The merger of HICL Infrastructure and The Renewables Infrastructure Group (TRIG) announced yesterday sparked divisive reactions, with analysts warning that the benefits accrue unevenly and activist shareholders arguing the deal is “exceptionally poor” for HICL shareholders.

If approved, the move would see the winding-up of TRIG, with its green energy assets transferred to HICL in exchange for new shares in its sister fund – with reference to respective net asset values (NAVs) at end of September – and cash.

This would create a £5.3bn trust with an initial dividend target of 9% per share, which would form part of a 10% target return on portfolio NAV.

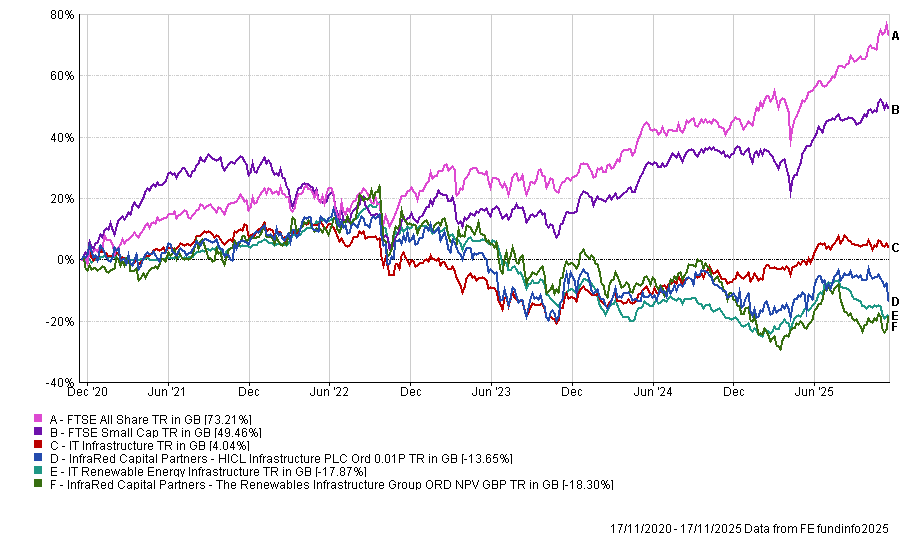

Performance of trusts against indices and sectors over 5yrs

Source: FE Analytics

The harshest critic of the proposal was the CG Asset Management team, which includes Capital Gearing co-managers Peter Spiller, Alastair Laing and Chris Clothier. As key HICL shareholders (with £11m invested as of 30 September 2025), they wrote an open letter in which they said they are “appalled” by the merger proposal, noting the subsequent sell-off in its share prices makes it “very clear that this is an exceptionally poor transaction for HICL” and more generally, “value destructive”.

“We can see no strategic rationale for the transaction. TRIG’s portfolio and HICL’s portfolio are invested in entirely different asset classes and their combination will not result in material cost savings,” they wrote.

“The only clear overlap between these companies is the manager, Infrared Capital Partners, who appears to be the principal beneficiary from the transaction. Under this proposal, TRIG will no longer need to hold that continuation vote [due next year], so Infrared Capital Partners is not exposed to a potential loss of assets under management.”

All analysts asked by Trustnet highlighted both trusts as ones to ‘hold’ for now and largely agreed that TRIG shareholders would be the main beneficiaries.

Ashley Thomas, infrastructure and renewables research analyst at Winterflood, said: “While TRIG shareholders experience a near-term reduction in their dividend per share (approximately -15%), this is more than offset by the option for up to 11% of the TRIG share capital to participate in a cash redemption option at a 10% discount to NAV (vs 34% NAV discount as of 14 November close).

“TRIG shareholder concerns regarding longer-term renewable subsidy and power price risk, balance sheet capacity, dividend sustainability and NAV growth potential are ameliorated through the combination by transferring the TRIG assets into HICL’s more defensive and more diverse asset base.”

Peel Hunt analysts Markuz Jaffe and Anthony Leatham applauded the boards of both companies for working on a transformative transaction, but were “concerned by the balance of incentives for each set of shareholders”.

“Given the weakness in HICL’s share price this morning in response to the news (down approximately 7% today at the time of writing), and observing how the combination is currently proposed, we see a potentially significant overhang of shares forming – where incoming TRIG shareholders might be eager to seek liquidity at price levels/share price ratings below HICL’s pre-announcement level, given where TRIG has been trading recently, potentially weakening HICL’s share price rating near term.”

Jaffe and Leatham therefore maintained their ‘neutral’ recommendation for HICL.

James Carthew, head of investment company research at QuotedData, also said he would hold the strategies, given how wide the discounts are, but was “less optimistic about a re-rating of the enlarged vehicle” than he would be for the two separate entities.

“Investors like to be able to pigeonhole their investments and, maybe there are some that would like a one-stop shop for all forms of infrastructure in multiple countries – but would they like an even broader geographic remit, or a more diversified portfolio – this will be skewed to renewables,” he said.

“The larger the investor gets, the more sophisticated they tend to be in their asset allocation decisions. It is much easier to imagine a large investor who decides that they want exposure to offshore wind or solar, or private finance initiative (PFI)-type contracts (HICL’s specialty), than one who wants an infrastructure generalist.”

There might be one silver lining for HICL, however, with Thomas pointed to 3I Infrastructure, which successfully undertook a strategic pivot into higher return assets in 2016. Its shareholders have experienced a 17% net annualised NAV total return over the 10 years from 2015 to 2025 (compared to the 14% net annualised total return from March 2008).

“HICL could broaden its investor base to incorporate investors seeking higher than core infrastructure level returns, with the additional ESG [environmental, social and governance] benefit,” he said.

However, he noted, investors who had been attracted to HICL for its large proportion of regulated and availability-based revenues and core economic infrastructure equity exposure are now left with just International Public Private Partnerships offering the asset characteristics similar to pre-combination HICL.

Matthew Hose and Fiona Huang, equity analysts at Jefferies, also gave both trusts a ‘hold’ rating. Having previously been cautious on the prospect of takeover activity for renewable funds, in this case, they said the merger “could serve to draw out cash bids for TRIG if the buyout maths do indeed work”.

Additionally, failure to consummate the merger “could potentially establish HICL as a target, and more broadly, the proposals could engender other, ideally better suited, mega-mergers to be considered across the sector,” they concluded.