The European Super League fiasco won’t put investors off football, according to Luis Garcia Alvarez of the MAPFRE AM Behavioral fund, who says that once you look past the noise and focus on the fundamentals, it is one of the most compelling growth stories in the market.

In what will go down in history as one of the most farcical moments in football’s history, plans for the European Super League were released on Sunday evening as 12 of Europe’s biggest clubs announced they were forming a new competition, backed by a £2.8bn commitment from JP Morgan.

There was an immediate kickback from fans, pundits and former players, who expressed their disgust at a football competition that operated as a ‘closed shop’, removing much of the competitive element from the sport and altering its very nature.

Not only were the plans shelved in little more than 48 hours, but the prime minister has announced a longer-term review into how the English game is run to prevent a repeat of this power grab.

However, Alvarez said that rather than acting as a red flag, the news of the Super League led to a sudden surge in investor interest in football, which he had been anticipating for some time.

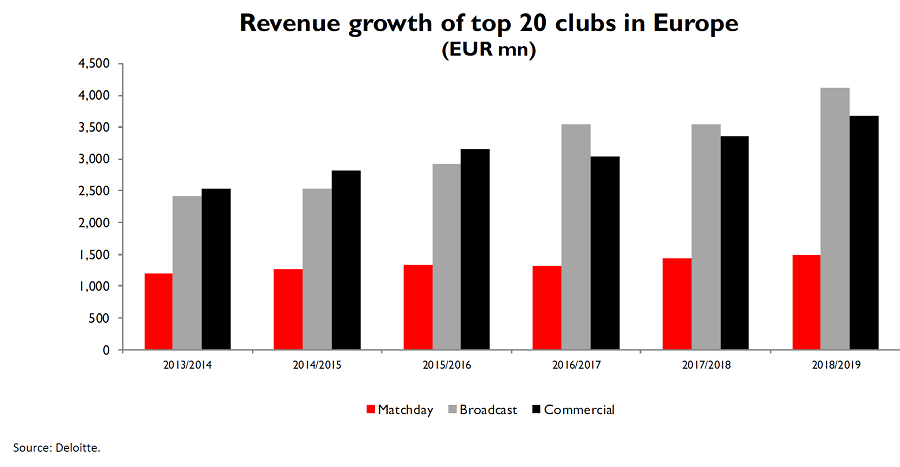

“Football is a content business, like Netflix or Disney, and content businesses have a high degree of operating leverage,” he said.

“This means that at the moment that revenues start growing, operating margins grow even faster and that comes with higher valuations.

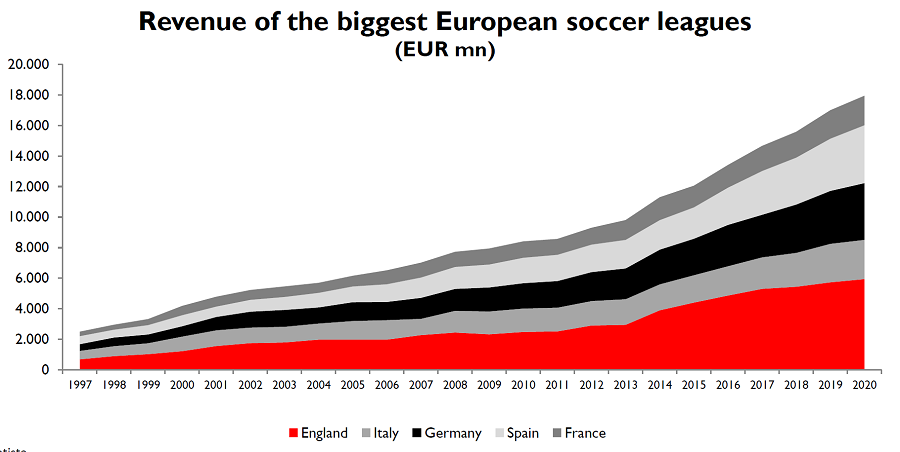

Source: Statista

“This is a story that we have seen in the last decade in the US sports franchises.”

Yet despite Alvarez’s claim that football is a content business, European clubs do not generally command the high valuations associated with the rest of this growth sector.

For example, he noted US sports franchises trade at about 30 to 35x enterprise value to EBITDA, compared with 2 to 5x from European clubs.

Yet the manager said that even these enormous valuation discrepancies only hint at the potential in the sector.

“Normally when you see higher enterprise value to EBITDA multiples, it means that these companies are going to grow faster,” he explained.

“But in sport, it is the other way around. It the European clubs, which are operating at lower multiples than the US franchises, that are going to grow faster in the coming years.

“You don't need to be a genius to see that football is catching up in things like TV, marketing tools, fan engagement tools, even behavioural science to know how to deliver a better experience.”

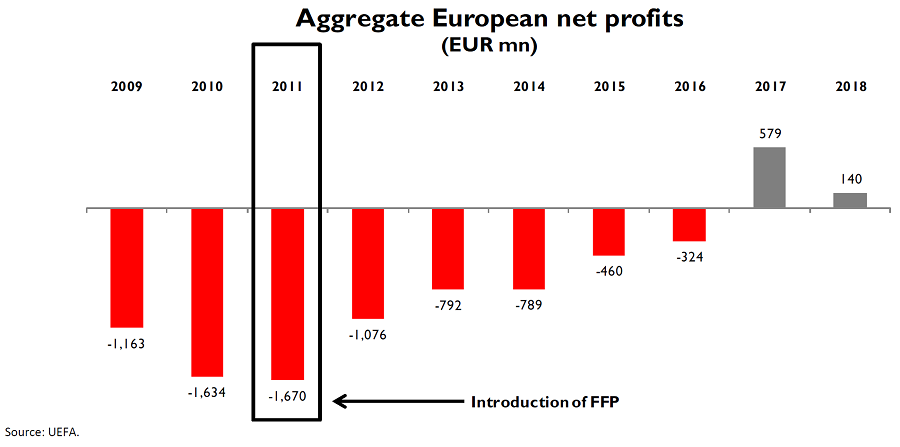

Alvarez said UEFA’s introduction of Financial Fair Play in 2011 was a game changer for investors in European football. Up until that point, clubs were running up huge debts, but the new rule required them to balance their spending with revenues in the medium term. By 2017, European football clubs were running a net profit.

“Other national leagues went one further,” he continued. “The Spanish La Liga introduced salary caps [based on factors such as their clubs’ revenues and debt].

“The Super League was going to use this option, targeting a 55 per cent limit on total revenues to the amount that you can spend on salaries, transfers and agents’ fees.

“Regardless of all the noise that we have had in the last couple of days… this is probably the future of European sports, because this is becoming a quasi-regulated business where the operating margins are protected. This means the probability of positive net profits becomes much higher, which is what you have seen in Spain for the last five years.”

It will not have escaped football fans’ notice that despite these rules and regulations, many of the clubs involved with the Super League saw their debt levels balloon in the Covid crisis, and one of the motivations for the new competition was the need for greater revenues.

In response, Alvarez pointed out that football is no different from other investments in that he won’t buy every stock in a growing sector, but looks for those on a reasonable valuation with a solid balance sheet and a track record of creating value for shareholders.

Also important is avoiding clubs that are being pressured by external forces. This led him away from European Super League founders such as Juventus and towards lower-profile clubs such as Ajax, Borussia Dortmund and Olympique Lyonnais.

This strategy paid off when the pandemic hit.

“Ajax are net cash, while Borussia Dortmund are very worried now because they are about to get to 1x or less than 1x net debt to EBITDA,” Alvarez said.

“I really wish that was a problem for the other companies in my portfolio.

“Olympic Lyonnais have more debt because they invested in their stadium five years ago. But if you add the market cap of Olympic Lyonnais and their financial debt, it adds up to about €450m, which is exactly the amount they invested in the new stadium.

“That was in a stadium where they were getting revenues of about €50m a year, which is gross profitability you wouldn't find in any other infrastructure asset around the world.

He added: “Maybe the market is discounting that people are not going back to the stadium any time in the future. I think we will get back quite soon. And if this is the case, the market is assigning zero revenue to a Champions League team.”

The problem with football is that revenues aren’t guaranteed, but are tied to the club’s fortunes on the pitch. If a team fails to qualify for the Champions League, for example, they will be deprived of a major source of revenue that they may have been relying on.

One of the Super League’s founders, Arsenal, qualified for the Champions League in every year between 1998 and 2017, but haven’t troubled the competition since then and are currently struggling to maintain their position in the top half of the Premier League.

This separates football from the major US sports franchises where teams start every season in the same league, regardless of performance the previous year.

However, Alvarez said that it is just a case of incorporating the uncertainty into financial models, as you would with any investment.

“When we invest in an infrastructure or construction company, we know they are going to win some contracts and lose some contracts,” he said. “What we look for is recurrent revenue across several years.

“How do we mitigate that uncertainty? We look for clubs that play in European competitions on a regular basis. Ajax play almost every single year because they are from the Netherlands [where there is less competition]. So do Borussia Dortmund, because they are the second team in Germany, with the exception of this year when they are fifth. It’s the same with Olympic Lyonnaise, they are the third or fourth team in France.

“This is what we incorporate in our numbers, this is in the price you pay for the investment.”

He added that the management teams of these clubs can mitigate any losses from failing to qualify for the Champions League, as they have a successful track record of making money in the transfer market.

In this sense, he said the clubs have a similar strategy to him.

“We consider ourselves as value investors in the sense we want to buy cheap and sell high, and this is basically what these three clubs do,” Alvarez said.

“They create talent very cheaply either in the transfer market or in their academies and they sell it at a higher price to elite clubs. They do this on a recurring basis.

“It's not only that Borussia Dortmund are selling [Erling] Haaland this year: after Haaland you have [Jadon] Sancho and [Giovanni] Reyna. Before Haaland, you had [Ousmane] Dembélé, who is now at Barcelona, and Christian Pulisic, who is now at Chelsea.”

Alvarez is a football fan himself but refused to reveal what club he supports or his personal thoughts on the European Super League.

Instead, he finished off by saying: “Football as a sport has been played for 150 years. But football as an industry is being born right now.”