VT Cape Wrath Focus – which has made the IA UK All Companies sector’s highest return over 2021 so far – has announced that it will not be taking a management fee for the next year.

Wales-based firm Cape Wrath Capital made the announcement while highlighting the opportunities being seen among UK value stocks and championing the strengths of single-strategy boutique asset managers.

As part of the annual management charge (AMC) on the value fund’s GBP A class will be fully rebated for all existing and new investors from 1 April 2021 until 31 March 2022.

The AMC on this share class is currently 0.3 per cent. It also levies a 20 per cent performance fee on outperformance of the MSCI UK IMI Net Dividends Reinvested index (subject to a high-water mark).

In addition, the fund’s ongoing charges figure (OCF), which currently stands at 0.45 per cent, will be capped at 0.40 per cent for the duration of the AMC rebate.

The group described the move as a “thank you” to investors.

Adam Rackley (pictured), investment director at Cape Wrath Capital and the adviser to the fund, said: “Investors have demonstrated their commitment to us through a long, challenging winter for UK equity value strategies. To show our gratitude to them, we are rebating the annual management charge for one year.”

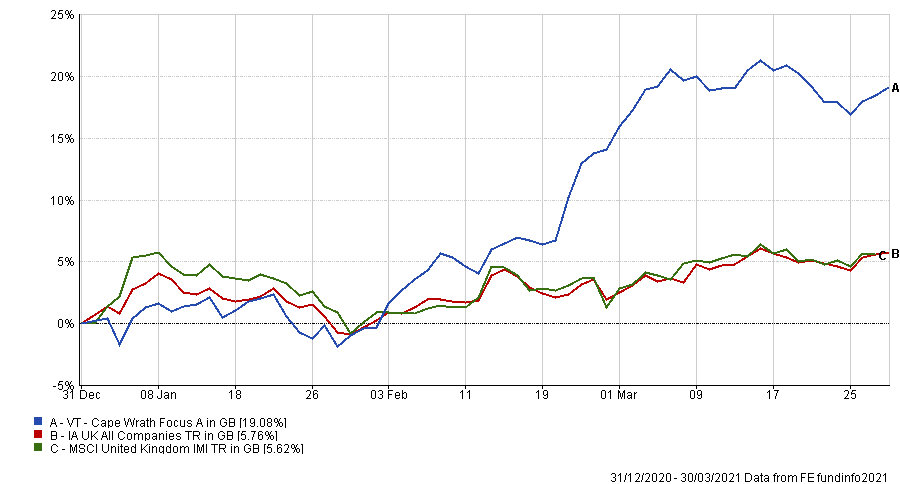

Performance of fund vs sector in 2021

Source: FE Analytics

Over 2021 so far, the £6.4m VT Cape Wrath Focus fund has generated a 19.08 per cent total return – which is the highest from the IA UK All Companies sector and the ninth-best result from the entire Investment Association universe.

This puts the fund in the sector’s top decile over one and three years, but – as suggested by Rackley above – times have been tougher for the fund in the past.

In 2017, the fund’s first full calendar year, it made a 1.77 per cent loss and was the worst performing member of the IA UK All Companies sector (the average fund made 13.99 per cent that year).

However, the resurgence in value stocks that has taken place since the first coronavirus vaccines were announced in November 2020 has seen the fund jump to the top of the performance tables over more recent time frames.

Performance of fund vs sector since launch

Source: FE Analytics

“The risk/reward asymmetry in the value corner of the UK equity market is as attractive as we’ve ever seen it, offering a once-in-a-lifetime opportunity to buy decent businesses at bargain prices, supported by earnings upgrades,” Rackley said.

“As a result, the fund’s cash position, which falls as opportunities become more plentiful, had dropped from 41 per cent on 31 January 2019 to 9 per cent by 26 February 2021.”

VT Cape Wrath Focus’ value philosophy focuses on finding companies where other investors have over-reacted to their current circumstances and pushed down valuations to the point where they no longer reflect fundamentals.

This results in a concentrated portfolio – the fund has just 18 holdings at present – with top holdings including over-50s insurance and travel firm Saga, petroleum exploration and production company EnQuest and telecommunications provider Dixons Carphone. Almost 55 per cent of the fund is in small-caps, with one-third in mid-caps and just 3.8 per cent in large-caps.

The fund is the only strategy overseen by Cape Wrath Capital, which was founded by Rackley in 2015.

He said: “Boutique asset managers have long been disadvantaged alongside their better known, better marketed, bulge bracket cousins.

“However, we can see that the tide is turning as investors become increasingly aware of the performance premium gained by investing in well-aligned, single-strategy firms that offer differentiated approaches and strict capacity limits.”