Drumnor Investments made some of the highest returns last year in the UK’s model portfolio service (MPS) space, FE fundinfo data shows, with Rivers Capital Management, Parmenion and Canaccord Genuity Wealth Management also towards the top of their peer groups.

Despite tariffs and geopolitical tensions, markets generally had a strong year in 2025, meaning that equity-heavy portfolios outperformed lower-risk strategies.

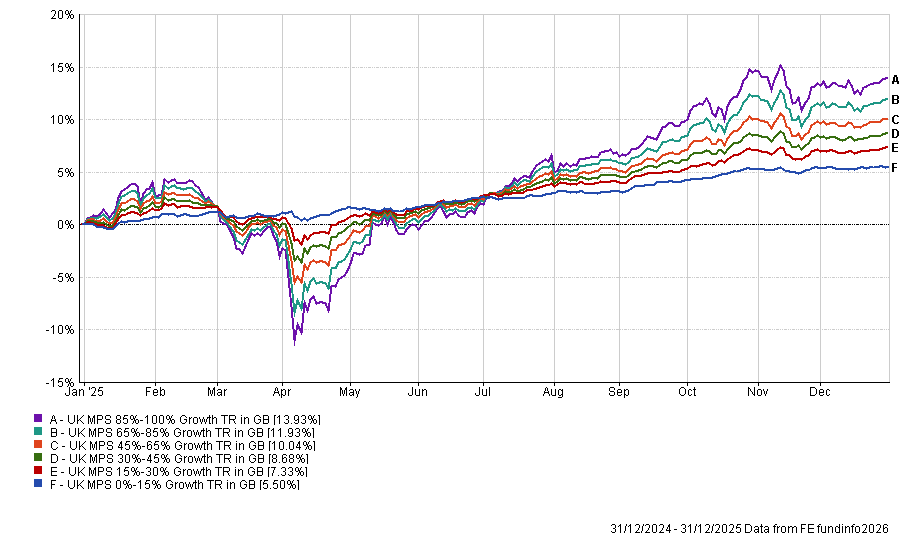

FE fundinfo breaks the MPS space into six sectors and the UK MPS 85%-100% Growth – home to the highest risk model portfolios – led the pack with an average return of 13.9% last year. Returns were lower the further down the risk spectrum we go.

Performance of MPS sectors in 2025

Source: FE Analytics. Average return in sterling between 1 Jan and 31 Dec 2025

Below, Trustnet reveals the portfolios in FE fundinfo’s 1,500-strong UK MPS universe that made the best returns for their clients in 2025.

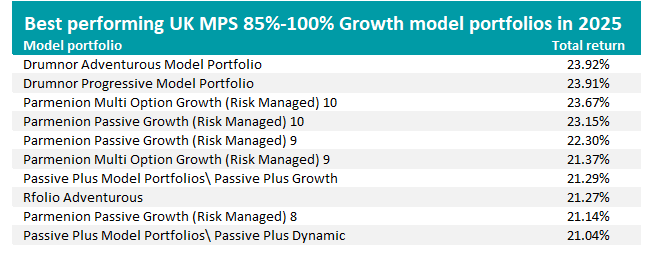

Starting with the model portfolios with the highest risk profiles, the best performing member of the UK MPS 85%-100% Growth sector – and the entire MPS universe – was Drumnor Adventurous Model Portfolio with a 23.92% total return. Drumnor Progressive Model Portfolio was just one basis point behind.

Run by chief investment officer Matt Strachan and investment manager Ciaran Garvey, all of the firm’s model portfolios start with a defined risk budget. They then allocate assets within set ranges and select both active and passive funds, typically choosing funds with at least £100m in assets.

The team builds each portfolio by weighing and blending these funds to control volatility over five years. They monitor risk and performance continuously and rebalance when changes are made or at the start of each year.

Source: Finxl. Total return in sterling between 1 Jan and 31 Dec 2025

As its name suggests, Drumnor Adventurous Model Portfolio has the highest risk profile of the range and is primarily invested in equities. Among its top holdings, it has both active and passive exposure to the UK (Vanguard FTSE U.K. All Share Index, MI Chelverton UK Equity Income, Jupiter UK Dynamic Equity), the US (Vanguard US Equity Index, Schroder US Mid Cap) and emerging markets (iShares Emerging Markets Equity Index, Artemis SmartGARP Global Emerging Markets Equity) as well as more specialist funds such as Landseer Global Artificial Intelligence and Ninety One Global Gold.

At the end of last year, the managers told investors: “The final quarter of 2025 rounded off a strong year for investment returns and a very strong one for the Drumnor model portfolio range. Back in April when president [Donald] Trump announced his ‘Liberation Day’ tariffs, few would have expected such a positive market recovery, with most developed bourses surging ahead and many indices hitting new all-time highs.

“If anything, it proves yet again that financial markets are adept at climbing a wall of worry, even one elevated by conflict and geopolitical uncertainty.”

Source: Finxl. Total return in sterling between 1 Jan and 31 Dec 2025

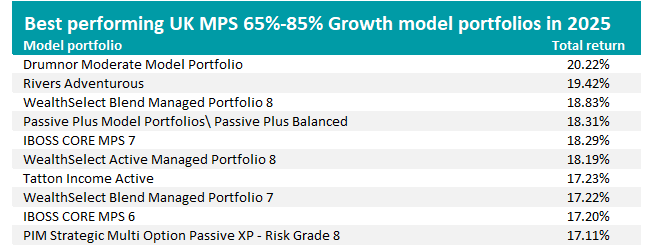

Another Drumnor model topped the UK MPS 65%-85% Growth sector: Drumnor Moderate Model Portfolio made a 20.2% total return in 2025.

It is managed with the same approach as the previous fund. While there are several funds in common in their top 10s (such as the UK, US and emerging market trackers and the gold and artificial intelligence funds), it looks outside stocks to holdings like Atlantic House Defined Returns, First Sentier Global Listed Infrastructure, Vanguard UK Investment Grade Bond Index and Royal London Short Term Money Market.

Source: Finxl. Total return in sterling between 1 Jan and 31 Dec 2025

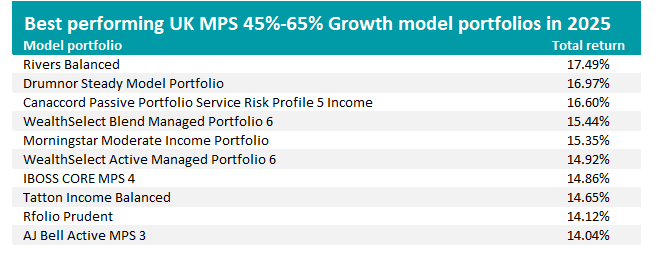

In the UK MPS 45%-65% Growth sector, Rivers Balanced was the best model portfolio last year, making a 17.5% total return.

Rivers Capital Management’s approach is based on five investment principles: inefficient markets require continuous monitoring, dynamically blending active and passive solutions improves returns, portfolios benefit from tactical risk adjustment to reflect asset valuations, face-to-face meetings with managers are an essential part of fund selection and long-term value to clients must drive all investment decisions.

Rivers Balanced’s top five holdings are Vanguard Global Equity Income, HSBC FTSE 100 Index, TwentyFour Monument Bond, Aegon Absolute Return Bond and Jupiter Merian Global Equity Absolute Return.

Source: Finxl. Total return in sterling between 1 Jan and 31 Dec 2025

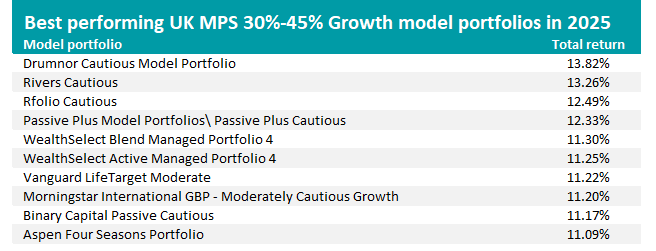

The UK MPS 30%-45% Growth sector was topped by another of Drumnor’s range as Drumnor Cautious Model Portfolio made a 13.8% total return, pipping Rivers Cautious (up 13.3%) to the post.

As would be expected, its top holdings are less titled towards stocks and include the likes of Vanguard UK Investment Grade Bond Index, Royal London Short Term Money Market and Atlantic House Defined Returns. It has just 13% in equities.

Source: Finxl. Total return in sterling between 1 Jan and 31 Dec 2025

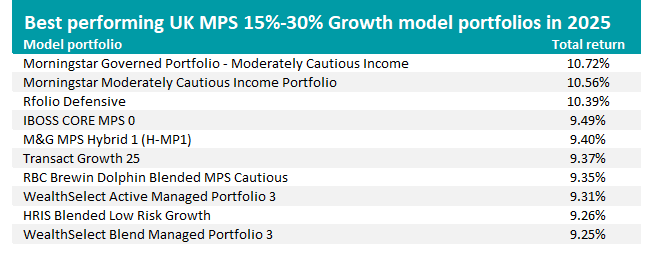

In the UK MPS 15%-30% Growth, two portfolios run by Morningstar vied for top place: Morningstar Governed Portfolio Moderately Cautious Income made 10.7% last year, while Morningstar Moderately Cautious Income Portfolio was up 10.6%.

Morningstar Governed Portfolio Moderately Cautious Income aims deliver a sustainable and rising income while avoiding permanent losses. Its top holdings include Fidelity Short Dated Corporate Bond, Fidelity Moneybuilder Corporate Bond and iShares Corporate Bond Index.

Source: Finxl. Total return in sterling between 1 Jan and 31 Dec 2025

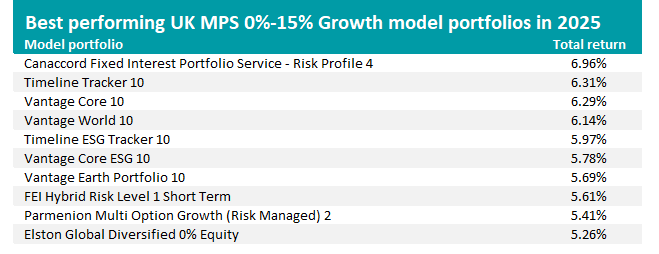

Finally, Canaccord Fixed Interest Portfolio Service Risk Profile 4 was the best performing model portfolio in the lowest-risk UK MPS 0%-15% Growth sector thanks to a 7% total return.

The portfolio is invested with six specialist fixed income fund managers, aiming for a net return of 5% per annum. Canaccord Genuity Wealth Management said: “We have invested with a number of these specialist fund managers for many years; they have outstanding capabilities, are well resourced and demonstrate a good history of preserving capital.

“They provide specialist knowledge in corporate and international bonds, including US short duration high-yield bonds and emerging market debt, while others are more boutique in nature, specialising in niche asset classes (such as asset-backed securities) with the ability to create bespoke mandates.”