Fund managers are as bullish as they have been all year, according to the Bank of America Global Fund Manager Survey, overweighting stocks and holding lower cash levels than in previous months.

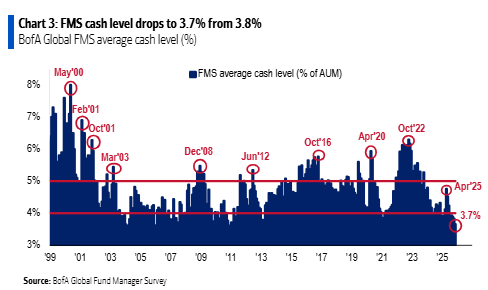

The firm’s sentiment indicator rose to 6.4 from 5.7 last month, the highest level since February 2025. This is based on a combination of factors, including equity allocations, global growth expectations and cash levels, with the latter falling to 3.7%.

It is worth noting, however, that in the 20 times that cash levels have stood at 3.7% or below, stocks fell and Treasuries outperformed in the following one to three months.

Expectations for global growth also improved, with a net 3% of respondents expecting a strong economy, compared with a net -8% in November. It is the first time this year that expectations for global growth have turned positive.

The latest edition of the Bank of America Global Fund Manager survey polled 172 asset allocators running a total of $475bn between 7 and 13 November.

The most crowded trade is long the ‘Magnificent Seven’ stocks of Alphabet, Apple, Amazon, Nvidia, Meta, Microsoft and Tesla, overtaking the long gold trade that was top of the list last month. A net 54% now believe being long the US tech giants is the most crowded, with long gold in second, dropping from 43% to 28%.

However, an artificial intelligence (AI) bubble is the biggest risk, fund managers noted, with more now worried about a potential pop. A net 45% of respondents are worried about a bubble, up from 33% last month.

Some 53% said AI stocks are already in a bubble, although this is 1 percentage point lower than last month, with a record 63% of participants seeing global equity markets as overvalued.

Yet 53% said they believed AI is already increasing productivity, a three-month high, while 15% said it would start to bear fruit in 2026.

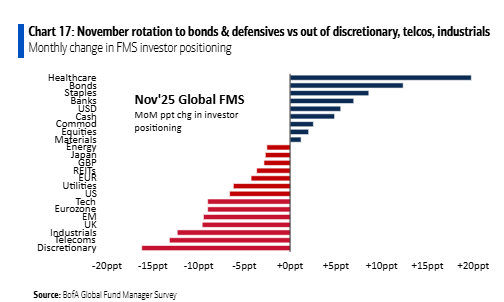

Survey respondents shifted their allocations last month into healthcare, bonds, staples and banks, while shifting away from consumer discretionary, telecoms, industrials and UK stocks.

Overall, investors are most overweight healthcare, emerging market stocks and banks, while most underweight UK stocks, energy and consumer discretionary.

What lies ahead

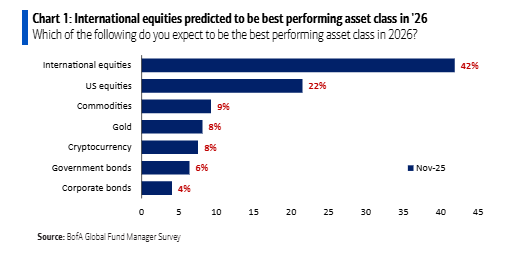

Turning to 2026, 42% of respondents said they expected international equities to outperform next year, with the US in second at 22%. Commodities, gold, crypto, government bonds and corporate bonds also made the list.

Some 37% expected the MSCI Emerging Markets index to be the top performer next year, while the UK’s FTSE 100 was the least loved, with just 3% of the vote. The Nasdaq, Nikkei, Hang Seng and Euro Stoxx were also popular.

Just 6% said the S&P 500 would outperform next year, with the most likely outcome that the index ends 2026 in the 7,000 to 7,500 range.

On currencies, the Japanese yen is expected to outperform, followed by gold and the US dollar. Around a third of those surveyed (34%) said gold would end next year in the $4,000-$4,5000 range. Once again, the UK sat at the bottom of the pile, with just 3% suggesting the pound would outperform.

The downside risk with the biggest bearish impact next year would be if inflation rose and the Fed hiked rates to compensate, with 45% noting this would be the biggest market mover. This was followed by AI capex spending stalling (26% of the vote) and the US unemployment rate rising to above 5% (17%).