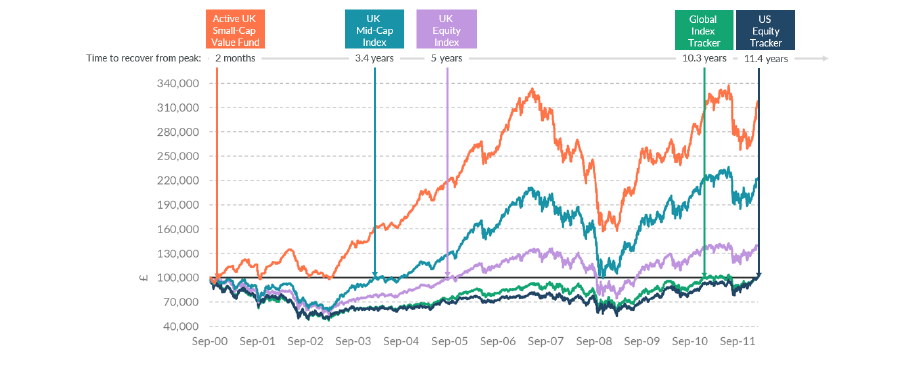

However, he warned that these assumptions were also around in the 1990s and backfired on investors as, in the following decade, the average global equity tracker “made you nothing”, Evan-Cook explained.

Performance of funds post 2000

Source: Downing Fox. Total return in sterling

The tech bubble collapse in 2000 was due to the high concentration of US equities, which had outperformed and become overvalued. When they corrected, they represented 50% of the global market and so dragged most portfolios down.

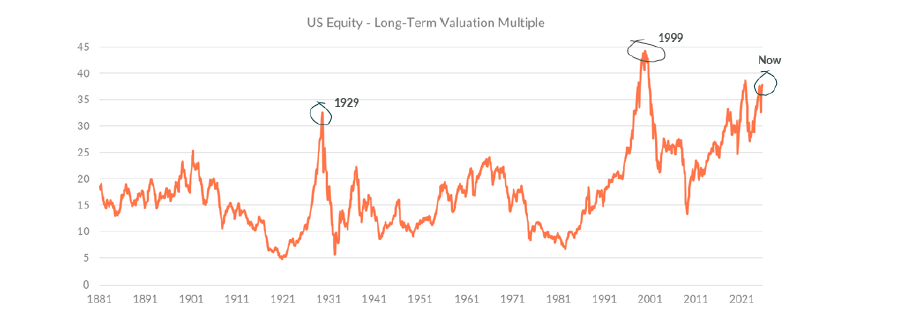

As Evan-Cook noted, while current valuations are not at the 1999 peak, they are approaching it. And global markets have become even more dominated by the US than they were 25 years ago.

If North America stocks re-rate, the resulting crash might look closer to the Nifty 50 downturn in the 70s, he suggested.

Long-term valuations of US Equities

Source: Downing Fox. CAPE Ratio, January 1881 to August 2025.

“Hence why it’s not outrageous to suggest that something as apparently reliable as a global tracker could go a long time without making money,” he said.

Not even the most popular stocks on the market would be immune. For example, in 2000, some investors thought Amazon would thrive due to the emergence of the internet, while others thought it was overvalued and heading for a fall. “Both investors would have been absolutely correct,” Evan-Cook noted.

Amazon shed almost 92% of its value between 2000 and 2005, but those that sold missed the rebound, he explained. This could happen again to some of the biggest stocks in the index, “despite how transformative things like artificial intelligence are”.

“Broadly, equity markets do go up over time”, Evan-Cook said “, but they can spend long periods of time that matter to investors going sideways or down. That’s a real risk right now.”

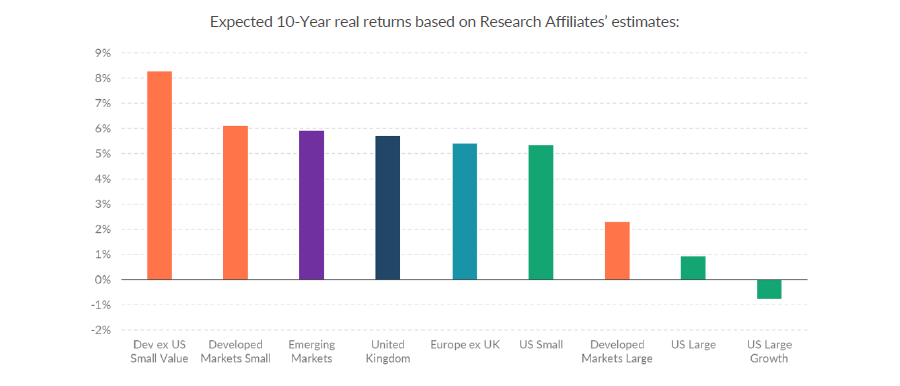

However, he said this is mostly a risk for global equity trackers and US mega-caps, with the outlook outside of US blue-chips being much more positive, as seen in the chart below.

Expected 10-year returns of equity markets

Source: Downing Fox. Research Affiliates.