While markets are currently looking expensive, Quilter portfolio manager Paul Craig, claims there are three areas that offer strong opportunities for investors.

Global markets rocketed after the initial crash last year due to massive stimulus packages and the high representation of tech stocks, which benefited from the pandemic. Even the sectors hit hardest by the economic lockdowns recovered much of their losses on positive vaccine news.

Yet while valuations in general now look expensive, Craig believes there are plenty of stocks that can continue to climb in the current environment.

“The current market cycle is bullish, but also on somewhat of a knife-edge,” he said. “The hard data and economic surveys are all trending in the right direction, and any concerns around economic growth stalling are easing.

“As such, we are in somewhat of an economic sweet spot right now, and there are opportunities for investors to get good-quality assets at attractive prices.

“It is this overriding quality that should be focused on. Given markets have come a long way in a short period of time, it ultimately won’t take a lot to knock them off their current valuations.

“Variants, levels of immunity and central bank tapering all remain on the table. The worry is many are chasing after the returns, instead of considering those businesses that have strong potential in a recovery, as well as quality characteristics should things turn sour once again.”

Below, Craig looks at three funds focused on different areas that stand to benefit from the current market environment.

Montanaro European Income

Craig said that while many businesses are revising earnings upwards and will have lofty targets in the short term, only those capable of delivering consistent earnings growth can thrive in different market environments.

This is why his first pick is the €398m Montanaro European Income fund, which targets both income and capital growth.

Manager George Cooke screens the European equity universe for high quality and structurally growing businesses across 14 metrics, building financial models to forecast growth, and assessing valuations and upside potential versus risk.

“There will be many businesses with a great opportunity set ahead of them as the economy re-opens and pent-up savings are spent. Looking out for those companies with strong earnings growth will be crucial,” said Craig.

The analysts at FE Investments are fans of this fund, saying: “The level of detail and analysis conducted, the size of the team and the discipline of the investment process give comfort that this is a repeatable process that will continue to add value to any investors looking for income with market-cap diversification.”

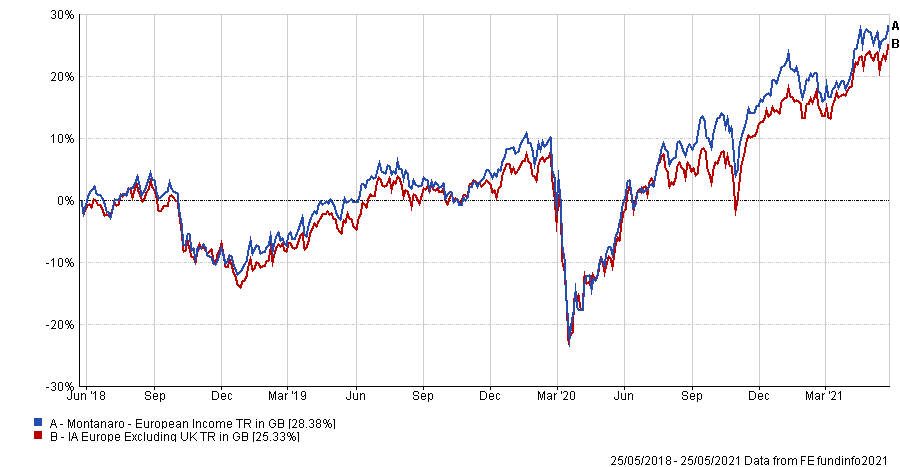

Performance of fund vs sector over 3yrs

Source: FE Analytics

Over three years, Montanaro European Income has made 28.38 per cent, while the average fund in the IA Europe ex UK sector has made 25.33 per cent. It has an ongoing charges figure (OCF) of 0.86 per cent.

SPDR S&P Euro Dividend Aristocrats UCITS ETF

“Dividend strategies have not been kind to investors over the last year,” said Craig. “Cuts and suspensions in dividend policies were the story of 2020, but already things are looking a lot brighter.”

Companies across the globe are now reinstating their dividends, often at more sustainable levels than before.

This is why Craig’s second choice is the €1.5bn SPDR S&P Euro Dividend Aristocrats UCITS ETF.

The fund tracks the S&P Euro High Yield Dividend Aristocrats index, made up of the 40 highest dividend-yielding companies within the S&P Europe Broad Market index.

“More so than ever, dividends are being scrutinised, so if a company is paying one, it should be a sign it has a strong balance sheet and prospects,” he added.

“This is particularly prevalent in the likes of the UK and Europe, where the banks have resumed their dividend payments, and will also likely benefit from central banks raising interest rates in the near-future.

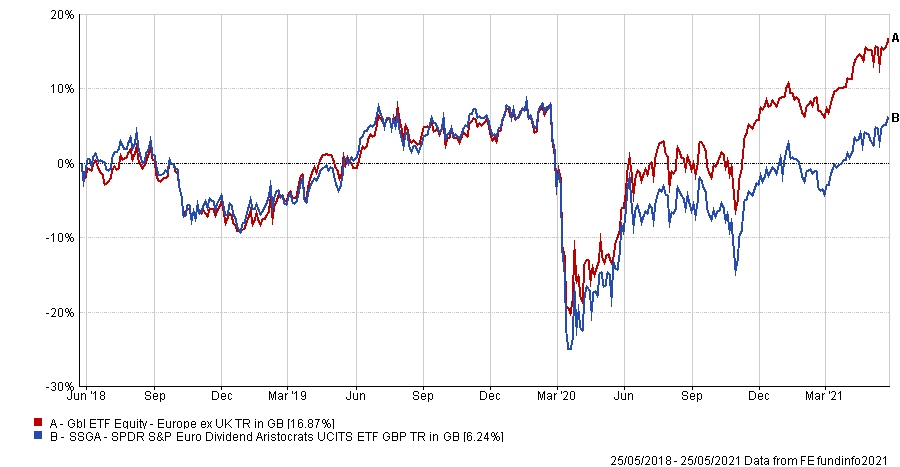

Performance of fund vs sector over 3yrs

Source: FE Analytics

SPDR S&P Euro Dividend Aristocrats UCITS ETF has made a total return of 6.24 per cent over the past three years, while its average Gbl ETF Equity - Europe ex UK sector peer made 16.87 per cent.

The fund has an OCF of 0.30 per cent.

JOHCM UK Dynamic

The final theme Craig is backing is active management, noting that stockpickers thrive in this kind of market.

His pick in this category is JOHCM UK Dynamic, run by Alex Savvides.

The £1.3bn fund aims to profit by investing in the stocks of distressed businesses that have identified their problems and are in the process of solving them.

Savvides, who launched the fund, looks to take advantage of uncertainty, mistakes and management changes to identify restructuring, recovering or undervalued companies.

The team at FE Investments said: “Savvides is willing to invest in smaller companies, albeit with recent limits, which are often overlooked by the market, and this has provided good value opportunities.”

Craig finished by saying: “It is vital to make sure you know what you are owning and not be overexposed to risks in the market.

“Passive funds will continue to be dominated by the big tech companies, yet it is likely these could fall the hardest in any market correction.

“Instead, active managers who are identifying the opportunities at attractive values, almost regardless of style, should do well in this environment.”

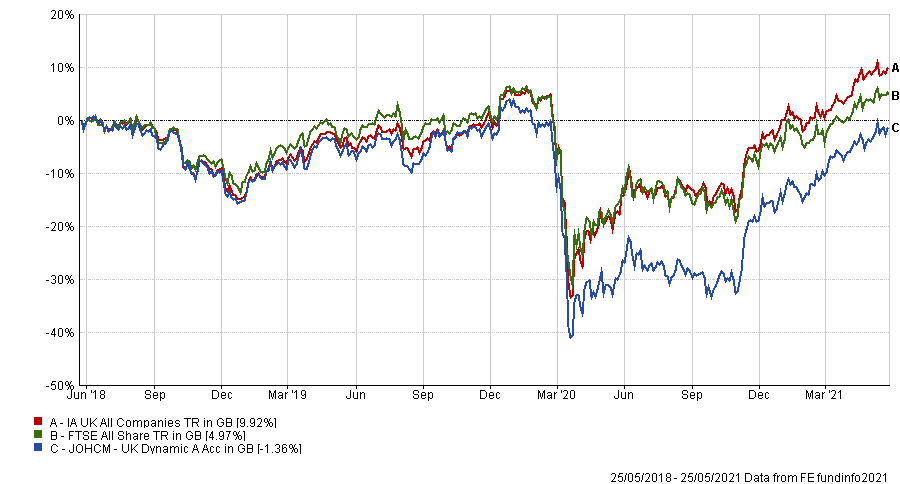

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, JOHCM UK Dynamic has made a loss of 1.36 per cent against a 4.97 per cent gain for the FTSE All Share and a 9.92 per cent return for the IA UK All Companies sector. It has an OCF of 0.8 per cent.