Investors must consider several things before picking a fund or trust: its manager, mandate, track record and the associated costs being just some of the important considerations to weigh up.

An actively managed strategy will incur various ownership costs, including transaction and performance fees, but the focus of this article will be the ongoing charges of investment trusts.

Ongoing charges are made up of the fund manager’s fees for running the portfolio, along with other costs such as administration, marketing and regulation. It’s useful as a standardised method of comparing the cost of strategies and should be considered as one of the key determinants of long-term returns.

Some might argue that relatively high charges could be indicative of a top performing fund as investors would gladly pay a higher premium for excess returns, following ‘you get what you pay for’ logic.

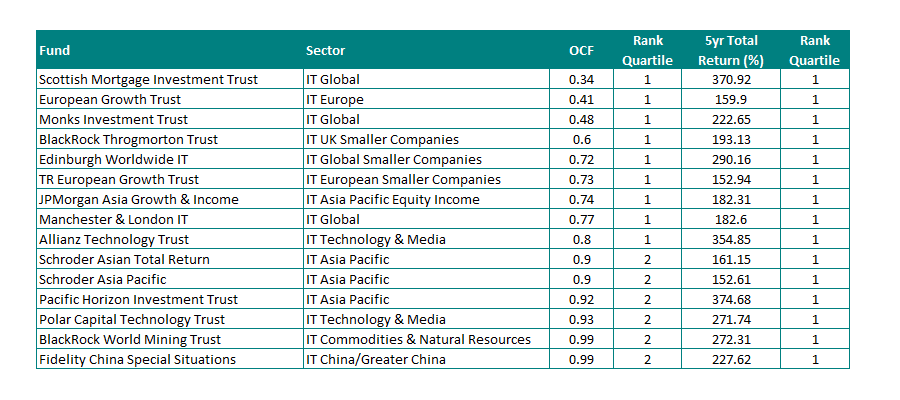

But what if the trust was in the top quartile of performers and also had the lowest ongoing charges figure amongst its peers? Using data from FE Analytics, Trustnet highlighted the cheapest investment trusts, or top-quartile ongoing charges, combined with top-quartile performance.

Top quartile trusts with top quartile ongoing charges

Source: FE Analytics

At the top of the list with the lowest ongoing charges and with superior returns over five years is the £17bn Scottish Mortgage Investment Trust, run by James Anderson and Tom Slater.

Anderson, who announced he will be stepping down in April of next year, has overseen a 370.92 per cent gain over five years and a 1,604.25 per cent return since he took over in 2000. And with ongoing charges of 0.34 per cent, it is the cheapest trust on the list.

While near-term performance has suffered as a result of its concentrated nature and vulnerability to the intermittent growth sell-offs that have occurred this year, the trust has legions of fans among both professional and private investors.

The five FE fundinfo Crown-Rated trust is currently trading at a 4 per cent discount to net asset value (NAV).

Another Baillie Gifford vehicle, European Growth Trust, is in second as the second cheapest fund with top-quartile performance. With ongoing charges of 0.41 per cent, the £565m trust has made a total return of 159.9 per cent over five years.

The fund was taken over by Baillie Gifford in November 2019 and has since been run by Moritz Sitte and Stephen Paice.

Since then, and indeed over a five-year period, the European Growth Trust has been a top performer in its IT Europe peer group on a total return basis.

According to Winterflood Investment Research: “While relative returns in recent months have been less favourable, underperformance in a value rally and a cyclical recovery is in line with our expectations for a high-growth orientated portfolio.

“In our opinion, the Baillie Gifford emphasis on a five-year view is sensible and their ability to identify and deliver outsize long-term returns has been proven in other markets and the open-ended sister fund.”

Unlike Scottish Mortgage, the trust is currently trading at a 4.9 per cent premium which, considering its been trading at discount consistently over the last five years, may not be the best entry point.

With a performance over five years of 222.65 per cent and ongoing charges of 0.48 per cent, Monks Investment Trust is third on the list. This puts the £3.2bn trust in the top quartile in terms of ongoing charges and five-year performance relative to its IT Global sector.

Previously run by Charles Plowden, it’s now headed up by Spencer Adair and Malcolm MacColl. This means it’s another trust managed by Baillie Gifford.

Adair said: “Our task is to find businesses that possess the right element of vision, ambition and execution to grow at attractive rates for long periods of time.

“2020 was traumatic for many, but it also accelerated the reshaping of many industries and created opportunities for successful business to capture significant value.”

Amidst a sea of Baillie Gifford strategies, the £821m BlackRock Throgmorton Trust is the next dual-top-quartile trust with ongoing charges of 0.6 per cent and a total return of 193.13 per cent over five years.

Dan Whitestone has overseen the fund since 2015 and implemented a single long/short portfolio with a focus on quality-growth companies.

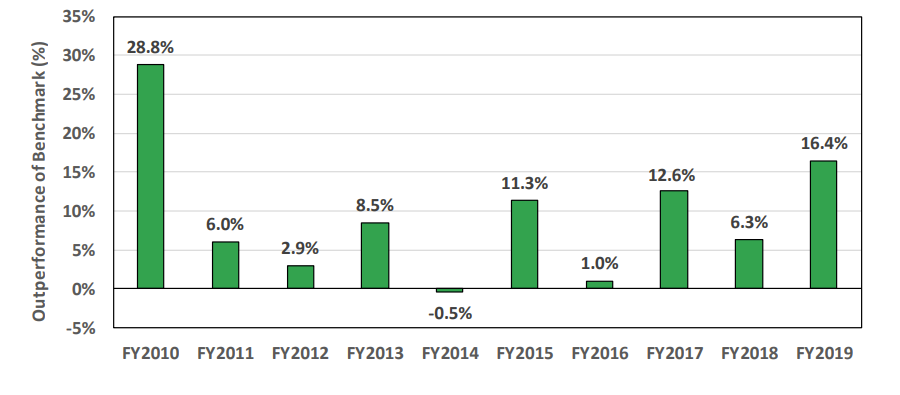

BlackRock Throgmorton Trust – relative NAV performance vs benchmark

Source: Winterflood Securities

The analysts at Winterflood said: “In our view, the fund is differentiated by its ability to short stocks as an additional source of alpha and it continues to be one of the most growth-oriented of its peers.

“So long as the manager can avoid a cluster of significant stock specific issues, the fund’s strategy should continue to deliver long-term outperformance.”

Next up, the £1.3bn Edinburgh Worldwide Investment Trust, which is the only smaller companies strategy on this list.

Managed by Douglas Brodie, Luke Ward and Svetlana Viteva, the team looks for capital growth from a global portfolio of initially immature entrepreneurial companies, typically with a market cap of less than $5bn at the time of initial investment.

Analysts from Rayner Spencer Mills Research said: “The closed-end nature of the trust suits the managers’ process to look at young companies which are dynamic and may be operating in nascent markets with less coverage by the wider market.

“The trust is ideally placed for those seeking growth from smaller companies across the globe, being mindful that periods of underperformance may occur when markets favour less risk.”

With ongoing charges of 0.72 per cent, the trust represents a cheap trust with a strong performance over five years, returning 290.16 per cent. This is notable too as the fund does not charge a performance fee.

Finally, the only income strategy on the list is the £490.7m JPMorgan Asia Growth & Income trust which sits in the IT Asia Pacific Equity Income sector.

Performance of trust vs sector & benchmark over 5yrs

Source: FE Analytics

On an initial investment five years ago, an investor would have made 182.31 per cent and would currently pay ongoing charges of 0.74 per cent.

In comparison, over five years, the average peer in the sector made 95.07 per cent and the MSCI AC Asia ex Japan benchmark returned 106.89 per cent.

The trust also pays a dividend of 3.52 per cent and, according to the Association of Investment Companies (AIC), has grown its dividend by 44.6 per cent over the past five years.