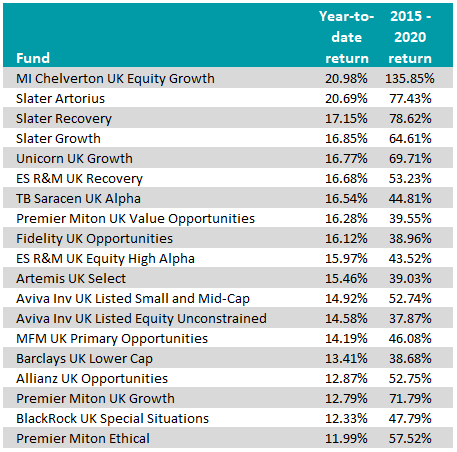

Only 19 of 254 UK equity funds have managed to deliver top-quartile performance in the growth-led market of 2015 to 2020 as well as over 2021 so far, when markets favoured the value and recovery trades.

During the last five years or so, UK equity investors have had a particularly difficult time as they grappled a Brexit referendum in 2016 and four years of economic uncertainty as the country negotiated its withdrawal from the European Union.

The coronavirus pandemic also hit the nation very hard and caused economic activity grind to a halt for most of 2020. However, in 2021, after the country finalised Brexit and the economy opens as vaccines are administered nationwide, it appears the worst could be over.

In a similar shift to that on the global stage, this has sparked a market rotation out of previously in-favour growth stocks towards the value stocks which appear cheap and more cyclically exposed to the real economy.

As such, this has dragged down many of the top performing growth funds that have benefited from years of record low interest rates combined with weak (and in 2020 negative) economic growth.

Below are the 19 funds with top-quartile performance between 2015 and 2020 that have managed to maintain a top-quartile rank in 2021-to-date.

Source: FE Analytics

The top performing name on the list is the £1.4bn MI Chelverton UK Equity Growth fund. The five FE fundinfo Crown-rated fund was the highest returning strategy year-to-date and over the 2015 to 2020 period.

This UK small- and mid-cap fund invests in highly cash generative companies with strong market positions that are expected to grow faster than UK GDP.

Managed by James Baker and Edward Booth, the top three positions in the fund are media company Future, investment firm Brooks MacDonald and building materials group Volution Group.

In their latest commentary, the managers said that the UK equity market looks “increasingly attractive for investment, given the likely pace of recovery relative to what is available elsewhere”.

They added that whilst fund performance has benefitted from its recently increased exposure to cyclical names, it is still geared more towards growth.

Despite being more growth focused in a seemingly value-orientated market, measured against all the funds in the sector - including those with third and fourth quartile 2015 to 2020 performance – MI Chelverton UK Equity Growth was the third highest performing fund year-to-date after the Consistent Opportunities Unit Trust and the VT Cape Wrath Focus fund.

Two other notable top performing funds in the list were £1.1bn Slater Growth and £238 Slater Recovery funds, both managed by FE fundinfo Alpha Manager Mark Slater.

Slater’s smaller Recovery fund has managed to deliver slightly higher performance year-to-date as well as over the 2015 to 2020 period.

While the two funds may have slightly different strategies – one focuses on turnaround situations and the other focuses on high earnings growth – they both have a few common holdings.

For example, the top three positions for both strategies are in media company Future, online gaming operator Gamesys Group and insurance firm Prudential.

The £121m Unicorn UK Growth fund, run by FE fundinfo Alpha Manager Fraser Mackersie and Alex Game, was another notable name in the list of top performers.

This fund invests across the market capitalisation spectrum, with over a third of the portfolio invested in mid-sized companies between £250m and £1bn in size, a quarter invested in small-cap firms between £50m and £250m, and the remainder in firms above £1bn.

Its top three holdings are in foreign exchange broker Alpha FX, video game developer Frontier Developments and Scottish IT firm Iomart.

Elsewhere in the list, Premier Miton UK Growth run by Benji Dawes and Jon Hudson and Premier Miton UK Value Opportunities run by FE fundinfo Alpha Manager Andrew Jackson both delivered top-quartile performance during both periods.

As the rotation out of growth into value took hold of markets, Jackson’s value strategy delivered a higher return of 16.28 per cent compared to the growth fund’s 12.79 per cent year-to-date.

Whilst for the 2015 to 2020 period, Dawes’ and Hudson’s growth strategy had a higher return of 71.79 per cent compared to 39.55 per cent from the value strategy.

Another notable strategy was MFM UK Primary Opportunities, which invests almost exclusively into UK companies raising money through primary placings, secondary placings, initial public offerings (IPOs) and rights issues.

The strategy is unique in its focus on institutional fundraises which are often priced at a discount to prevailing market prices and not available to retail investors.

One notable fund absent from the table was the £6.3bn LF Lindsell Train UK Equity fund – the sector’s largest active strategy.

Whilst the top performing growth fund run by Nick Train delivered top quartile between 2015 and 2020, it has suffered in recent months with bottom quartile performance of 5.56 per cent year-to-date.