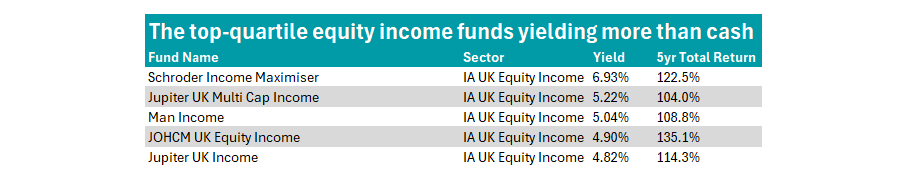

Just five equity income funds have paired top-quartile total returns with a yield above cash, a recent Trustnet study has found.

Cash has been a viable alternative to dividends in recent years as interest rates rocketed after the pandemic. Although they have started to come down, the annual equivalent rate (AER) of easy access savings accounts currently stands at 4.75%, according to data from Moneyfactscompare, a healthy hurdle rate for any equity income portfolio.

Indeed, just 22 strategies in the IA UK Equity Income and IA Global Equity Income sectors delivering a higher yield.

Of these, just a handful of funds managed to pay out more than cash while also posting a top-quartile total return within their peer groups, as seen in the chart below.

Source: FE Analytics. Data to end of September. Table sorted by highest yield.

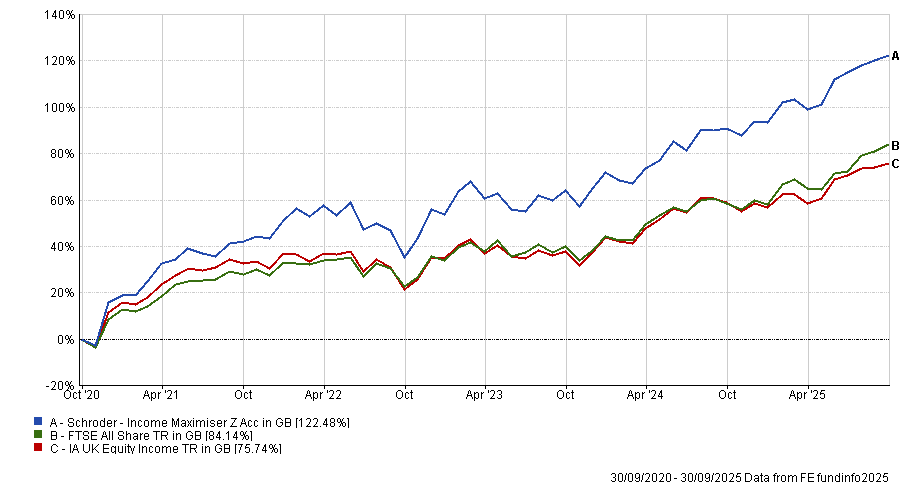

Topping the chart is the £881m Schroder Income Maximiser fund, which paired a yield of 6.9% with a total return of 122.5%, the sixth-best in the IA UK Equity Income sector.

Due to the income focus, the portfolio is currently overweight consumer discretionary and consumer staples compared to the benchmark, while underweighting popular financial stocks. For example, it holds supermarkets Sainsbury’s and Tesco in its top 10, while the largest stock in the market, HSBC, does not appear.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Data to end of September.

The fund targets a 7% yield by investing in UK stocks, with covered call options (or derivatives) used to enhance the income by sacrificing some of the capital gains.

Despite this, it has not sacrificed performance, with top-quartile returns over the past one, three and 10 years. However, investors should be aware that much of this performance was under the leadership of Nick Kirrage, who departed the team earlier this year, and his long-time co-manager Kevin Murphy, who joined Brickwood Asset Management in 2024.

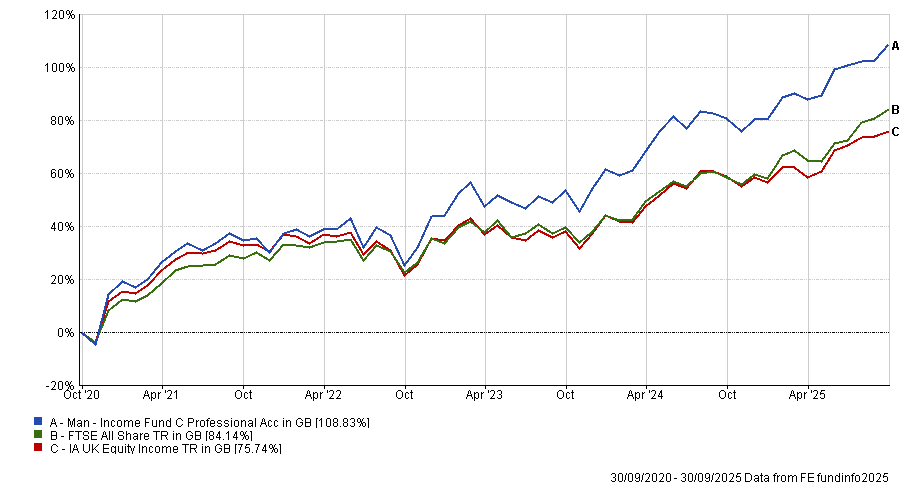

Income investors may also be drawn to the Man Income fund, which is yielding 5% and has a strong track record, making a total return of 108.8% over the past five years.

Led by FE fundinfo Alpha Manager Henry Dixon, the fund aims to achieve an income above the FTSE All Share over one-year rolling periods, with capital appreciation above the market over five-year rolling periods.

Analysts at FE Investments said Dixon takes a “disciplined investment approach”, screening the universe for companies trading at “distressed levels”. They added that the fund could also invest in bonds that are more compellingly valued than shares to help boost the income.

Since 2020 this approach has paid off with the fund capturing outperformance “from overweighting energy and financial names at the right times”, such as in 2024 when it was a top-quartile performer, despite favouring mid-caps which “sold off harshly”.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Data to end of September.

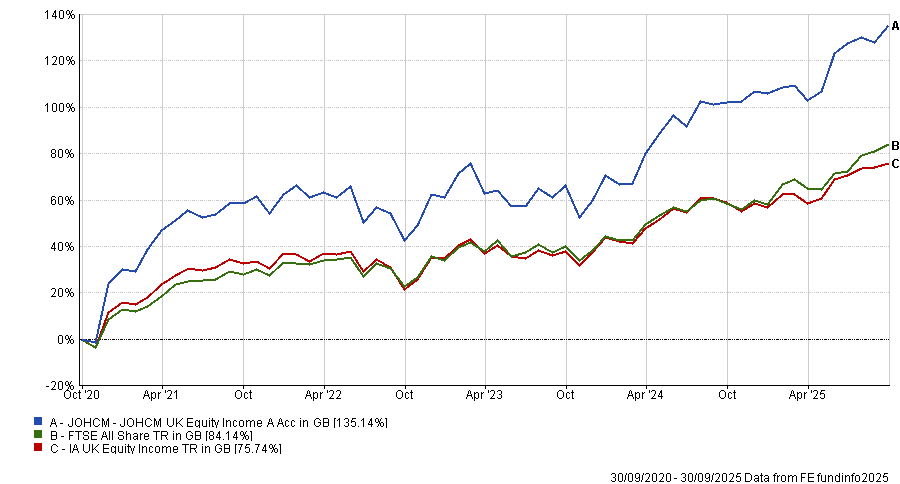

Clive Beagles and James Lowen’s JOHCM UK Equity Income fund has delivered the third-best performance in the IA UK Equity Income sector over the past five years and a yield of 4.9%.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Data to the end of September.

The strategy has a strict dividend yield discipline, targeting shares yielding above the FTSE All Share on a forward-looking basis.

Analysts at RSMR rate the fund highly, noting that it is led by a “well-established team who have demonstrated a tried and tested process over many cycles”.

Due to the strict focus on valuation and yield, the fund will tend to hold more small-caps than most other UK equity income funds, which “have the potential for significant share price gains over time”.

However, analysts said investors should prepare for “lumpy performance” as the tendency to buy out-of-favour stocks means the portfolio’s holdings can “languish” for extended periods.

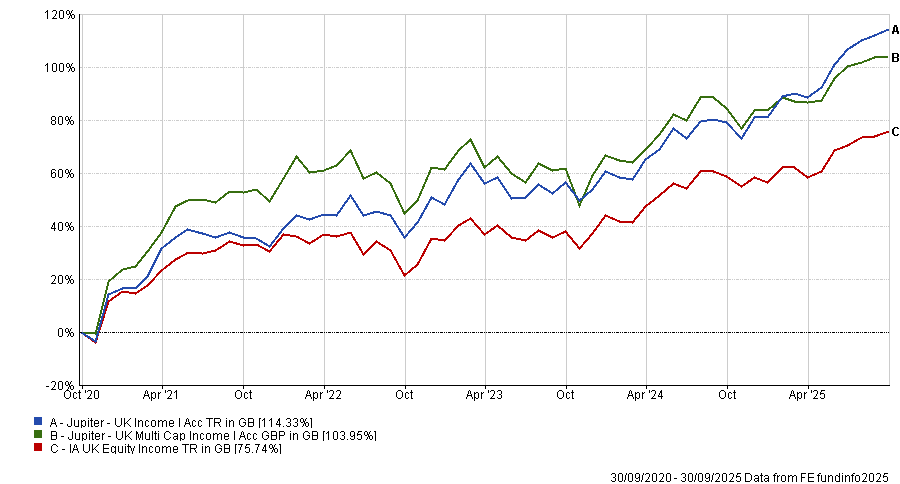

Another fund providing a cash-beating payout and top-quartile return is the £1.6bn Jupiter UK Income fund. Led by Adrian Gosden and Chris Morrison, the strategy has posted a five-year return of 114.3% and has beaten the yield on cash by 0.07 percentage points (4.82%)

It invests in around 45-60 names, with an emphasis on the sustainability of businesses' free cashflow generation, according to analysts at Titan Square Mile. While the strategy is designed to pay a premium yield, the managers are careful to “not put capital at risk” to get there, which the Square Mile team praised.

They also pointed to the “small but experienced and capable team”. Gosden has almost 30 years of investment experience and has previously run “highly successful” strategies such as Artemis Income, while Morrison serves as a “good complement” to Gosden.

“We view this as a solid option for investors seeking exposure to a relatively high conviction portfolio of income-generating stocks, managed by a highly capable investment duo.”

Gosden and Morrison’s other fund, Jupiter UK Multi-Cap Income, completed the chart with a 5.22% payout and a 104% five-year return.

Performance of funds vs sector over 5yrs

Source: FE Analytics. Data to end of September.