AXA Framlington Japan and Baillie Gifford Japanese are some of the funds that FundCalibre’s Juliet Schooling Latter recommends for capturing the secular growth story in Japan.

Japanese equities have been somewhat unpopular since the Japanese asset bubble burst three decades ago and ushered in a period of weak growth and disinflation. But the launch of prime minister Shinzō Abe’s ‘Abenomics’ stimulus package in 2012 caused the country to become more attractive to foreign investors.

The country also held up well in the coronavirus sell-off as both of Japan’s main indices, the TSE DTOPIX and Nikkei 225 index, fell less than the global counterparts. During the recovery, the only developed market index to beat them so far was the US’ S&P 500.

In the coronavirus crisis itself, Japan had a more conservative approach than Europe choosing not to go into a full-scale lockdown while keeping businesses open with limited social distancing to allow the economy to keep moving.

FundCalibre research director Schooling Latter said: “As many Japanese companies have been hoarding cash for years, the economic impact of the virus is expected to be smaller than in other countries.”

Japan has been fortunate to have witnessed a very low death toll of 988 deaths (as of 23 July), which seems especially low given the country’s aging demographic.

Looking at opportunities in the market today, Schooling Latter said: “After three decades of stagnant growth, it has taken almost another decade for both businesses and investors to have faith that prime minister Abe’s reforms will actually work.

“But work they have and, while Europe, the UK and the US are questioning their futures, Japan now has one of the most stable political backdrops in the world and the conservative practices of management has left its cash-rich companies well-prepared for the global lockdown.”

The research director (pictured) added: “Corporate governance is improving, and the country has a number of high quality firms that are under-researched. Not only this, but some of its areas of strength are also now being driven by secular growth.”

Within this secular growth trend there are four key areas, according to Schooling Latter: robotics and automation, medical solutions, aspirational brands and finally digitalisation of Japan.

Below are four funds, Schooling Latter highlights to tap into Japan’s secular growth opportunities.

AXA Framlington Japan

The first is Chisako Hardie and Tom Riley’s AXA Framlington Japan fund, which Hardie has managed for just over a decade.

The fund invests across the market-cap space, but it has a bias towards small- and mid-cap companies, consequentially increasing the risk profile of the fund. But FundCalibre said this is well counterbalanced with strong diversification across its 100 holdings.

Schooling Latter said the managers identify investment opportunities for the fund by looking for thematic trends to inform their stock picking and help generate ideas.

“Recent themes include: the globalisation of Japanese food, ageing populations, automation and the increased use of electronics in cars. Investments are often held for many years but will be sold when they become fully valued,” she added.

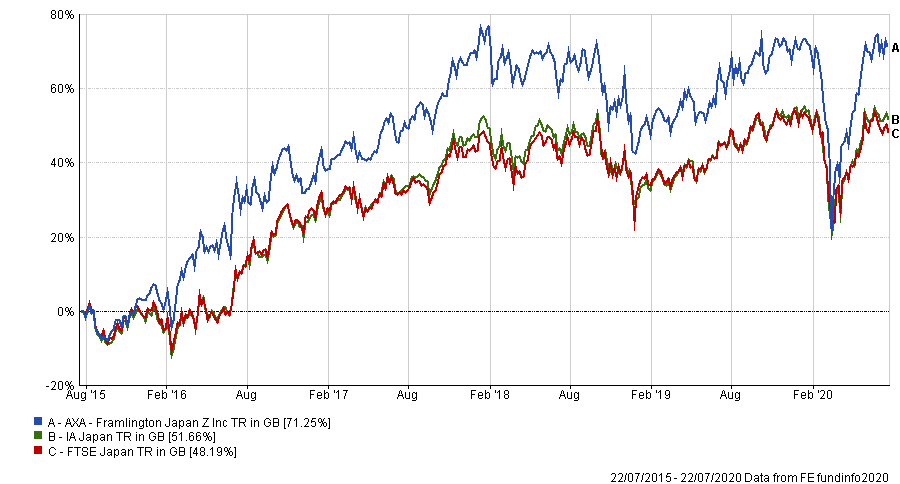

Over the past five years AXA Framlington Japan has outperformed with total return of 71.25 per cent, beating the IA Japan sector (51.66 per cent) and the FTSE Japan index (48.19 per cent).

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

It has an ongoing charges figure (OCF) of 0.84 per cent.

Baillie Gifford Japanese

Schooling Latter’s next fund pick is the largest and oldest fund in the IA Japan sector: Matthew Brett’s £3.1bn Baillie Gifford Japanese fund.

Launched in 1999, the fund’s process is built around five specific factors: a company’s competitive advantage, industry, financial strength, how well it is run and finally its valuation.

On investing in growth, Brett said that “in contrast to other major markets, growth often commands little or no valuation premium in Japan and we continue to identify global leading businesses which trade on a substantial discount to their peers. This provides an excellent backdrop for our investment style.”

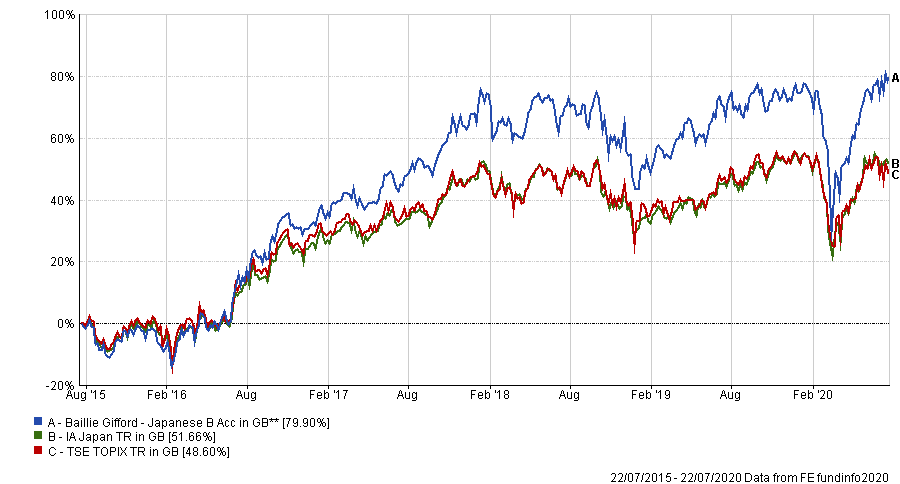

Over the past five years, the fund has made a total return of 79.90 per cent, outperforming both the IA Japan sector and the TSE TOPIX index (48.60 per cent).

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Baillie Gifford Japanese has an OCF of 0.62 per cent.

Comgest Growth Japan

Next is the £2.4bn Comgest Growth Japan fund, co-managed by Chantana Ward, Richard Kaye and Makoto Egami.

Schooling Latter said the fund is a concentrated portfolio of only 30-40 “high-quality, long-term growth companies”, which are either headquartered or carrying out most of their activities in Japan.

To find these companies, the managers look for six factors to determine quality: the business model, financial criteria, organic growth, barriers to entry, sustainability of the business and quality of management.

The fund has made top quartile returns over all investment time frames up to and including five years (one month, three months, six months, one year, three years and five years).

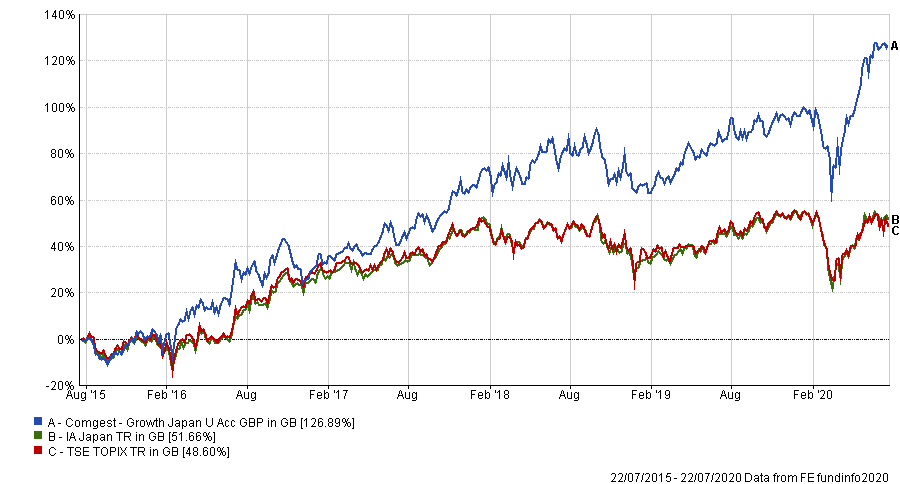

Over five years Comgest Growth Japan made the second best return of the IA Japan sector at 126.89 per cent, outperforming the sector and the TSE TOPIX index.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The five FE fundinfo Crown-rated fund has an OCF of 0.92 per cent.

T. Rowe Price Japanese Equity

Schooling Latter’s final fund pick is another multi-cap strategy: Archibald Ciganer’s €1.3bn T. Rowe Price Japanese Equity fund.

Investing in around 60-100 companies, the fund has an overweight to small-caps, Schooling Latter highlighted.

“The manager aims to find businesses he believes can deliver sustainable growth, before other investors recognise their potential,” she said.

“He will adapt his investing style as needed to suit changing market conditions, which has helped him to outperform in different environments.”

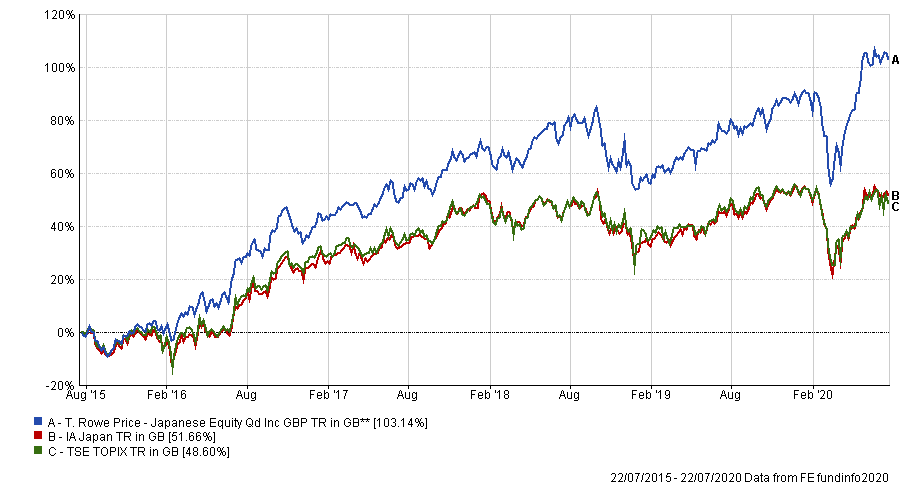

Ciganer was appointed to the four FE fundinfo Crown-rated fund in 2013 and over the past five years the fund has made a total return of 103.14 per cent.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

T. Rowe Price Japanese Equity has an OCF of 0.73 per cent.