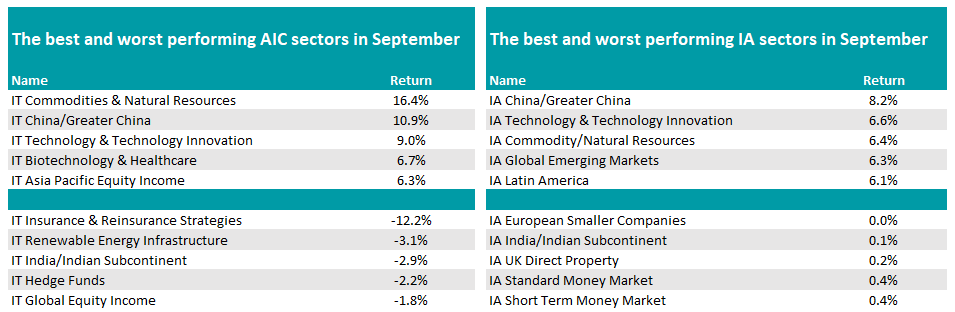

Commodities, Chinese equities and technology stocks were the places to be in September as funds specialising in these areas topped the performance tables last month.

It was a strong September for investors, with no sectors in the Investment Association (IA) universe making a loss on average (although there were some losses for individual funds).

There was plenty of news about last month.

The US Federal Reserve cutting rates by 0.25 percentage points, although the Bank of England and European Central Bank did not follow suit.

Ben Yearsley, director at Fairview Investing, said: “I don’t think anyone could accuse Jerome Powell of being the unreliable boyfriend a la Mark Carney, but finally the Fed delivered a rate cut and hinted at more to come.

“In the face of a slowing economy, the equity markets reacted to the (bad) news by hitting more all-time highs. Was it the comments about further rate cuts from various sources that did the trick?”

Elsewhere, Japan’s prime minister Shigeru Ishiba resigned after he lost his parliamentary majority, while France prime minister François Bayrou was ousted after he lost a no-confidence vote.

At a company level, Tesla made a pay offer to chief executive Elon Musk of $1trn over the next decade, with the CEO buying $1bn worth of Tesla shares last month, sending the share price to near all-time highs.

Staying with the ‘Magnificent Seven’, Nvidia is investing $100bn with one of its biggest customers – OpenAI – to build data centres.

President Donald Trump also made waves on the market by suggesting companies should drop quarterly earnings statements.

At a sector level, China funds dominated the IA universe, up 8.2% on average, the second month in a row it has led the charge.

It rose “on continued hopes that the worst of the Chinese property correction is in the past and that Beijing’s stimulus measures are starting to encourage consumption,” said Yearsley.

The remainder of the top five all made more than 6%, however, with IA Technology & Technology Innovation, IA Commodity/Natural Resources, IA Global Emerging Markets and IA Latin America performing strongly last month.

Latin America is of particular note, as the asset class is benefiting from a rise in commodity prices as well as a weaker dollar, noted Yearsley.

Source: FE Analytics

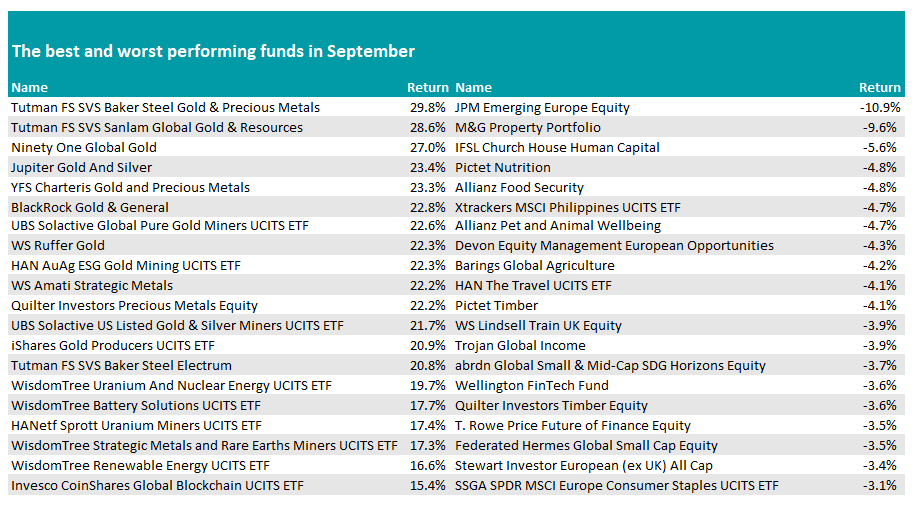

However, when looking at the best-performing funds, the main story was gold. The spot price closed the month at $3,873 after the Fed’s rate cut, boosting yellow metal specialist portfolios.

“Gold, gold as far as the eye can see. The top 10 was awash with the shiny stuff,” said Yearsley. “Every fund was either a pure gold fund or a gold and precious metals one. It’s quite rare for this to happen, as normally there’s an outlier.”

SVS Baker Steel Gold & Precious Metals topped the list with a gain of 29.8%, while the “usual suspects” in the space of Jupiter and Blackrock also made the list.

On the downside, JPM Emerging Europe Equity was the biggest faller, down 10.9% as optimism that we could be coming to the end of the Russia-Ukraine war petered out.

The remainder of the biggest fallers was a “mixed bag”, said Yearsley, with a loose theme of food emerging as a problem area.

Some big names had a poor month, including FE fundinfo Alpha Manager Nick Train’s WS Lindsell Train UK Equity and James Harries’ Trojan Global Income and Alexander Darwall’s Devon Equity Management European Opportunities.

Source: FE Analytics

Turning to trusts, the IT Commodities & Natural Resources sector topped the IT China/Greater China peer group by some 6 percentage points last month, up 16.4% and 10.9% respectively. Technology, healthcare and Asia equity-income strategies rounded out the top five.

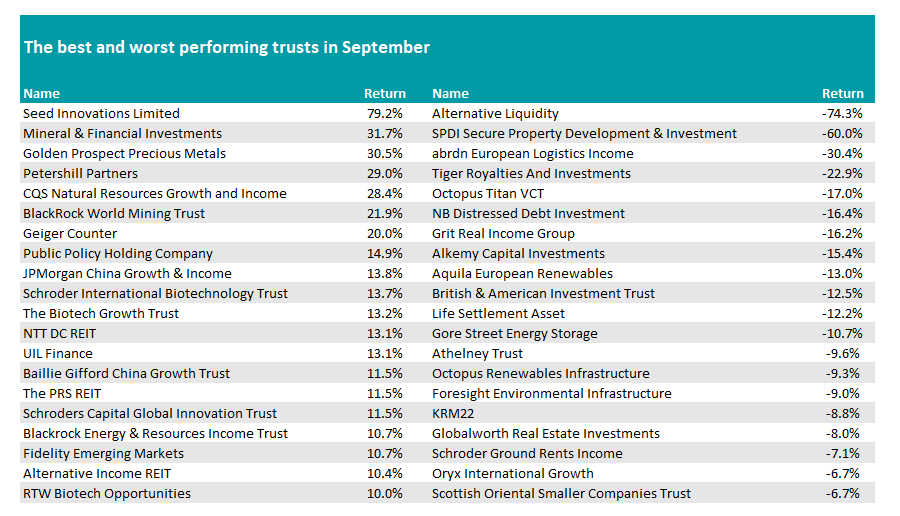

At an individual level, Seed Innovations Limited climbed 79.2% after it announced board changes, while commodity funds also shone.

Mergers and acquisitions also took centre stage, said Yearsley, with Petershill Partners announcing it was being taken private after trading at a huge discount for a number of years. It gained 29% in September.

Source: FE Analytics

“To be fair that was the only one in the top five that had corporate action as a catalyst,” he said, with the remainder “all commodity-related”.

Also among the top 10 (and up 20%), was uranium play Geiger Counter, which rose “after the US indicated it would top up strategic reserves of uranium”, said Yearsley.

On the downside, Alternative Liquidity trust dropped 74.3%, while SPDI Secure Property Development & Investment was down 60%.