There are several unique reasons why Asia caters well for income investors seeking sustainable and growing dividends, according to Joyce Li, co-manager of the $407m Matthews Asia ex Japan Dividend fund.

The first comes down to the ownership structure of many Asian dividend-paying companies, where there is a culture of dividend paying regardless of what stage of growth it may be in.

Li (pictured) said: “In Asia there are a lot of owners are entrepreneurs, they're still relatively young and, although the companies are listed, they still maintain a meaningful share in the companies.

“There's really no tax benefit of share buybacks versus dividend paying, so it's very straightforward for them to have this share of dividend pay out to share the growth of the companies.”

As such, even among fast-growing firms it isn’t hard to find companies that are paying consistently growing dividends in the region.

Another unique thing about dividend investing in Asia is that there are what Li considers “dynamic and emerging leaders in their niche markets”.

“Although they are mid- or small-cap by market capitalisation, they can be the leaders in their area,” she said.

“Due to the characteristics of the financial system in Asia, companies must rely own their own cash flow generation to grow, therefore they are very used to cash flow distribution in the form of dividends - even before they go public.”

This makes the source of dividends very diverse by industry.

“We don't really look for typical financials, utilities or telecoms,” Li continued. “Consumer and even healthcare technology firms are really good dividend payers that contribute to the overall dividend pay out in the market.”

Li also highlighted the role that dividends play in terms of a corporate governance tool or indicator. Dividends are often used to convince investors that cash flows are indeed legitimate in what is perceived as a murky regulatory environment.

“One of the things that are very unique about Asia is when people look Asia, they always feel like this is a wild market,” Li said.

“There's a lot of value destroyers – we don't deny that. Also, although accounting rules are very similar to Western market, the execution or the due diligence in those accounts - true accounting quality - definitely takes a lot more work.

“We have over time observed that a dividend pay out policy that's consistent with a company’s earnings and growth stage is a really good testing tool for its willingness to pay dividends, its ability to pay dividends and whether its cash flow prospects are consistent with its earnings.”

For example, Li recalled a firm in the healthcare sector that turned free cash flow positive three years ago and started to pay about 20 per cent of its earnings in dividends, gradually raising it.

“That's an important signal for us because that indicates the company turned free cash flow positive in a sustainable way and the company looked at their backlogs and felt confident enough to really start a dividend policy,” the Matthews Asia ex Japan Dividend manager said.

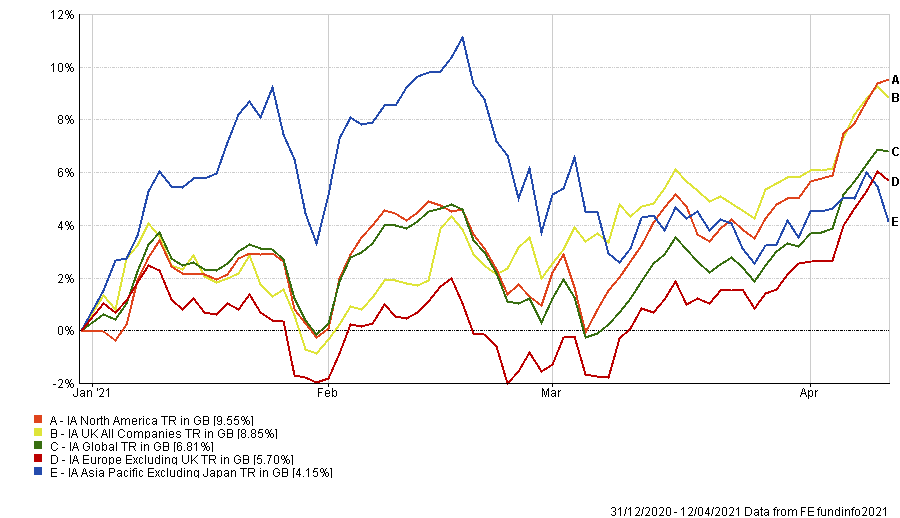

In general, Asian equity markets had a stellar 2020, with a total return higher than the other major equity markets. However, year to date they aren’t leading the pack as much.

Performance of major regional IA sectors year-to-date

Source: FE Analytics

Despite this, Li said that there are several indicators for Asian equities that signal the fundamentals look strong in the years ahead.

One indicator she follows is the capital expenditure cycle, which kicked in just before the pandemic hit and then paused during the pandemic, before restarting mid-last year. This cycle, in her view, is a very important underlying driver for Asia's earnings growth.

Another indicator she has been monitoring is middle class consumption. She said: “Fortunately because north Asia has been relatively unaffected for a long time during the pandemic, the consumption momentum also continues.”

The third indicator is inflation, more specifically, to what extent the supply chain hiccups in recent months are short term and whether there will be more than a moderate increase in inflation over the next quarter.

Li said: “With all those three aspects that we monitor, we have relatively high confidence that the earnings cycle is uninterrupted.

“So the high base definitely caused some questions - whether we're going to face a high base in consumption growth - but fortunately the growth of consumption has broadened out from China now into Asia, south-east Asia and India.

“Therefore, we are even within consumption, we are moving slowly or gradually towards consumption beneficiaries, beyond just China.”

Although she is still confident in Chinese equities, the fund is beginning to broaden its exposure out into areas beyond just China.

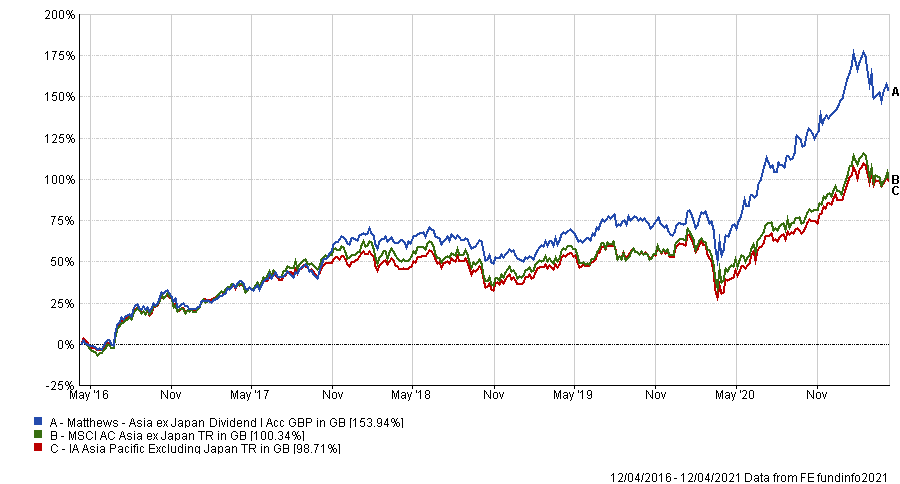

The Matthews Asia ex Japan Dividend fund has delivered a total return of 153.94 per cent over the last five years, compared to 100.34 per cent form the MSCI AC Asia ex Japan benchmark and 98.71 per cent from the average fund in the IA Asia Pacific ex Japan sector.

Performance of the fund over 5yrs

Source: FE Analytics

The five FE fundinfo crown-rated fund has an ongoing charges figure of 0.90 per cent and a yield of 1.33 per cent.