Tech stocks have borne the brunt of investors’ growing concerns around inflation as US and European equity markets, with seeing a significant sell-off in the past few days.

The S&P 500 index fell 2.17 per cent during Monday’s session, with its tech stocks posting a loss of 3.65 per cent. The tech-heavy Nasdaq 100 also shed 3.74 per cent that day.

This prompted the FTSE 100 to drop of 2.47 per cent yesterday. This is despite the UK being on a strong run since the start of 2021 due to the rotation into value stocks and period of economic recovery favouring more cyclically biased indices.

But the FTSE 100 did open on more of a positive today, with the index currently up 33 points in the first hours of trading, following on from an easing of the US sell-off in Tuesday’s session.

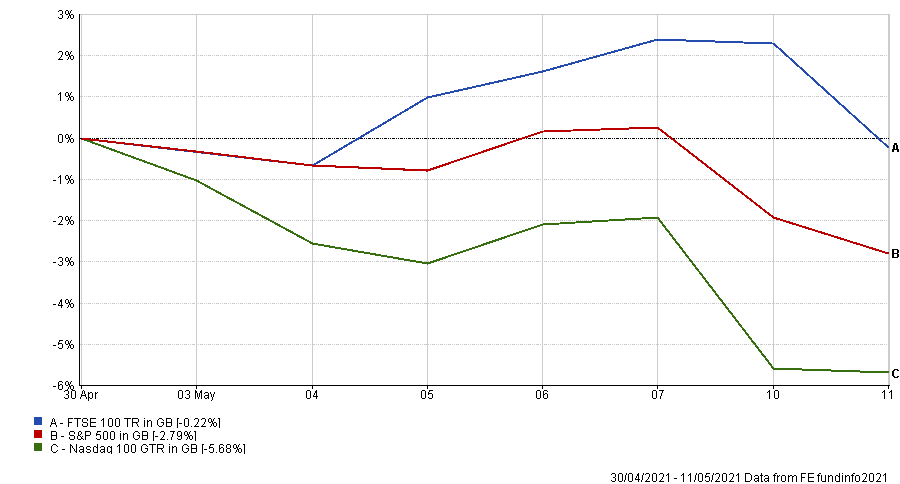

Performance of indices since the start of May 2021

Source: FE Analytics

This recent sell-off is the latest part of a market shift away from growth stocks and into value and cyclical areas of the market following the rollout of several effective Covid-19 vaccines.

November’s announcement of several vaccines catalysed the style rotation as investors began to price in a period of economic restart and growth from the pandemic, an environment cyclical stocks tend to do well in.

This is a polarisation to the low interest rate, low inflation and loose monetary policy conditions that have been in place for the past decade and enabled growth stocks to dominate.

Increased inflation expectations have been the ultimate driving force behind the recent sell-off.

Ben Laidler, global markets strategist at investment platform eToro, says: “We are in the midst of an accelerating reflation investment environment, with both rising economic growth and inflation expectations.

“This has panicked investors, which is why we have seen a major sell-off in both US and European stocks … with high-growth technology stocks suffering most.

“Rising inflation will continue to drive an investor rotation from the heavily-favoured, more expensive technology sector, as well as other sectors that outperformed in 2020, towards the cheaper and more cyclical sectors, such as financials, commodities and industrials, that are most benefited by this growth recovery.”

Laidler added that this could benefit the UK and European equity markets in particular as these economies could lead the re-opening trade.

“The region's economies now lead the re-opening, against a backdrop of cheap valuations when compared to the US, and markets more focused on the cyclical sectors most benefitting from the growth rebound,” he said.

But as mentioned above, it’s not the case that the UK, a cyclically dominant and tech light market, has been unaffected by the equity sell-off.

Nick Hyett, equity analyst at Hargreaves Lansdown, said: “When it comes to stocks and shares, if the US sneezes the world catches a cold. But it should be no surprise that [the] inflation-driven market sell-off started across the pond.”

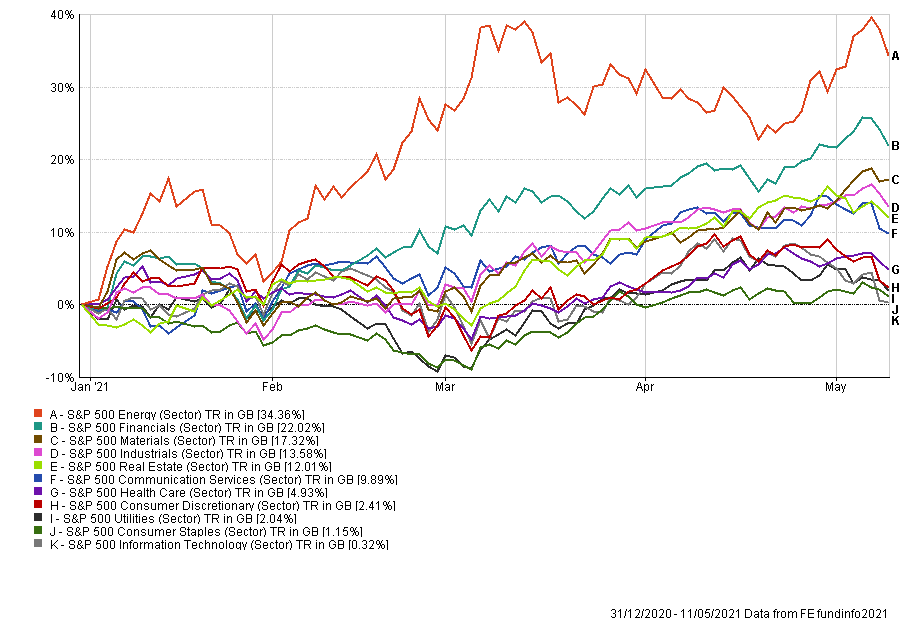

Performance of S&P 500 sectors over 2021

Source: FE Analytics

That being said, Hyett added that rising inflation expectation are likely to have the biggest negative impact on US tech stocks overall.

“All things being equal higher inflation implies higher interest rates, and higher interest rates are particularly toxic for companies that promise little in the way of profits today, but rapid growth in the years to come,” he said.

“That’s a pretty accurate description of many tech stocks, and the US market is increasingly dominated by US tech names.”

The analyst added that even with the market concerns investors should not completely abandon the tech sector yet.

“This time last year the oil price had just plummeted into negative territory for the first time ever, and that alone means costs are going to be higher now than they were a year ago, in turn driving goods prices higher. A temporary boost in inflation was inevitable. What matters is whether inflationary pressure is sustained – there’s no convincing evidence that’s the case yet,” he said.

Indeed Nigel Green, chief executive and founder of deVere Group, added that the more “savvy” investors could use this as an opportunity to buy into the popular growth tech names.

“Nobody seriously believes the future isn’t online,” he said.

One of the main debates surrounding this market activity has been whether the US Federal Reserve will react to growing inflation concerns.

Currently the Fed’s stance is that inflation is ‘transitory’. It plans to keep interest rates low and continue its bond buying programme, suggesting it’s a long way off withdrawing support for the US economy as it focuses on the recovering labour market.

Thomas Wells, who runs the four FE fundinfo Crown-rated Sanlam Global Inflation Linked Bond fund, said this rhetoric indicated that the Fed is effectively giving inflation the go-ahead to run higher.

He said: “I’m painting a picture here of rising input prices and rising consumer prices over the last few months and I’m describing a future where higher prices will ultimately feed back into the economy.

“Now that is a really nice environment for inflation linked assets but what makes this especially attractive right now is that the usual mechanism to choke off inflation is raising interest rates and the Fed have explicitly gone out and emphasised that that is not going to happen for some time. They are focused on the labour market which is, as we saw last Friday, miles away from where it needs to be.

“So consequently we have inflation expectations rising, to and above the levels that central banks are targeting and it’s being greeted with a blessing from central banks.”