Exposure to niche areas of the market has allowed some global equity exchange-traded funds (ETFs) to achieve high levels of return during 2020, research by Trustnet has found.

Within the Global ETF Equity – International sector, there are certain strategies which have benefited from some key trends during the pandemic.

Increasing digitalisation and the continuing rise of the “gig-economy” have allowed some ETFs to achieve high double-digit returns.

Some strategies have even achieved triple-digit returns through investing in megatrends or by taking leveraged bets.

Conversely, there have been funds in the sector that suffered as a result of tracking companies that can be sensitive to issues around travel restrictions and dividend cuts.

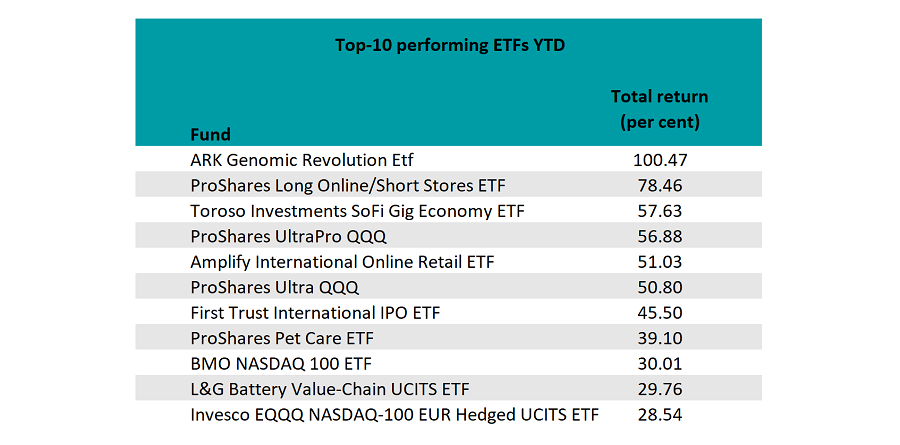

Top performing funds of the sector YTD

Source: FE Analytics

The top-performing fund was the $2.3bn ARK – Genomic Revolution ETF, an actively managed strategy that invests in companies involved in innovative areas such as gene therapy, bio-inspired computing and molecular medicine.

Overseen by Catherine Wood – chief investment officer at ARK Investment Management – the fund is largely comprised of biotechnology companies spread across all market-cap ranges.

US genetic information company, Invitae is the largest holding in the portfolio at 12 per cent and the fund has made a total return of 100.47 per cent in 2020 (to 31 October).

The second-best performing strategy was the ProShares Long Online/Short Stores ETF, a long/short strategy designed to profit from the potential growth of online companies and the decline of bricks & mortar retailers.

It takes 100 per cent long position in retailers predominantly selling online or via other non-store channels and has a 50 per cent short position in those that rely principally on revenue from physical stores. It has made a total return of 78.46 per cent.

The Toroso Investments SoFi Gig Economy ETF comes in third with a return of 57.63 per cent, another thematic fund investing in companies around the world involved in the so-called “gig economy” which promotes freelancing and shared resourcing.

A leveraged play on the Nasdaq 100 index is the fourth-best performer in ProShares UltraPro QQQ ETF, which seeks a return that is three times that of the index.

While the Nasdaq 100 has returned 30.62 per cent for this year, ProShares UltraPro QQQ ETF has made 56.88 per cent.

Rounding out the top-five is the Amplify International Online Retail ETF – another online retail strategy focused on markets outside of the US, tracking the EQM International Ecommerce index – which has made a return of 51.03 per cent.

However, leverage can be a double-edged sword, increasing losses in the same way it enhances gains.

Indeed, the worst-performing strategy in the Global ETF Equity – International sector is the GraniteShares – 3x Long Vodafone Daily ETP (exchange-traded product), making a loss of 76.20 per cent.

The fund gives investors three times exposure to the total return investment of UK-listed telecoms company Vodafone, which has made a 27.56 per cent loss during the first 10 months of the year.

However, it should be noted that the stock has made 18.12 per cent since the end of October, as news of progress on several vaccines has buoyed markets.

Bottom performing funds of the sector YTD

Source: FE Analytics

The economic impact of the Covid-19 pandemic is reflected in the performance of the second-worst performing ETF: ETFMG Breakwave Dry Bulk Shipping.

The strategy gives investors long exposure to the dry bulk shipping market – the movement of commodities – through a portfolio of near-dated freight futures contracts.

Given its sensitivity to the global economy, it has – unsurprisingly – made a loss of 54.18 per cent year-to-date.

Two dividend ETFs also feature among the bottom five – Global X Super Dividend and Fidelity International High Dividend – as companies came under pressure to cut or suspend dividends to conserve capital as the pandemic took hold.

Third-placed Global X Super Dividend ETF – which invests in the top-100 highest dividend payers globally – made a loss of 36.25 per cent, while Fidelity International High Dividend in fourth made a loss of 28.4 per cent.

Finally, the ProShares Short QQQ ETF – a sister strategy to the ProShares UltraPro QQQ ETF – a strategy that corresponds to the inverse of the daily performance of the Nasdaq-100, has made a loss of 28.27 per cent.