Gold has gone from strength to strength this year and mining stocks have gone further still. The yellow metal has surged to around $3,800 per ounce, breaking multiple record highs, as investors have poured into the traditionally safe-haven asset.

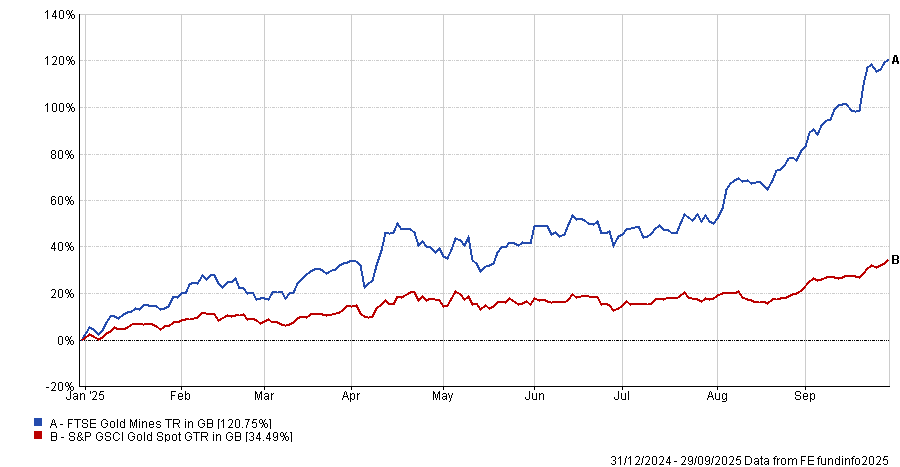

However, gold miners have ridden this wave even higher, with the FTSE Gold Mines index up 120.8% in 2025. By contrast, the S&P GSCI Gold spot is up just 34.5%, a gap of more than 80 percentage points.

Performance of miners vs gold YTD

Source: FE Analytics. Total return in Sterling.

Indeed, mining companies such as Endeavour Mining and Fresnillo have been some of the best-performing stocks in the FTSE 100 so far this year, according to recent research from AJ Bell.

This may leave investors wondering if now is the right time to buy gold miners, but several experts remain cautious.

Madhushree Agarwal, portfolio manager at Nedgroup Investments, noted that the primary reason to own gold is for its protection and diversification purposes.

Gold miners are an inappropriate method of gaining exposure to this because they can face “company-specific risks”, such as rising costs, operational setbacks, regulatory headwinds or adherence to environmental, social and governance (ESG) principles that can impact their performance.

Even if gold is rising, investors could still get the stock pick itself wrong, she explained, limiting the ability to serve as an effective diversifier.

“By investing in the physical metal, we capture the pure diversification and protective qualities gold is designed to deliver, without diluting that exposure through company-specific risks or broader equity-market dynamics,” Agarwal explained.

Richard Weiss, chief investment officer of multi-asset at American Century Investments, agreed that gold mining stocks are an inappropriate “proxy for gold exposure”.

While the returns may seem initially correlated, he argued that because gold mining stocks are tied to both the price of the metal itself and the behaviour of the stock market, the returns between the two can be substantially different.

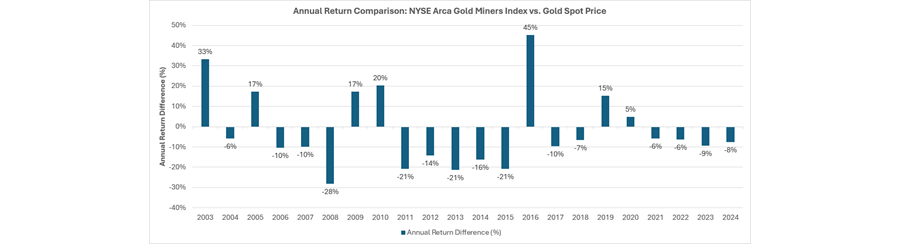

Indeed, over the past two decades, the gap between gold miners and gold spot was almost 45% in 2016 and was above 20% in multiple years.

Source: American Century Investments.

He said: “They [gold and miners] exhibit significant divergence at critical points, undermining the miners' ability to provide much-needed diversification.”

Capital Gearing Trust’s Emma Moriarty agreed with Weiss but was also concerned about valuations.

Many of the prominent gold mining stocks are in the US, she said, meaning increasing exposure to gold miners would involve further allocation to already stretched North American valuations.

“The returns that we would expect to receive from an asset class are, at least in part, a function of the starting price. So with gold now trading at near all-time highs, we are at an expensive starting point,” she said.

Due to high starting valuations for both gold and equities, Moriarty’s team maintain a low (1%) allocation towards physical gold and broadly avoid mining stocks.

David Coombs, head of multi-asset at Rathbones Asset Management, is also negative on miners.

He said that, while the miners can be a “long-term beneficiary” of higher prices, there are significant challenges. Supply cannot be shifted quickly and many mining stocks have issues around ESG, as well as financial risks that make them “less appropriate” as a diversifying asset.

Additionally, gold itself is “almost impossible to value”, he said. “You have zero visibility on central bank buying, so how do you know what it’s worth? It’s complete nonsense,” Coombs continued.

However, he has opted to increase his allocation towards gold more recently, by purchasing a structured product (SP). This caps the upside of their gold investment at 15%, but offers a “capital guarantee”, giving money back when it matures if the gold price is lower than when it was bought, he explained.

However, some investors believe gold mining stocks still have room to run. Evy Hambro, co-portfolio manager of the BlackRock World Mining Trust, noted the outlook for gold mining companies currently looks much more positive.

Companies have started to benefit from “reduced cost pressures and falling energy prices”, which has led to much higher margins. Gold miners have used these higher margins to increase their dividends and fund large share buyback programmes, returning more money to shareholders.

He said: “Given the gold price forward curve trades well above most market estimates, it is likely that miners could continue to generate profits that exceed expectations.”

Similarly, Ben Conway, co-manager on the Hawksmoor multi-asset range, pointed to gold equities as one of their “stunning” recent performers and explained that the prospects are “still very good” for these stocks.

Robert Crayford, manager of the CQS Natural Resources Growth and Income trust, agreed “there is further to go” for gold miners.

“We believe generalists are still underweight the sector, which should continue to drive flows into miners given the strong earnings and fundamentals,” he said.

Valuations in the “mid-tier gold producers” looked particularly attractive with balance sheets “as strong as we have ever seen them”, he said.

Additionally, smaller mining companies are benefiting from a surge of mergers and acquisitions (M&A), which could contribute to much greater upside over the long term, he argued.