On World Ocean Day, Tilney Investment Management’s Louie French picks three sustainable funds that ESG-conscious investors could consider for their own portfolios and make a positive contribution to the planet.

The growing climate crisis shows no signs of halting and threatens life on land and in the oceans. In fact, the UN estimates that climate change and unsustainable fishing have already resulted in the depletion of 90 per cent of big fish populations and the destruction of 50 per cent of coral reefs.

“It’s clear that as a society we have to act now,” said French, manager of the Tilney Sustainable MPS. “There is no planet B, as the Attenborough and Thunberg inspired placards have highlighted at demonstrations across the world.

“The good news from an investment perspective is that we have positive choices that we can make with our savings to encourage the greening of our cities and energy sources. This will support companies that are promoting a more circular economy and are cleaning up the plastic pollution in our rivers and oceans.”

The funds listed below are also held within the Tilney Sustainable MPS, which is aligned with the UN’s Sustainable Development Goals for 2030.

Impax Environmental Markets

First up is the £1.3bn Impax Environmental Markets trust, which has been run by Bruce Jenkyn-Jones and Jon Forster since launch in 2002.

The trust invests globally in companies that provide environmental solutions through their products or services and enables investors to benefit from growth in the markets for cleaner or more efficient delivery of basic services of energy, water and waste.

“Impax have a strong performance track record and are well respected specialists in this area of the market,” said French. “They also report the positive impacts of their investments in the annual report, which include net CO2 emissions avoided, renewable energy generated and the treatment for waste and water.”

Analysts at Rayner Spencer Mills Research called the trust a “mature investment trust with a highly experienced team in the environmental and sustainability space”.

They added: “The fund is suitable for growth investors who are looking for a core holding in the environmental space with access to leverage.”

Performance of fund vs sector & benchmark over 5yrs

Source: FE Analytics

Over five years, Impax Environmental Markets has made a total return of 183.71 per cent, compared to a 99.46 per cent gain for the MSCI ACWI and 97.99 per cent for the average peer in the IT Environmental sector.

It has ongoing charges of 0.95 per cent.

WHEB Sustainability

French’s second pick is WHEB Sustainability, managed by Ted Franks and Ty Lee.

“WHEB are specialist investors that seek to have a positive impact on the environment and society,” he said. “The objective of the fund is long-term capital growth via a portfolio of global companies which have strong growth prospects linked to key sustainability growth themes.”

The nine themes WHEB seek broad exposure to are environmental services, resource efficiency, water management, sustainable transport, cleaner energy, safety, health, wellbeing and education.

French added that investors in WHEB are able to access its online Impact Calculator, which illustrates the underlying positive impact that companies in WHEB’s investment portfolio help create.

Rayner Spencer Mills analysts noted: “The company actively engages with companies and management on ESG issues, challenges their approach and monitors their response, as WHEB believes that managing ESG liabilities and opportunities can be just as informative about a company’s future growth potential as standard fundamental analysis.”

Performance of fund vs sector & benchmark over 5yrs

Source: FE Analytics

Over the same time frame, the £922m WHEB Sustainability fund has made 86.47 per cent, while the average fund in the IA Global made 93.03 per cent while the MSCI World index posted 100.21 per cent.

It has an ongoing charges figure (OCF) of 1.05 per cent.

The Renewables Infrastructure Group

Finally, the manager opted for the £2.3bn Renewables Infrastructure Group trust. The London-listed investment company has over 75 renewable infrastructure projects in the UK, Ireland, France, Sweden and Germany.

“TRIG aims to deliver a sustainable yield on a diversified portfolio of predominately wind and solar assets across a number of distinct geographies,” he said.

Its objectives are clearly stated, aiming to mitigate climate change, preserve the natural environment, positively impact the communities in which Renewables Infrastructure Group works and to maintain ethics and integrity in governance.

Analysts from Winterflood Investment Research commented: “In our view, TRIG is well managed and is attractive within the peer group given its diversification and size.

“Yields and low correlation with other asset classes offered by the infrastructure sector are likely to remain attractive for investors and we would expect the strong ESG credentials within the renewable energy infrastructure sector to also increasingly be a factor in demand.”

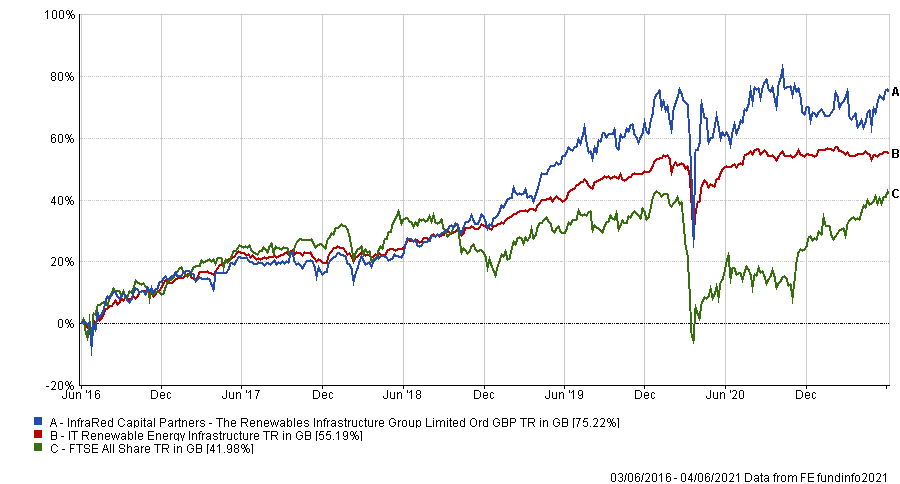

Performance of fund vs sector & benchmark over 5yrs

Source: FE Analytics

Similarly over five years, Renewables Infrastructure Group has made 75.22 per cent, compared to 55.19 per cent for the IT Renewable Energy Infrastructure sector and 41.98 per cent for its FTSE All Share benchmark.

The trust has ongoing charges of 0.94 per cent.