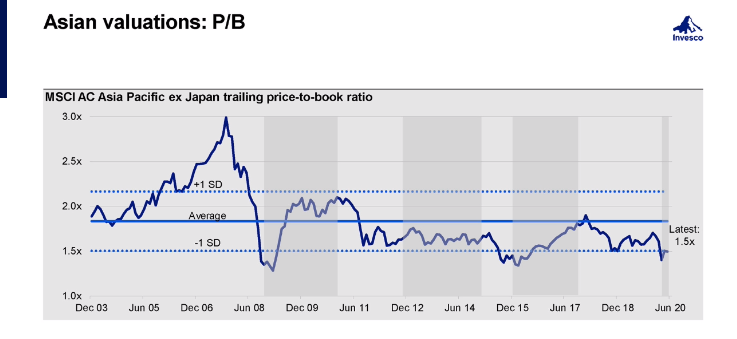

There have been just two points in the past 15 years when Asian equities have been cheaper than current levels – which suggests the region could be about to embark on a period of powerful performance.

This is according to Ian Hargreaves, who runs the Invesco Asia Trust. The manager said that not only is Asia cheap on a historical basis, with its price-to-book (P/B) ratio of 1.6x one standard deviation beneath its average, it is also cheap on a relative basis, comparing favourably with 2.2x from the rest of the world and 3.4x with the S&P 500.

Source: Invesco

Yet while he believes such low starting valuations bode well for an investor buying in at this point, he warned they need to be selective if they want to tap into the recovery.

“There are two big things going on in markets,” said Hargreaves. “One is the coronavirus, the other is the divergence between value and growth. It is important to note that the divergence had been going on for quite a while before the coronavirus and when it struck, it just accelerated.

“We thought that when the market hit the trough at the end of March, it was too cheap overall. Now it has bounced back 25 to 30 per cent, we wouldn't really say that.

“But what we would say is the opportunities in investing in Asia are now more about this big discrepancy between value and growth, rather than opportunities to just simply ride the wave of the market going up.”

Of course, many managers warned at the start of the year that the growth versus value dispersion had reached such an extreme, a reversion was inevitable – yet in the end, the opposite was true.

Hargreaves admitted it was possible the divergence could go even further, but said in such a scenario he could bring the value/growth split in his portfolio up to 60:40 from its current 50:50 level.

While the manager does not believe the growth names in his portfolio are expensive, any movement far above what he regards as fair value would see him trim these positions in anticipation of a catalyst to spark a value revival.

“So what's the catalyst for a value rotation? It’s the other way around to the way we think, as we are bottom-up: we see where the value is in the market and buy accordingly, then think about top-down,” he added.

“Obviously there are plenty of arguments, such as inflation kicking in. But when we look back at previous changes of leadership, I think sometimes you can point to valuation being the catalyst and I think we're approaching that point.”

While Hargreaves is not a value manager, his process involves investing in companies that he believes are worth considerably more than their valuation suggests.

He said this is possible because a company’s share price is typically more volatile than the fair value of the underlying business. Company fundamentals continuously move and because the market has a tendency to extrapolate both positive and negative shifts into the future, it is possible to gain an edge when it overreaches itself.

“There are a few key elements of the process,” he explained. “Firstly, we often look in unloved parts of the market for new ideas. We then bring our team skill and experience to bear to really get to grips with the fundamentals of the companies we're looking at and to develop an understanding of where we believe the market might be wrong in how it's valuing the business.

“This requires an ability to think long term and often necessitates the courage to move against mainstream thinking.”

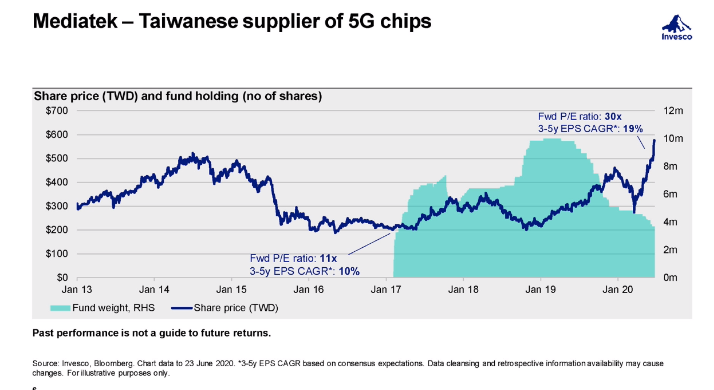

One example of this process in action was the investment in Mediatek, a Taiwanese designer of silicon chips that power consumer electronics products such as flat-screen televisions, smartphones and voice assistant devices such as Amazon Echo.

Hargreaves said the company has a strong record of growth and profitability, generating positive free cash flow in every one of the last 20 years. However, when he started to look at it in January 2017, it had fallen on hard times and its share price was about 50 per cent below its all-time high.

“The problem was that it underestimated how quickly the market in China would transition from 3G smartphones to 4G and its 4G product just wasn't mature at the time, which led to low selling prices,” the manager continued.

“Along with high manufacturing costs, this resulted in a double hit to its margins and profits.

“What got us interested initially in January 2017 was that pretty much 50 per cent of the market cap was backed by cash on the balance sheet and investments it had.

“Even excluding that cash, the company was trading on a low-teens multiple but on earnings that were on margins 50 per cent below historical levels. A low multiple of trough earnings, in essence.”

Hargreaves said that, along with his knowledge of the company’s track record, talks with Mediatek’s management convinced him this was primarily a timing issue that would be addressed by new product launches later in 2017, rather than a fundamental problem with the company's technology.

However, because sell-side analysts were focused more on weak sales in the first half of the year, he was able to invest in the knowledge that the new products would allow gross margins to recover to more normal levels, driving “a leveraged improvement in profit”.

“The downside support from the cash balance and the low multiples strengthened our belief in the significant undervaluation, but what was really important here was our focus on the medium term rather than the short-term weakness in earnings,” he continued.

“If you fast-forward to today, you can see the share price did recover: the 4G chips led to an improvement in margins. More recently, the share price has had another leg-up and that has been driven by a re-rating as it became clear that Mediatek is also well placed in 5G and can benefit from the problems that Huawei is currently experiencing.

“But in our view, it's beginning to approach fair value and so our shareholding has been coming down. This is a very typical pattern that you see in our investments: there's an inverse relationship between the share price and our shareholding.”

Data from FE Analytics shows the Invesco Asia Trust has made 109.82 per cent since Hargreaves took charge in February 2011, compared with 107.16 per cent from its IT Asia Pacific sector and 89.07 per cent from the MSCI AC Asia ex Japan index.

Performance of trust vs sector and index under manager

Source: FE Analytics

The trust is on a discount of 12.68 per cent, compared with 11.4 and 11.44 per cent from its one- and three-year averages.

It is 4 per cent geared and has ongoing charges of 1.02 per cent.