There could well be a bubble in US technology stocks, according to Schroders multi-asset fund manager Ugo Montrucchio, but not among the mega-cap names that everyone is watching.

Montrucchio based this argument on the lessons that Schroders has learnt running multi-asset portfolios for more than 70 years – the group launched its first balanced mandate in 1948.

Bubbles have been long been a concern for investors. They occur when stock prices inflate significantly and no longer reflect what the company is really worth, Montrucchio explained. The main problem with them is that they burst and cause valuations to crash.

Markets have seen several bubbles over the years, and one in US tech stocks in recent history: the 1990s dotcom bubble saw the rapid rise and fall of US internet and technology stocks.

This episode has been compared to the high-flying mega-cap US tech stocks driving the S&P 500 today, namely the FAAANMs (Facebook, Apple, Alphabet, Amazon, Netflix and Microsoft). All of these companies have been responsible for a large part of the index’s returns and some believe their valuations are now too lofty.

US tech stocks have remained a dominant force in markets even after the dotcom crash, driven by quantitative easing in markets and changing consumer demands. In the past year US tech names has outperformed even more, as tech companies thrived in the locked-down working from home environment.

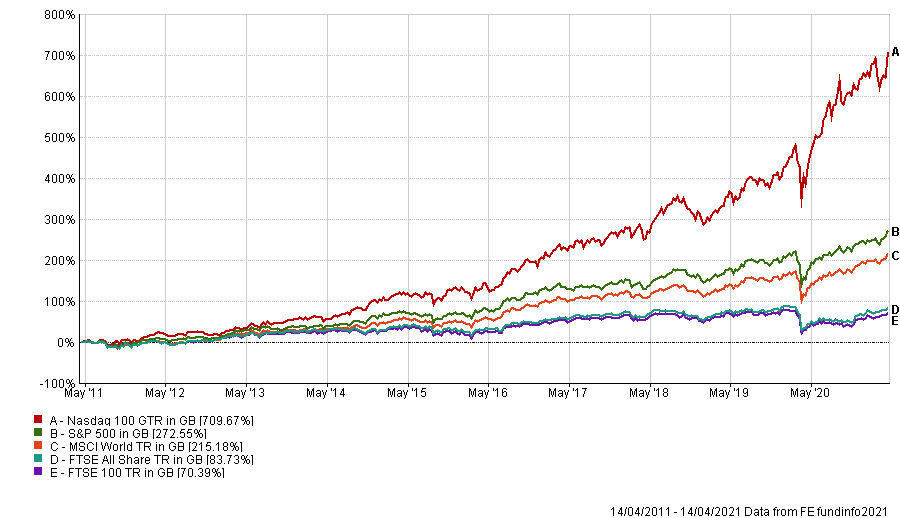

Below shows the performance of the Nasdaq 100 – which is heavily weighted to tech - versus other global indices over the past decade. Tech’s outperformance is clear.

Performance of indices over 10yrs

Source: FE Analytics

But the well-known FAAANMs is not where the new tech bubble is, according to Montrucchio.

He clarified that usually investors have to wait until after bubbles burst to spot them and it’s not entirely possible to ascertain whether or not the combination of technological advancements and extended periods of quantitative easing have inflated markets into a bubble territory.

But with his own experience, combined with Schroders’s 73 years of running multi-asset portfolios, Montrucchio sees a new US tech bubble.

“I do believe we could very well be in a bubble, but it is localised in certain areas of US technology stocks. These have been beneficiaries of significant investment but trade at excessive and unsustainable multiples,” he explained.

“To my mind, the bubble is not so much in the large-cap technology stocks, the FAAANM stocks of this world. While they do trade on expensive valuations, they also have a long history of producing very strong margins year after year.

“Rather, I think the bubble could be in the second-tier tech stocks which are trading at lofty valuations and whose revenue projections are overambitious.”

Looking at stocks outside technology and those hit worst by the Covid pandemic environment from suggests valuations are not excessive, according to Montrucchio.

He said the valuations of companies that struggled in 2020 and didn’t participate in the November vaccine rally remain “very much acceptable”.

He said: “A way to navigate through what may well turn out to be a bubble is to diversify your exposure and cast your investing net as wide as possible.”

With the combined 73 years of multi-asset investment experience Montrucchio identified six more lessons for investors.

Diversification still matters

One is that diversification still matters, especially in periods where inflation may be on the rise.

When there have been periods of low, stable inflation in the past, there has typically been a negative correlation between equities and bonds, something which has been amplified by the persistently low interest rates.

But when the environment changes and inflation increases, “history suggests there’s a positive correlation between equities and bonds”, Montrucchio said.

“In this environment bonds may struggle to as effective diversifiers,” he said. “Investors will therefore need to think harder about how to go about creating a diversified portfolio,” he added.

Flexibility in asset allocation still matters too

Another lesson is keeping the investment strategy flexible enough to adapt to different stages of the economic cycle.

Montrucchio explained that asset allocation becomes more important than individual stock picking during periods of economic recession or recovery because the dispersion of returns from various asset classes increases.

But during economic expansion this switches and stock selection contributes more to returns. “This is why we believe there’s merit in being flexible with one’s investment strategy, varying asset allocation throughout the economic cycle,” he said.

Monetary support is likely to give way to fiscal support

The past year has seen unprecedented amounts of fiscal and monetary support unleashed to help deal with the financial and economic impacts of Covid-19.

Entering the 2008-9 economic crisis, the US Federal Reserve began pumping significant amounts of liquidity into markets via quantitative easing to rebuild banks’ balance sheets. This liquidity fed through into financial markets and became a big driver of financial returns for the following decade. But it didn’t impact the real economy as much.

But Montrucchio said: “This time around, with monetary policy accommodative in most of the world, the baton has passed to fiscal policy to support ailing economies. We’re likely to see this transition from monetary expansion to fiscal support play out over the next five years.”

This could lead to higher inflation down the line

Monetary and fiscal stimulus directed at the economy and consumers rather than markets could push up inflation but it’s currently too early to tell, the fund manager said.

He explained: “Pre-Covid, the prevailing view was that the global economy was facing secular stagnation. In other words, poor growth and low inflation as demographics and a technological revolution conspired to structurally depress economic and price growth.

“These structural forces still exist. The combination of these and the transition to huge fiscal support means that the upside risk to inflation appears more balanced, in my view.”

Regulation and cost pressure is here to stay

The penultimate lesson concerns regulation and cost pressure, two things which Montrucchio believes are going to persist in the industry.

According to him: “One aspect of this is the debate about active versus passive management.

“However, the debate misses the point that there’s space for both active and passive in a portfolio. They are not mutually exclusive, so you don’t have to pick one over the other. There’s a very strong case for using a blend of active and passive.

“A passive approach is very effective in providing access to efficient markets such as those in the US, while active managers can add value particularly in inefficient markets like emerging markets, credit or distressed debt.”

Sustainability will only grow in importance

The final lesson is how the presence of sustainability and ESG (environmental, social and governance) is going to increase, especially in managers’ conversations with clients about their investment goals.

Citing data from the World Economic Forum, Montrucchio said, that since the financial crisis the top five long-term risks facing society have changed from economic concerns to “nearly exclusively environmental”.

He said: “It’s very clear to me from my conversations with clients that people are taking more active steps to move towards more sustainable investment approaches. It’s equally clear to me that the scale of the problem we face is immense and that it will have profound implications for how we allocate capital in the years to come.”