The onset of the Covid-19 pandemic saw markets slump around the world and investors become more risk averse as the future became decidedly uncertain.

One of the asset classes that suffered the most as the crisis unfolded in the UK was property – an illiquid asset which often struggles during times of crisis – with several open-ended strategies closed to redemptions.

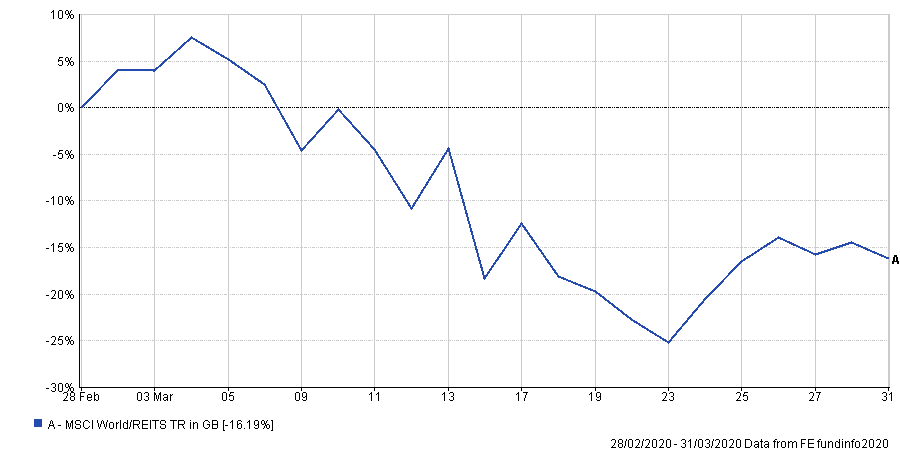

Indeed, global real estate investment trusts (Reits) experienced some of their worst drawdowns in history in March with the MSCI World/REITs index down 16.19 per cent.

Performance of index in March

Source: FE Analytics

Despite current valuations, however, there are some good opportunities to be found for what have historically been useful portfolio diversifiers, according to several experts.

And as the initial rush for liquidity subsides and markets settle, investors could yet return.

“Reit earnings will be less negatively impacted than equity market”

Global Reits are currently trading at a 20-60 per cent discount to net asset value (NAV) compared with pre-March levels, said PGIM’s head of global real estate securities Rick Romano (pictured), as even what were previously regarded as defensive, such as assisted-living properties.

Nevertheless, April rent collection was stronger than expected across many different property types suggesting that this is an asset class that shouldn’t be completely written-off, according to the manager of the $34m PGIM Real Estate fund.

“We anticipate Reit earnings streams will be less negatively impacted than the broader equity market, due to long-term lease durations in real estate and high credit quality tenants,” he said.

“Additionally, the composition of the Reits market has shifted over the past 15 years to be less economically cyclical and is instead largely driven by secular demand-based property types – such as cell towers, data centres, single family rentals and manufactured housing.”

Indeed, trends in place prior to Covid-19 could now be accelerated, the PGIM manager added, with a major increase in e-commerce and online food deliveries moving far ahead of the traditional ‘bricks and mortar’ retailers, which are now being forced online to compete.

“Many will remain as long-term e-commerce participants, and asset value reductions in the retail space that were expected to occur over a five-year timeline will now likely occur in just 18 months,” Romano said.

“Recessions have been fertile ground for outsized return opportunities”

“The global health crisis and recession have turned property markets upside down in dramatic fashion, as shelter-in-place orders have given certain tenants the economic and political cover to avoid or delay rent payments,” said Jon Cheigh, chief investment officer and head of global real estate at Cohen & Steers.

With global REITS underperforming the past few months and consequently trading at ‘meaningful discounts’, the next few months will be a major challenge for many landlords, according to Cheigh (pictured), although they will have enough liquidity to navigate this period of low cash flow.

“Given Reits’ strong balance sheets, access to capital and attractive valuations, we have confidence investors will look back at 2020 as an attractive vintage year and a buying opportunity,” he said.

“Recessions have been fertile ground for outsized return opportunities. Just as the Reit recapitalisations in 2009 led to substantial returns in the ensuing years, we expect similar opportunities will emerge to provide capital infusions – whether to help healthy companies pursue acquisitions, or to assist high-quality but cyclically challenged businesses.”

As such, Cheigh said the specialist asset manager is positioning in property types “experiencing resilient demand in the crisis” – such as digital infrastructure, housing and self-storage – as well as undervalued and well-capitalised companies operating in challenged sectors, which they expect to emerge stronger from the crisis.

“The crisis appears to have accelerated some long-term growth themes”

Gillian Tiltman, manager of the $63.2m NB Global Real Estate Securities fund, said that it’s not just housing real estate that has taken a big hit during the global lockdown as “empty streets and silent skies,” have meant that outdoor food, retail and shopping centres have had “virtually no footfall for two months”.

“Hotel, travel and leisure sites are in mothball and offices are largely empty,” she explained. Healthcare facilities, including senior housing and skilled nursing facilities, have been especially hard hit, while significant restrictions on elective procedures have hurt the profitability of hospitals and medical office buildings.”

However, the manager noted that Reits market have previously benefited from low interest rate environments, a situation markets find themselves in today as Covid-19 prompted governments to bring interest rates down to their lowest-ever levels to help offset some of the economic impact.

“This could support asset values, enable real estate operators to refinance on favourable terms and attract yield-seeking investors,” she said, particularly with the crisis accelerating some of the Reit sector’s long-term trends.

This includes a theme that has become much more prominent during the lockdown period, and how people are becoming increasingly connected by devices to the online world for information and entertainment as well as the broader ‘Internet of Things’ that is creating fully networked homes, factories and supply chains.

“These advances require the rollout of 5G connectivity, which in turn requires a much denser, ‘small-cell’ communications infrastructure than we currently have,” said Tiltman (pictured). “That is already generating a lot of demand for cell towers, a growing subsector in the Reits universe.”

“We do not believe the current market resembles 2008-09."

John Creswell (pictured), executive managing director at Duff & Phelps Investment Management Company – who manage Nordea’s Global Real Estate strategy, noted that since 1996 whenever the NAV for US Reits has traded at a discount of greater than 10 per cent, the returns for the FTSE Nareit Equity Reits index in the following 12 months has been positive in 33 of 38 periods.

“Previous crisis lows included a discount to NAV of 22 per cent at the end of the dotcom bubble, 17 per cent in the global financial crisis and 15 per cent in the 2013 ‘taper tantrum’,” he explained. “Had an investor purchased Reits during these three periods, the 12-month forward returns would have been 16.51 per cent, 85.47 per cent, and 19.35 per cent, respectively.

“Nevertheless, we do not believe the current market resembles 2008-09. Since then, Reits have strengthened balance sheets and are better positioned with lower leverage.

“Less than 10 per cent of Reits’ debt comes due in the next two years, mitigating the need to refinance at a time when credit markets have been disrupted.”

“In addition, the world’s major economies have taken decisive action and launched fiscal and monetary stimulus that is without peacetime precedent to support the financial system.”