Markets appear to be heading for a more volatile second half of the year, which some investors might shy away from but others will seek to capitalise on the increased turbulence.

With this in mind, Trustnet asks market commentators for the funds which come into their own during volatile markets – either because they protect investors from the worst or they use the turbulence to generate strong returns.

Troy Trojan

The first pick is the £5.6bn Troy Trojan fund. Placing capital preservation at the core – in line with all Troy Asset Management’s funds – is an ideal approach for volatile markets and for protecting against them when they fall, according to Adrian Lowcock, independent fund commentator.

Indeed, it has the third best 10-year annualised volatility of the entire IA Flexible Investment sector, at 5.48 per cent compared with 9.43 per cent for its average peer.

Investing in a mixture of quality shares, private equity, precious metals and cash, FE fundinfo Alpha Manager Sebastian Lyon and deputy manager Charlotte Yonge manage the exposure of these four assets depending on the market climate.

“Lyons has proven his ability to deliver although the funds style will likely lag in rising markets,” Lowcock said.

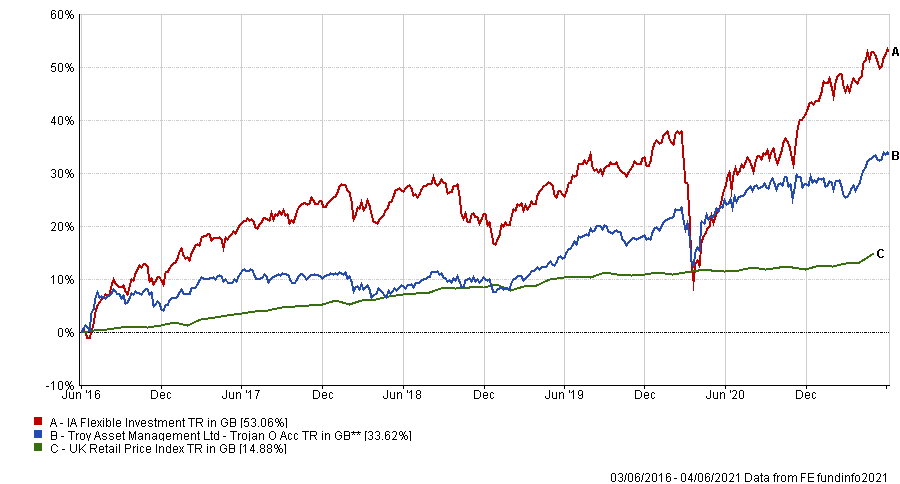

Over the past five years Troy Trojan has made a total return of 33.62 per cent, underperforming the IA Flexible Investment sector. However, much of this time featured a strongly rising market.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Looking at maximum drawdown, or the worst peak-to-trough loss over the period, highlights the fund’s defensive characteristics. Its 9.21 per cent maximum drawdown is the second lowest of the sector, where the average was 15.53 per cent.

Troy Trojan has an ongoing charges figure (OCF) of 1.01 per cent.

iShares Physical Gold ETC

Next is a passive option focusing on one of the ‘classic’ safe havens of markets and more traditional hedges of inflation: gold.

“For investors who are worried about the general market, gold can act as a haven and this is a large popular option that investors like,” said Dzmitry Lipski, head of funds research at interactive investor.

The $14bn iShares Physical Gold ETC aims to track the return of the gold spot price. It tracks the price of gold and physically invests in gold bars, rather than taking synthetic exposure.

It made a total return of 54.36 per cent over five years, just under The LBMA Gold Price (54.79 per cent) but more than the GBL ETF Commodity & Energy index (43.63 per cent).

It has an OCF of 0.15 per cent.

Janus Henderson Absolute Return

Going back to active fund options and the Janus Henderson Absolute Return fund is a “rare beast” among total return funds, according to AJ Bell’s Ryan Hughes, because “it can be seen as a successful absolute return fund in a sector where so many have failed”.

Absolute return strategies typically aim to deliver positive returns regardless of the market environment, but many of them have struggled in the post-global financial crisis, liquidity-fuelled bull market that has seen equities surge.

But the £1.4bn Janus Henderson Absolute Return fund’s ability to take long and short positions has helped it debunk this trend, according to Hughes.

“Their long/short equity approach has proven it worth over the last 11 years, protecting time and again from large equity market falls and comes into its own when the market dislocates as they demonstrated during the Covid crash last year when the fund was flat over Q1 2020 while the FTSE All Share fell 25 per cent,” AJ Bell’s head of active portfolios said.

“More recently, the remit of the fund has broadened away from UK equities to take a more global approach as the managers look to take advantage of price dislocations across the world.

“While the fund is expensive, there are few that have managed to prosper during volatile markets and therefore as a way of insolating elements of a portfolio to a pick-up in volatility, this fund can provide useful diversification benefits.”

Run by FE fundinfo Alpha Managers Ben Wallace and Luke Newman it aims to provide a positive absolute return, regardless of market conditions, over any 12-month period and outperform the UK base interest rate – after deductions – over a three year period.

It’s made a total return of 12.06 per cent over five years, narrowly underperforming the IA Targeted Absolute Return sector (12.35 per cent).

Holding a four FE fundinfo Crown Rating it has an OCF of 1.07 per cent.

T. Rowe Price Global Focused Growth Equity

Investing in volatile markets can also involve looking for funds that thrive in such conditions, rather than seeking to minimise losses. The T. Rowe Price Global Focused Growth Equity fund is a good example of such a fund that benefits from volatile markets, according to FundCalibre’s managing director, Darius McDermott.

“The manager is very pragmatics and although the fund has ‘growth’ in its name, he is willing to invest in out-of favour names with growth prospects too – and he did exactly that in March last year taking advantage of lower valuations for value stocks he deemed could be winners coming out of the crisis.”

FE fundinfo Alpha Manager David J. Eiswert looks for companies he feels are on the ‘right side of change’, usually part of technological innovation and secular disruption trends.

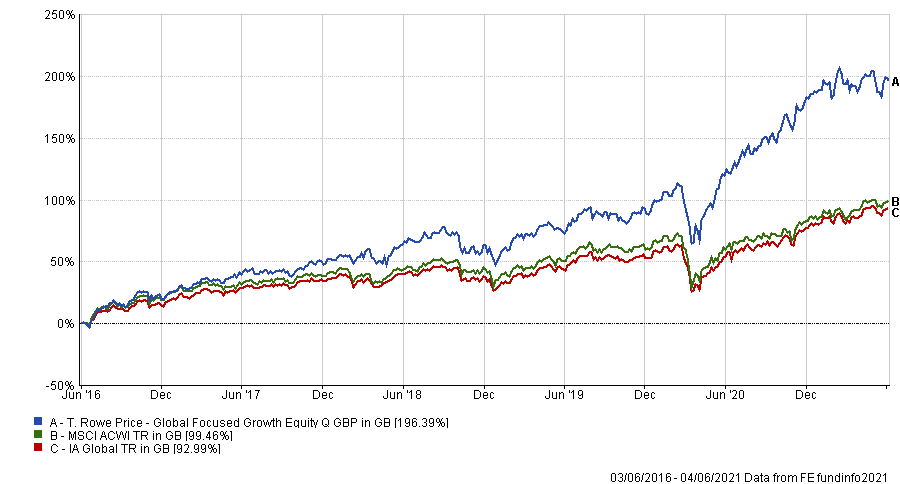

The $5.1bn fund does have relatively high volatility, with 10-year annualised volatility of 14.63 per cent putting it in the fourth quartile. But it has delivered high returns, being the third best performing fund in the IA Global sector over five and 10 years.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Holding an FE fundinfo Crown Rating of five, T. Rowe Price Global Focused Growth Equity has an OCF of 0.84 per cent.

Tyndall North American

Finally, GDIM investment manager Tom Sparke chose the Tyndall North American fund because it has successfully navigated the intense market rotations and style bias of recent years by running a “flexible” and “pragmatic view of style in an equity portfolio.”

Sparke said: “Higher growth stocks would have made you a high return in recent years, but got hit badly in the downturn, whereas value has been in the doldrums for years and is just seeing its own renaissance.

“In a volatile market, especially one similar to that which we have seen earlier this year, I think it is easier to hold funds with flexible mandates and a pragmatic view of style in an equity portfolio.

“As such, a more agnostic manager should be able to maximise upside and limit losses in tougher times. The fund has no predisposed bias in terms of equity style and has managed to hold winners in good times for stock markets and maintain value in tougher markets,” Sparke said.

Manager Felix Wintle runs a top down process, analysing what point in the cycle markets are at and building a core allocation of long-term thematic ‘winners’.

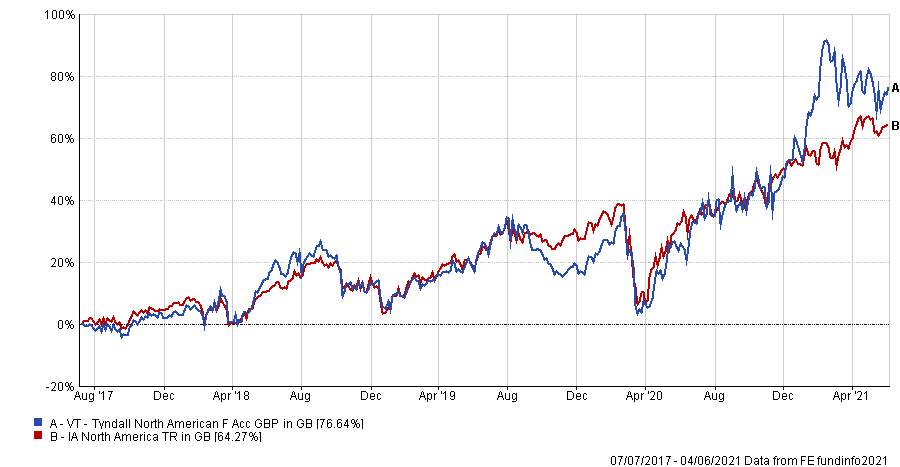

Like the previous fund, it does have relatively high volatility in comparison to its IA North America peers, running at 17.25 per cent since launch in July 2017. But it has outperformed the sector over this period, returning 76.64 per cent.

Performance of fund vs sector and index since launch

Source: FE Analytics

Tyndall North American has an OCF of 0.99 per cent.